Banking Consolidation Leads Investors to Inject N110bn in UBA, First Bank, Zenith, Access, Others

- The Nigerian government has given its full backing to the Central Bank of Nigeria (CBN) planned banking consolidation

- In a recent event, Presidential spokesperson Bayo Onanuga said Nigeria needs a solid financial services sector to carry a $1 trillion economy

- The planned recapitalization of the banking industry has led to investors pumping money into the stocks of big banks in Niger

Pascal Oparada has over a decade of experience covering Tech, Energy, Stocks, Investments, and Economy.

The presidency has expressed support for the Central Bank of Nigeria's planned consolidation in the banking sector, saying it would help grow Nigeria's economy to a new high.

The support came five days after the CBN governor, Olayemi Cardoso, said the apex bank would ask banks to raise new capital.

Source: Facebook

Presidency supports CBN's plan for banking consolidation

Read also

German firm to acquire Union Bank loans as CBN activates automatic debit on debtors' accounts

The President stated on Tuesday, November 28, 2023, at the 40th Anniversary Celebration of the Guardian Newspapers in Lagos that there would be a strong need to revisit banks' capital adequacy.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

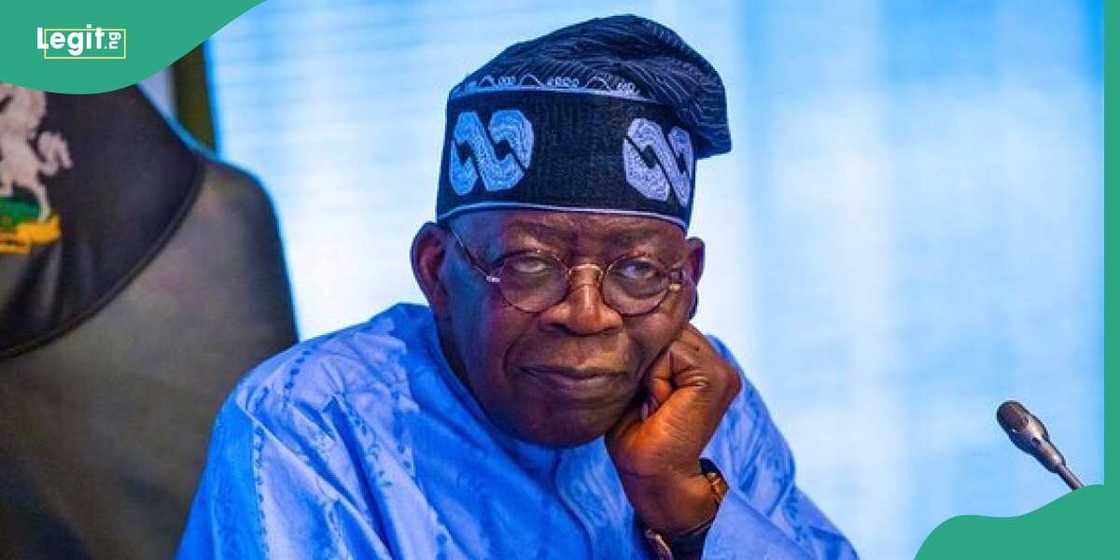

Bayo Onanuga, who represented President Bola Tinubu at the event, said the ambition of the current government is to attain a $1 trillion economy in seven years, stating that the plan is achievable. Still, it takes a robust financial sector to arrive at the goal.

He said:

"To arrive at the $ 1 trillion economy, we must address the capital adequacy of our banks that will prepare the fuel for this journey."

Cardoso had hinted at the 58th annual Bankers' Dinner on Friday, November 24, 2023, that a stress test carried out on Nigerian banks showed that while they can withstand mild to moderate stress, they cannot service a $1 trillion economy envisioned by Tinubu's administration in the next seven years.

Cardoso said:

"Stress tests conducted on the banking industry also indicate its strength under mild-to-moderate scenarios of sustained economic and financial stress, although there is room for further strengthening and enhancing resilience to shocks. Therefore, much work must be done to fortify the industry for future challenges."

Megabanks haul in cash ahead of consolidation

Punch reports that investors are positioning themselves in the stocks of top-tier banks listed on the Nigerian Exchange Limited following the planned consolidation announcement of the commercial banks in Nigeria.

Some big banks are reportedly envisaging mergers or outright acquisitions of smaller banks in the proposed consolidation of the sector.

Some listed banks gained over N101.18 billion on Monday, November 27, and Tuesday, November 28, 2023, following the planned consolidation in the banking sector.

United Bank for Africa (UBA) market cap increased to N731.97 billion on Tuesday, November 28, 2023, from N713.06 billion recorded on Friday, November 24, 2023.

Read also

Naira’s loss at the official and parallel markets upsets Tinubu, CBN’s $1 trillion GDP plan

Zenith Bank saw its market capitalization rise to N1.10 trillion, and Access Bank saw its market cap increase to N639.81 billion on Tuesday, November 28, 2023.

First Bank emerged as the biggest gainer as its market capitalization rose to N800.47 billion from N717.91 billion, representing an 11% rise.

Sterling Bank's market cap increased by 4.51% to N106.81 billion, and FCMB's value rose to N137.63 billion.

Biggest losers

The five biggest losers include Guarantee Trust Bank, Jaiz Bank, Unity Bank, Wema Bank, and Stanbic IBTC Holdings.

The market cap of Ecobank and Fidelity Bank remained the same over the two days.

Financial expert and ex-banker Uzoma Uzorka told Legit.ng that Nigerians should expect a repeat of the 2005 banking consolidation.

"What we are looking at is that the number of banks in the country will shrink to 10 or 15 because there will be a lot of mergers and acquisitions.

"I hear that some banks are already discussing mergers. The N1 trillion banks do not have problems as they are sure-footed to withstand the forthcoming policy."

"I am rather concerned about the small players in the industry. It is either they merge or offer themselves for acquisition by the so-called megabanks," he said.

CBN discloses reason naira gained over N100/$, says 31 banks paid to offset FX backlogs

Legit.ng reported that the Central Bank of Nigeria has made tranche payments to 31 banks to clear the Forex backlogs plaguing the FX market.

The bank also said it has set up foreign exchange mechanisms to address FX issues.

The governor of the Central Bank of Nigeria (CBN), Yemi Cardoso, disclosed this on Friday, November 24, 2023, at the bankers' dinner in Lagos.

PAY ATTENTION: Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Source: Legit.ng