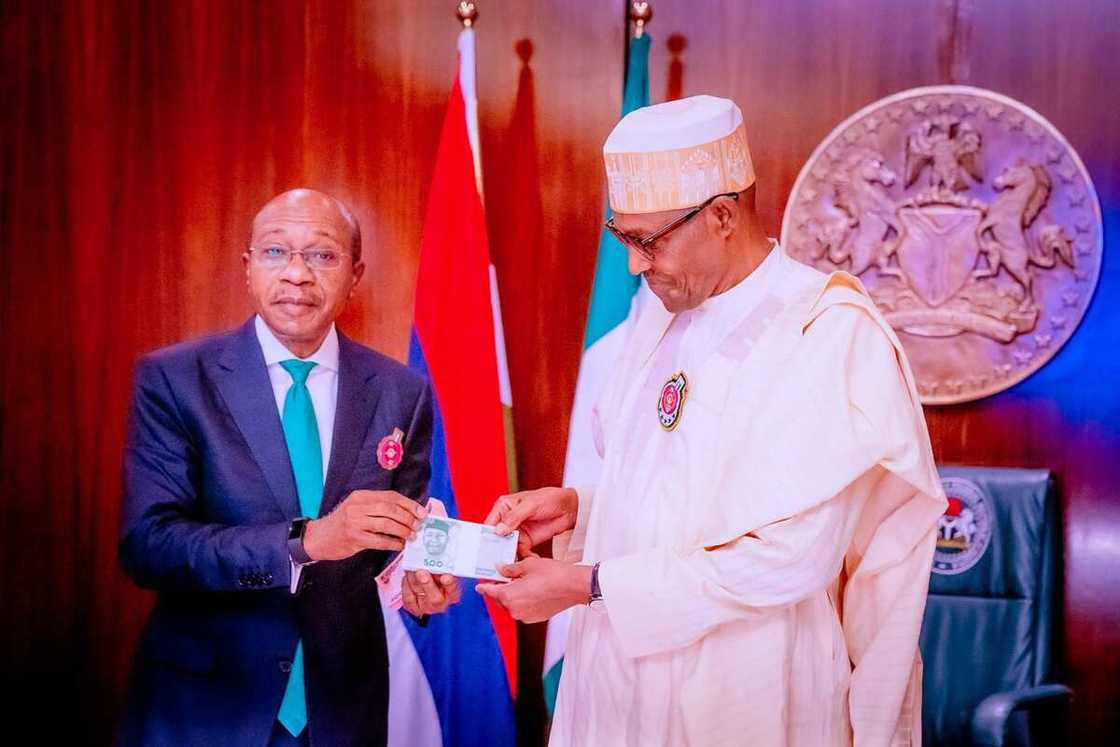

Naira Scarcity Has Cost Nigerian Economy N20 Trillion as CBN Mops UP 70% Cash From Circulation

- Nigerians are falling into abject poverty due to naira scarcity caused by CBN’s redesign programme

- The Centre for Promotion of Private Enterprises (CPPE) stated that Nigeria’s economy had lost about N20 trillion due to the cash crisis

- CPPE asked CBN and President Muhammadu Buhari to direct banks to comply with the Supreme Court order

The current naira redesign policy of the Central Bank of Nigeria (CBN) has cost the Nigerian economy over N20 trillion.

According to the Centre for the Promotion of Private Enterprise (CPPE), Africa’s largest economy lost as 70% of cash is mopped up from the economy.

Source: Facebook

Economy grinding to a comatose

A report quoted CPPE as saying in a press statement that the prolonged cash shortage in the country has disabled the economy and economic activities in Nigeria and is now a primary risk to the livelihoods of many.

Read also

Did Emefiele give money to Lagos LP guber candidate for election? Fresh details emerge as CBN reacts

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Muda Yusuf, the Director, and Chief Executive Officer of CPPE said that retail transactions across sectors have been catastrophic and nerve-wracking as payment system challenges linger.

Yusuf stated that the Nigerian economy had lost about N20 trillion since the beginning of the cash crisis.

He said the losses come from the shutdown of economic activities, crippling of trading activities, stifling of the informal economy, reduction in the agricultural sector, and the paralysis experienced in the rural economy.

Buhari and CBN should direct banks to issue old notes

Per the CPPE report, millions of Nigerians have fallen into poverty and deprivation due to the naira redesign policy, especially with CBN mopping up about 70% of cash from the system.

The CPPC boss said Nigerians are traumatized because of the actions of the apex bank.

Yusuf stated that the economy is gradually shutting down due to the collapse of payment systems across all platforms.

Read also

NEDC: Anti-corruption group tackles CSOs for raising false alarm on corruption in govt agency

The erstwhile boss of the Lagos Chamber of Commerce and Industry said the CBN has not officially communicated to the commercial banks regarding the Supreme Court ruling, stating that Buhari’s silence has become worrisome.

The statement said:

“The CBN should be directed to immediately inform the Nigerian public that the old currency notes [alongside the new notes] remain legal tender until the 31st of December 2023, in line with the Supreme Court judgment.”

“The president should publicly empathize with Nigerians on the unwarranted and inexcusable pain and suffering that the currency redesign policy has wreaked on them.”

CBN mops up N2.09 trillion in 4 months as cash scarcity persists

Recall that Legit.ng reported that the Central Bank of Nigeria (CBN) had shrunk the currency in circulation from N3.29 trillion as of October 2022 to N1.38 trillion by January 2023 as it embarks on the demonetization policy with the naira redesign policy.

According to data obtained from the apex bank, this represents a drop of N1.91 trillion in three months.

The move is due to the naira redesign plans of the CBN announced by Godwin Emefiele in October last year.

Source: Legit.ng