New Details emerge on World Bank's $800m loans to FG that will be shared with 50m Nigerians from June

- New details have emerged regarding the new $800 million loan granted by the World Bank to the Federal Government of Nigeria

- The Nigerian Minister for Finance, Zainab Ahmed, explained that the loan will be shared with 50 million Nigerians till June 30, 2024

- A finance document seen by Legit.ng shows that it will take 25 years for Nigeria to complete full repayment

The Federal Government of Nigeria had recently secured $800 million loan from the World Bank to provide palliatives for over 50 million Nigerians after the removal of fuel subsidy.

The money will be shared to vulnerable persons captured in its National Social Safety Net Programme.

While the move looked generous, a finance document seen by Legit.ng reveals that it will take Nigeria 25 years to complete the full repayment.

Source: Facebook

Insight into World Bank loan

Read also

IMF urges CBN to sustain anti-inflation campaign ahead of Tinubu's presidency, makes prediction

he document also showed that the financing agreement was a concessional finance and was signed on August 16, 2022, by the Nigerian Finance Minister and the World Bank Country Director for Nigeria, Shubham Chaudhuri.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

Concessional loans are called soft loans because they have more generous terms than market loans.

These generally include below-market interest rates, grace periods in which the loan recipient is not required to make debt payments for several years or a combination of low-interest rates/grace periods.

How World Bank loan for Nigeria will work

The document reveals that the loan attracts a maximum commitment charge rate of one-half of one percent per annum on the Unwithdrawn Financing Balance and a service charge of three-fourths of one per cent per annum on the withdrawn credit balance.

The interest charge is one and a quarter percent per annum on the withdrawn credit balance, Punch reports.

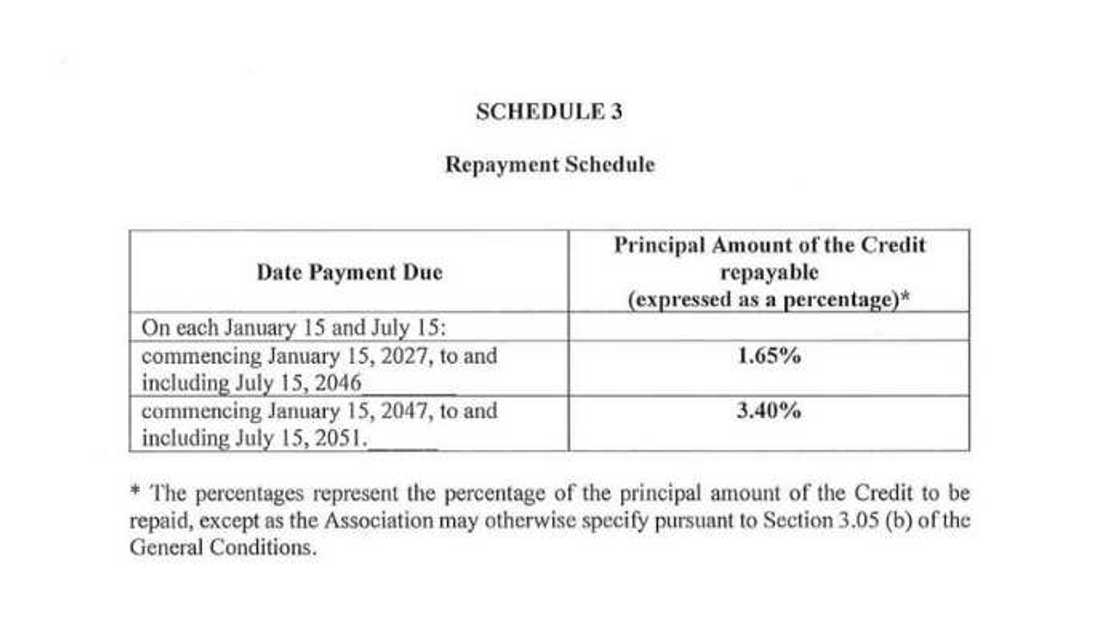

Also, a percentage of the principal amount of the loan is expected alongside the other charges, and this will increase over time.

While the first payment will be 1.65 percent of the principal amount, the last payment will be 3.40 percent of the principal amount.

Repayment plans

Details of the agreement between the federal government and the World Bank has a repayment plan which will be made from 2027 to 2051, twice a year.

FG prepares to share $800m World Bank loan, full repayment with be for 25yrs loan.

Source: Facebook

Nigeria repays China, Islamic bank, others N3.63tn debt

Meanwhile, in another report, Legit.ng revealed that has successfully repaid part of its debt to countries and institutions.

The report provided a breakdown of how the money was paid to China, Islamic bank among others.

Although the repayment is good news, the Nigerian government has borrowed another N6.69 trillion.

Source: Legit.ng