Leaks show McKinsey pushed fossil fuel agenda at Africa climate summit

Source: AFP

Consulting giant McKinsey & Company sought to place controversial carbon market schemes favoured by its fossil fuel clients at the heart of the Africa Climate Summit, according to internal documents and sources who talked to AFP.

The documents reveal that the firm worked behind the scenes to shape the agenda of September's Nairobi gathering, a key event in the run-up to the UN's COP28 talks in Dubai.

McKinsey's clients include some of the world's biggest oil and gas companies, from ExxonMobil to Saudi Arabia's state-run Aramco.

A nine-page confidential "position paper" seen by AFP also touted the Africa Carbon Markets Initiative (ACMI), which McKinsey has publicly said it helped develop, and called for the building of a $6 billion market for carbon offsets on the continent.

Carbon offsets are billed as a way for big polluters like oil companies to make up for their CO2 emissions by supporting green projects like those that claim to safeguard forests. But experts dispute their worth and have warned of greenwashing.

Read also

Entrepreneur and Zeetin founder Azibaola Robert urges collaborations after COP28 as he bags award

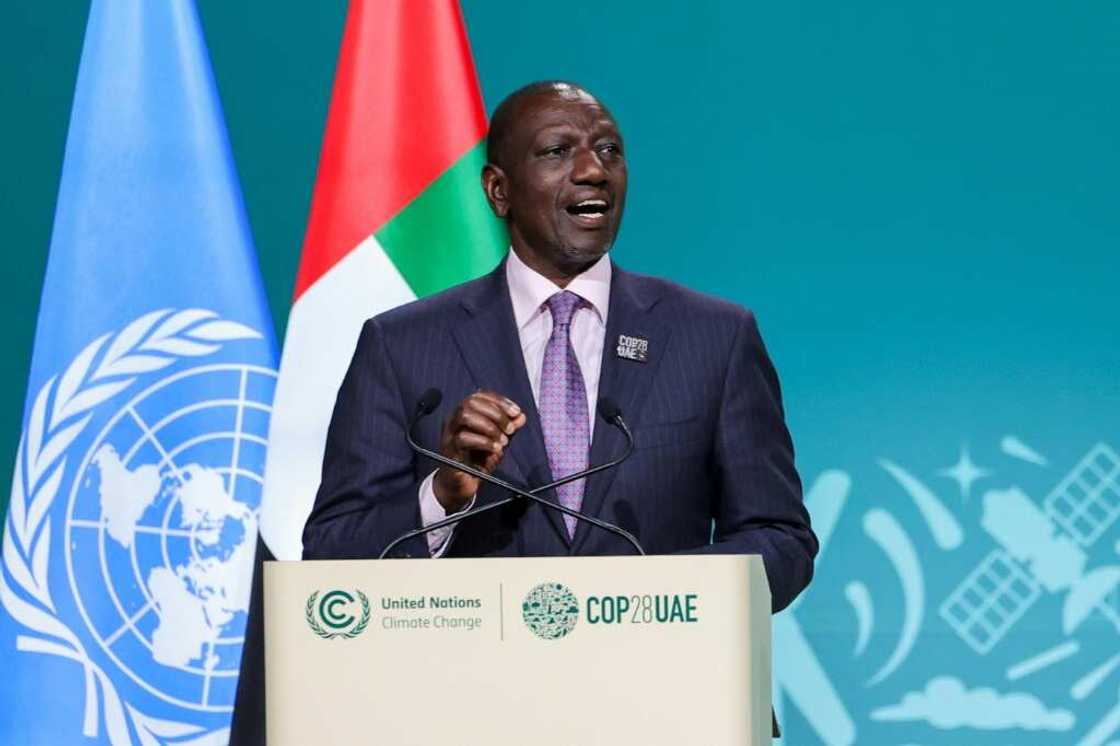

More than 500 civil society groups signed a protest letter to Kenyan President William Ruto in the run up to the meeting saying McKinsey "unduly influenced" the summit through key documents it drafted on behalf of the host country.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

"When McKinsey got involved in the planning of the summit, they sought to benefit from commercial deals that would emerge," said Mohamed Adow, head of research group Power Shift Africa.

Adow was among three dozen African and global advisors from research groups, foundations and international organisations asked by the organisers to review the "position paper" to set the agenda for the talks.

He said McKinsey played a leading role in drafting the document, which was sharply criticised by several advisors as overplaying the role of carbon markets, according to comments they shared seen by AFP.

Carbon markets hype

McKinsey denied any wrongdoing, with Kenya's environment minister Soipan Tuya insisting it is "extremely far from the truth" to say that the firm held too much sway at the summit.

McKinsey told AFP it was a "technical partner" to the summit, one of many that contributed to preparations, and that all documents were "approved by the Africa Climate Summit and the Government of Kenya."

Archived web pages indicate that a mention of the company as a partner was removed from the event's website. McKinsey said it had been included in error.

Two members of the advisory group formed at the request of Ruto, who asked not to be named, said they were unaware of McKinsey's role.

"Given their client list, McKinsey had an undeniable conflict of interest," Adow told AFP.

In one confidential document promoting its expertise in carbon markets, the firm listed companies it had advised, including Chevron, BP and Tata Steel.

It also flagged McKinsey's work on solar, wind and gas power and electrification, as well as "performance transformation" work for firms operating coal- and oil-fired power plants.

Critics of carbon markets say they do not live up to their hype and allow polluters to offset the damaging greenhouse gas they produce too cheaply.

A study earlier this year found only a tiny fraction seemed to deliver, and last year a major UN report concluded that "too many non-state actors are engaging in a voluntary market" marked by "low prices and a lack of clear guidelines".

McKinsey drafted climate summit plans

Source: AFP

The two experts in Ruto's advisory group said the paper diverged from long-standing positions of the 54-nation African Group and disregarded top African priorities such as money to help the continent's economies cope with climate impacts.

McKinsey said the documents "were for use by the president of Kenya and they reflect his ambitions, not McKinsey's."

In the end, the summit drew hundreds of millions of dollars in pledges for carbon projects, including $450 million from COP28's oil-rich hosts the UAE, which is seeking to secure vast tracts of land in Africa -- reportedly the size of Britain -- to develop carbon-offsetting projects.

With their worth increasingly questioned, the price of carbon credits for nature conservation projects nosedived from $16 per tonne in January 2022 to about $1 last month.

In October, South Pole, the biggest seller of carbon offsets, pulled out of a huge scandal-hit forest protection programme in Zimbabwe. McKinsey was among companies that had purchased credits from the scheme.

That and other damaging reports have thrown the entire sector into turmoil.

"Carbon offsets rarely achieve the climate benefits they claim," researchers led by Danny Cullenward of the Institute for Carbon Removal Law and Policy in Washington reported last month.

PAY ATTENTION: Donate to Legit Charity on Patreon. Your support matters!

Source: AFP