FG Moves to Fast-Track Loan Disbursement to MSME Within 14 Days

- The Nigerian government has revealed that it is working on a scheme that will fast-track loan disbursement to Nigerians in a short time

- The government set a 14-day timeline on which loan small businesses can have access to their loans

- The government said the move is part of Ease of Doing Business in Nigeria to spur growth in the MSME sector

Legit.ng’s Pascal Oparada has reported Tech, Energy, Stocks, Investment and the Economy for over a decade.

The Nigerian government has said it is working towards providing solutions to grant loans to Medium, Small, and Micro enterprises within 14 days.

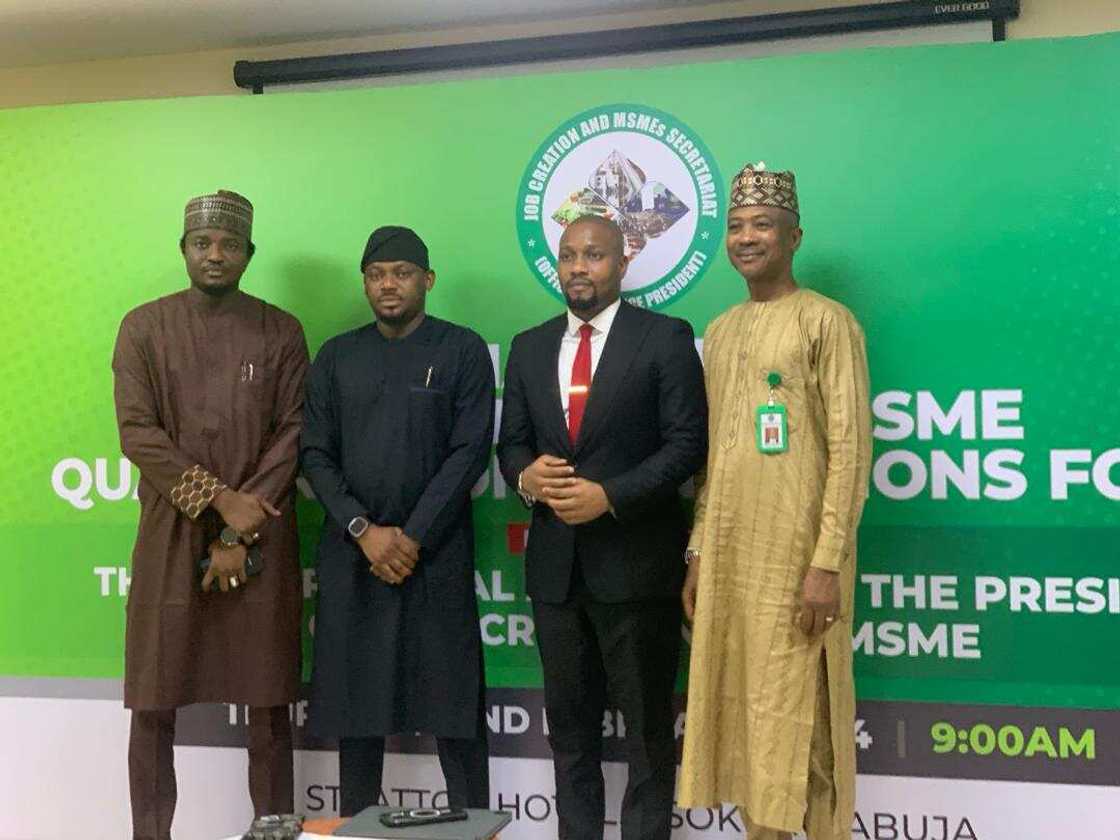

Speaking at the Inaugural Job Creation and MSME Quarterly Communications Forum, the Senior Special Assistant to the President, Temitola Adekunle-Johnson, said such a move would help reduce the rate at which small businesses close down due to waiting time for fund approval.

Source: Getty Images

FG to partner with Access Bank

With the hope of achieving a single-digit loan for small business owners, Johnson said, FG is trying to gain seamless and easy access to funding for SMEs.

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

He said:

“We want SMEs to be able to apply for a loan and get it approved within 14 days at worst, and not in six months because some of these businesses can fold up within those six months of waiting for loan approval.

“The disbursements will be quick after the loan assessment is processed. That would help us reduce the bottlenecks of MSMEs running from pillar to pole looking for funding and not having the collateral to achieve the loans.

In addition, FG, in partnership with Access Bank, has set aside 50 billion to support skills acquisition by 5 million Nigerians under a job creation initiative.

New initiative to fast-track loans in 14 days

YouThrive’s initiative empowers MSMEs differently by building their capacity and access to affordable finance and digital, technical, and skill acquisition training.

A report by Punch says that Chioma Ogwo, the Head of Non-Financial Services for Access Bank, assured that small business owners will be empowered through various avenues, including capacity building, provision of accessible funds, and digital and technical skills that could serve as a basis for thriving and wealth creation.

Ogwo added that FG and the bank will give affordable loans at 15 per cent and free grants to deserving SMEs who have done well.

According to her, there will be a business exchange programme for the beneficiaries that would enable the SMEs to go and exchange ideas with their counterparts in other countries.

Speaking on the sidelines of the event, Charles Odii, the Director-General of the Small and Medium Enterprises Development Agency of Nigeria, confirmed that 3 million jobs were lost to flooding in Nigeria in 2023.

Read also

“Each person to receive N25,000”: FG to begin distributing money to unemployed Nigerian youths

Odii noted that the federal government has developed a technology to alert of an impending danger of flooding across the states, a development he said would help the government take proactive measures to evict potential victims.

According to him, SMEDAN is helping to mitigate the challenges faced by MSMEs, especially production costs and low rent, to enable them to be productive and support the economy.

FG to Disburse N150bn to Traders, Small Businesses in 774 LGAs

An earlier report by Legit.ng said that The Nigerian government is set to start disbursement of N50,000 to small businesses in all the 774 local government areas in the country to ease the impact of subsidy removal.

The minister of industry, trade and investment, Doris Uzok-Anite, disclosed this.

She stated that the scheme consists of the Presidential Conditional Grant for Programme and the Presidential Palliative Loan Programme targeted at Manufacturers, SMEs, MSMEs, and businesses.

Read also

FG announces plan to share N25,000 cash to 15m Nigerians monthly, gives condition to benefit

PAY ATTENTION: Stay Informed and follow us on Google News!

Source: Legit.ng