Senior US Fed official backs 'careful' approach to rate cuts

Source: AFP

PAY ATTENTION: The 2024 Business Leaders Awards Present Entrepreneurs that Change Nigeria for the Better. Check out their Stories!

The US Federal Reserve should be "careful" about the timing of interest rate cuts, a senior bank official said Wednesday, adding to the cautious tone taken by US central bank officials in recent months about moving too quickly.

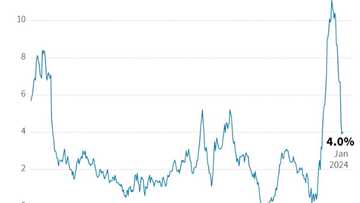

The Fed swiftly raised and then held its benchmark lending rate in a largely successful bid to bring inflation down from multi-decade highs towards its long-term target of two percent.

In December, policymakers on the rate-setting Federal Open Market Committee (FOMC) indicated they expect three interest rate cuts this year, but did not clarify when the first cut could come -- setting off a wave of speculation in the financial markets.

Speaking in Washington on Wednesday, the Fed's vice chair for supervision, Michael Barr, said the Fed should remain cautious about moving too soon, given the ongoing risks to it hitting its two-percent target.

"As Chair Powell indicated in his most recent press conference, my FOMC colleagues and I are confident we are on a path to two percent inflation, but we need to see continued good data before we can begin the process of reducing the federal funds rate," he said in prepared remarks.

"I fully support what he called a careful approach to considering policy normalization given current conditions," he continued.

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

"Given the limited historical experience with the growth and inflation dynamics we currently face, and no modern experience of emerging from a global pandemic, we have yet another reason to proceed carefully, as we have been doing," he added.

Barr's comments echo not only his superior's comments last month, but also those of other FOMC members in recent days, who have made clear they feel the Fed can afford to be patient on cuts, and carefully scrutinize the incoming data.

Followings remarks by Powell and other FOMC officials, futures traders no longer expect a rate cut in the next two rate meetings in March and May.

Instead, they have assigned a probability of around 80 percent that the Fed will make its first cut by the time of its rate cut in June, according to data from CME Group.

Source: AFP