Proof of Ownership Certificate: Nigerians Knock FG Over N1,000 Annual Charge for All Vehicles

- Taiwo Oyedele, a tax expert has stated that the introduction of proof of ownership charge of N1,000 is retrogressive

- He argued that the tax adds complications to the myriad of multiple taxes which already exist in Nigeria

- He urged the government to set aside the tax in the interest of good order and to prevent setting a bad precedent

Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

Taiwo Oyedele has described the federal government's plan to charge private and commercial motorists the sum of N1,000 for proof of ownership certificate annually as retrogressive.

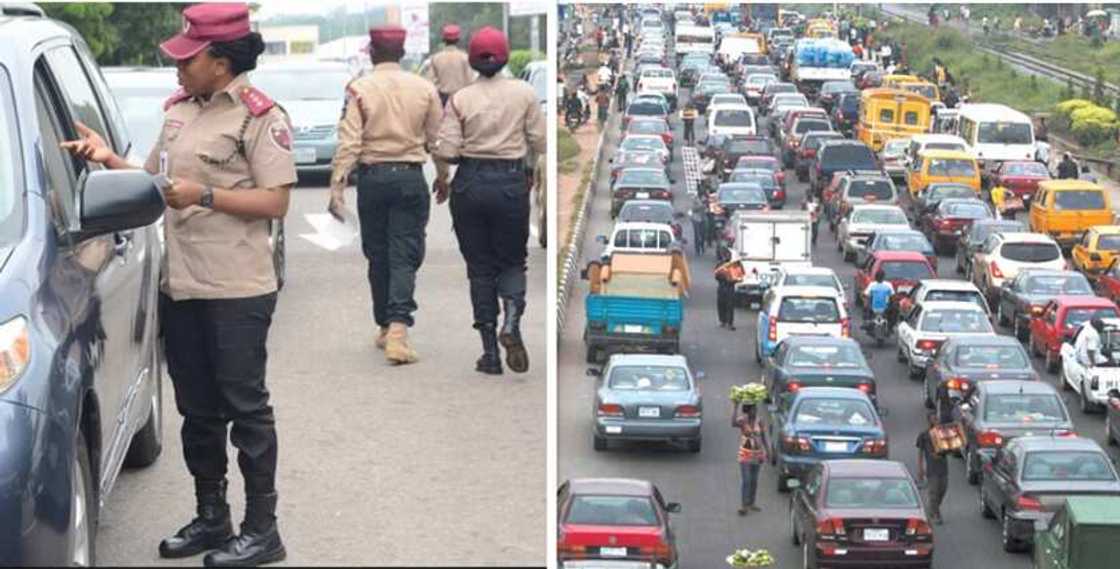

As previously reported by Legit.ng, the Federal Government has recently implemented a new measure requiring motorists in the country to pay an annual fee of N1,000 for the verification of their Proof of Ownership Certificate.

Until now, the Federal Road Safety Corps (FRSC) had been providing the document free of charge to new vehicle buyers.

However, the introduction of the new fee means an additional expense on top of the payments required for vehicle particulars and registration.

Source: UGC

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Expert says annual payment of Proof of Ownership Certificate is retrogressive

According to the government's statement, the fee serves the purpose of monitoring the real-time status and integrity of all vehicles registered on the National Vehicle and Identification Scheme (NVIS) database.

Oyedele, a fiscal policy partner and African tax leader at PricewaterhouseCoopers (PwC), tweeted that the imposition of the tax shows poor conception and inadequate design.

He said that besides appearing to serve as a mere revenue-generating mechanism, one could argue that its benefits largely favor non-state entities rather than the government itself.

He added that it becomes nonsensical to be compelled to provide annual proof of vehicle ownership when you already possess a government-issued certificate validating your ownership.

He said:

The tax adds complications to the myriad of multiple taxes which make doing business difficult and dampens tax morale.

While this tax will not necessarily stop the earth from rotating, it is wrong both in terms of signaling from a multiple taxation perspective and in terms of timing given the recent fuel subsidy removal.

To be sensitive and demonstrate empathy, government should not impose any new or higher taxes on transportation, energy or food which are the most impacted by the subsidy removal. The same reasons why the recent attempt to collect VAT on diesel needs to be reconsidered.

He, therefore, urged the government to set aside the tax in question in the pursuit of maintaining proper order and preventing the establishment of an unfavorable precedent.

Also speaking on the matter, Jude Isong, a motorists in Lagos referred to the new fee as an act of multiple taxation on the part of government.

He said:

This is a fee that we have already sorted out from the time the vehicle is bought. Also, while renewing vehicle licenses and other particulars every year, this is usually part of what is checked and approved in the process.

Asking us to now pay an additional N1,000 at this time is multiple taxation, especially when we have to deal with the rising costs of food, petrol, transportation and even electricity. It doesn't make any sense.

Experts speak as FG moves to implement 5 new taxes

In related news, Legit.ng reported that the Federal Government's intention to impose new taxes on beverages, vehicle importation, telecommunication, among others.

Among the taxes that have garnered attention, the 5% excise duty tax on mobile telephone services, fixed telephone, and internet services stands out as one that raised eyebrows.

The tax, which was previously under suspension, has now been incorporated into the new Fiscal Policy Measures for 2023. This recent development comes after it was signed by the Minister of Finance, Budget, and National Planning, Zainab Ahmed.

The scope of this tax encompasses both postpaid and prepaid mobile telephone, fixed, and internet services.

Source: Legit.ng