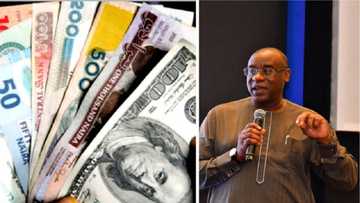

"N1000/$": CBN Moves Against Black Market Operators to Halt Naira's Fall, Slows Diaspora Remittances

- The Central Bank of Nigeria (CBN) has warned black market dealers that its proposed measures could lead to losses for them

- The Acting Governor of the CBN, Folashodun Shonubi, disclosed this on Monday, August 14, 2023

- Shonubi said the reason for the naira float was to attract foreign investment into the country

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

Following the fall of the naira in the black market, the Central Bank of Nigeria has begun introducing Forex intervention measures to clamp down on currency dealers and speculators in the FX markets.

The Acting Governor of the CBN, Folashodun Shonubi, revealed the development to journalists at the State House in Abuja on Monday, August 14, 2023, after meeting with President Bola Tinubu.

Source: Facebook

CBN says black market dealers would incur loses due to CBN's proposed moves

The CBN boss said he came to tell the President what the apex bank was doing to halt the naira slide.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

According to Shonubi, Tinubu showed concerns over the effects of the recent developments in the Forex market, especially on Nigerians.

He said the black market's naira volatility is driven not only by economic factors but also by speculative demand.

The CBN governor warned speculators that the planned measures could potentially lead to severe losses for them.

He said the reason for the visit to the President was to reassure Tinubu that the CBN was taking decisive action to address the issues raised.

Per the CBN boss, the measures would yield positive outcomes in a few days.

He revealed that the greatest goal of the apex is to create an efficient and reasonable operating environment that reduces the negative impacts on the lives of Nigerians.

He said:

"Mr. President is very concerned about some of the goings in the foreign exchange market. One of the things we discussed is what could be done to stabilize and what could be done to improve the liquidity in the market and also the goings on in the various other markets, including the parallel market.

"He's concerned about its impact on the average person since, unfortunately, a lot of activities that we do, which are purely local, are still referenced to exchange rates in the parallel market."

Punch reported that CBN has begun introducing measures to reduce pressure on the naira in the black market.

The apex bank issued a circular to dealers, international money transfer operators (IMTs), and the public.

CBN introduces strong measures on Diaspora remittances

The circular dated August 9, 2023, signed by the bank's Director of Trade and Exchange Department, Ozoemena Nnaji, placed limits on the naira payout on diaspora remittances.

The circular directed that operators should make the naira payment alternative for proceeds of Diaspora remittances within a limit of -2.5% to +2.5% of the previous day's average rate on the Investors' and Exporters' (I&E) window.

The naira's fall came as the CBN introduced measures to remove obstacles deterring foreign investors. Still, the expected dollar inflows have been slow despite the recent $2.5 billion inflows recorded in the last two months.

CBN's lack of intervention in the Forex market has also led to the massive naira slide at both the official and parallel markets.

Investigator probes CBN staff, NIBBS, NSPMC as bank’s personnel loan hits N40 billion

Legit.ng reported that tensions are rising in the financial system as the administration of President Bola Tinubu resolves to bring to book those found culpable in the past nine years at the Central Bank of Nigeria (CBN).

The President appointed Jim Obazee on July 28, 2023, as a Special Investigator of the CBN and related entities.

According to The Guardian, the investigating team has been significantly expanded with members drawn from different fields of expertise in the financial industry, with Obazee as the helmsman.

Source: Legit.ng