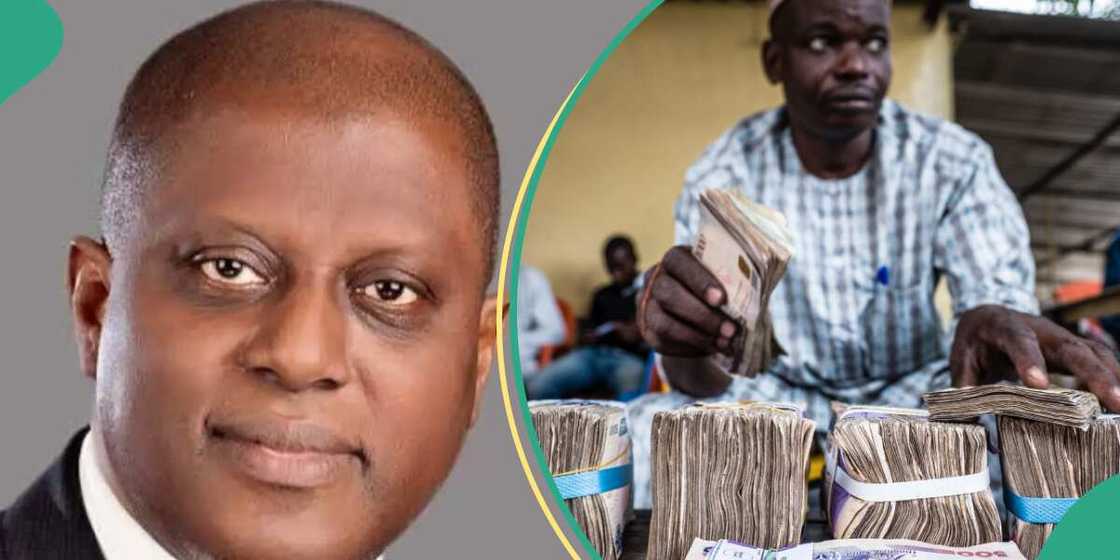

CBN Crashes Dollar, Releases $6.7 Billion to Banks With Special Instructions on Forex Debts

- The naira is experiencing a resurgence against the dollar as the federal government begins to clear backlogs

- The Foreign exchange market witnessed a significant turnover of $2.23 billion in October

- The naira also rebounded on the parallel and official markets as CBN reportedly supplied banks with $6.7 billion to clear backlogs

Pascal Oparada has over a decade of experience covering Tech, Energy, Stocks, Investments, and Economy.

The volume of dollars traded in the Nigerian Foreign Exchange Market (NAFEM) window increased by 23.8% monthly to $2.23 billion in October 2023 from $1.8 billion in September, showing an increase in Forex inflows.

Data shows that weekly transactions in the official NAFEM showed that turnover recorded upswings across the four weeks in October from $326.44 million in the first week of October to $642.89 million in the last week but thawed to $163.04 million in the previous two trading day in October.

Read also

Dollar falls below N1,000 at P2P for 1st time since September as CBN’s forex solution pays off

Source: Getty Images

The Forex market closed at a high in October

FMDQ data shows that the naira fell to N815.23 per dollar in the Investors and Exporters (I&E) window at the end of October 2023, from N755.27 per dollar recorded on September 29, 2023.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

The black market rate closed at N1,170 per dollar at the end of October 2023 from N1,000 per dollar on September 29, 2023.

Vanguard reports that the disparity between the official and parallel market rates widened to N354.68 per dollar on October 31, 2023, from N244.73 per dollar recorded on September 29, 2023.

However, the naira has experienced a resurgence against the dollar in the first two days of November as the Nigerian government moves to clear Forex backlogs blamed for the crash of the naira.

Legit. ng earlier reported that the foreign exchange market is nearing convergence in line with the plans of the Nigerian government.

CBN supplies banks with Forex to clear backlogs

Various media reports say that the Central Bank of Nigeria supplied commercial banks with about $6.7 billion on November 2, 2023, to clear the long overdue backlogs plaguing the naira.

The result is the resurgence of the local currency on the official and parallel markets.

The naira traded for N793.28 per dollar on Thursday, November 2, 2023, against the N815 recorded on the previous day.

The naira appreciated by N20 at the parallel to trade at N1,150 per dollar as against the N1,170 exchanged the day before.

Analysts predict more recoveries for the naira

Analysts are optimistic that the naira will regain its real value before the end of December as the Nigerian government continues its various intervention measures.

Ijioma Ojukwu, a currency trader, said there are fewer demands for the dollar on the streets, leading to the recovery of the naira.

“The naira is recovering because fewer people are asking for dollars now. The reason is that most importers have already purchased their goods for December since August.”

“I think what the federal government is doing is also commendable, to give the naira a breather, and I am sure it would appreciate to about N800 per dollar in the black market by December,” he said.

JP Morgan predicts naira to dollar exchange rate by December as FG targets N650 a dollar

In an earlier report, Legit.ng reported that JPMorgan Chase & Co has predicted that the naira to US dollar will close the year at N850 in the foreign exchange market.

The financial company stated this in a November 1 note titled "Nigeria local markets strategy: Getting set for re-opening".

JPMorgan also expects the Nigerian government to be willing for greater exchange rate flexibility, BusinessDay reports.

Source: Legit.ng