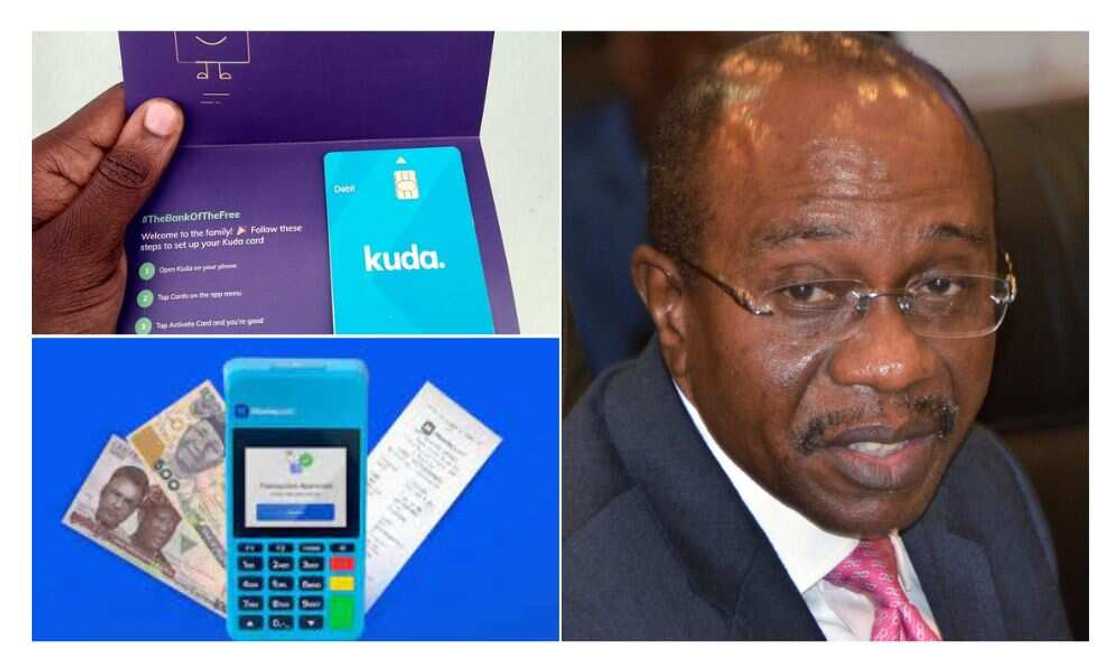

CBN Releases Names of 10 Digital Banks Licensed to Operate as MFBs, Issue POS Services

- The Central Bank of Nigeria (CBN) says there are 10 licensed digital banks in Nigeria

- The apex bank said that digital banks are also allowed to provide microfinance banking in the country

- The banks operate primarily as apps without branches but are accorded the same rights as conventional banks

Digital banking is gaining roots in Nigeria as operators employ the best technological tools to solve Nigerians' transaction challenges and deploy tech-savvy personnel.

To deepen financial inclusion, the Central Bank of Nigeria has approved licensing digital payment platforms to operate microfinance banking and Point of Sale (PoS) services in Nigeria.

Source: UGC

Fintech platforms morphing into banks

Despite being confined to digital spaces, these platforms are ubiquitous and have recently solved myriads of financial problems for Nigerians.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

The banks fall into the fintech ecosystem but serve the same purpose as the traditional banks, which have a physical presence.

A report says these fintech platforms operate under various licensing categories and offer multiple services, delivering financial services via mobile apps and other touchpoints.

According to the CBN database, about 894 companies have been licensed as microfinance banks as of February 2023.

However, only some fully digital companies can be described as digital banks.

Except for a few digital banks, some have also obtained licenses from CBN to operate PoS services.

The names of the banks include:

- Sofri

- Mint

- Piggyvest

- VFD

- Moniepoint

- FairMoney

- Carbon

- Kuda

- Eyowo

- Sparkle

Kuda Bank launches SofPoS, lets users accept card payments from their phones, ends free transfers

Legit.ng reported that Nigeria’s first digital bank, Kuda, has added a new feature to the Kuda Business app, which includes Sales Mode, Kuda Payroll, and business registration.

TechPoint reported that the Nigerian neo bank is set to launch a SoftPoS feature, allowing users to accept smartphone cardless payments.

SoftPoS permits customers to accept contactless cards and turn their smartphones or tablets into a secure payment terminal or Point of Sale (PoS).

Also, due to the recent hiccups experienced by bank customers and their inability to use mobile apps and other digital touchpoints, Nigerians have begun the search for alternatives as fintech firms have taken over the ecosystem and provided better experiences.

These licensed mobile operators have provided relief to many Nigerians at the time of unprecedented transaction failures.

Source: Legit.ng