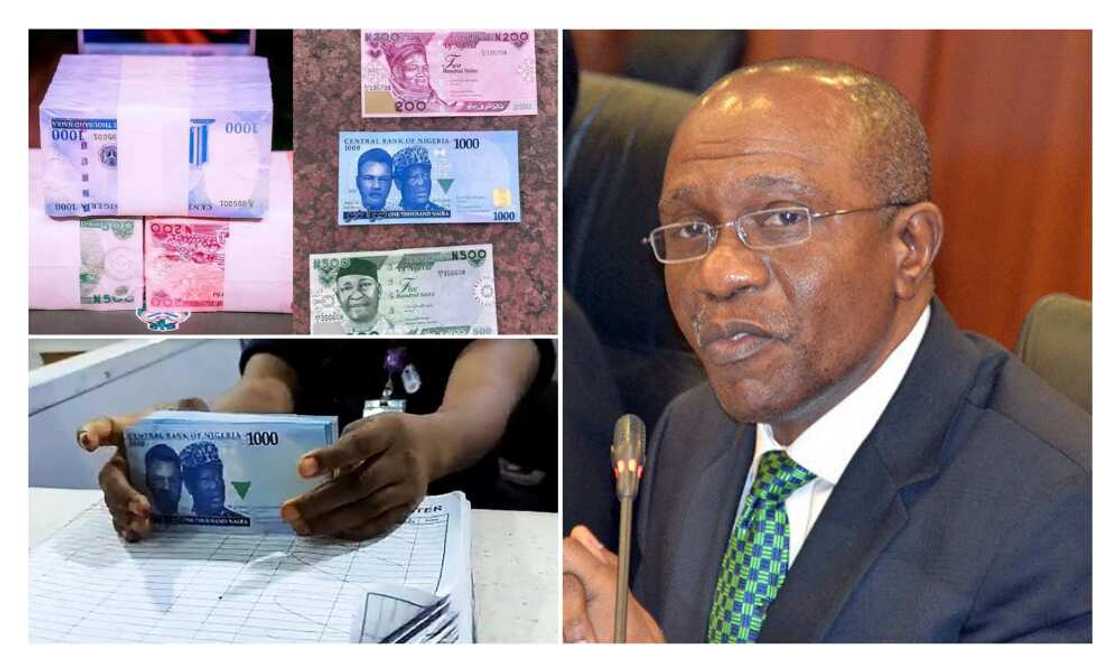

CBN Mops Up N2.09 Trillion in 4 Months as Cash Scarcity Persists

- As of October 2022, the total currency in circulation was N3.29 trillion due to the mop-up of old naira notes

- Following the naira redesign policy of the CBN, the cash in circulation dropped to N1.38 trillion as of January 2023

- CBN said the naira redesign policy is meant to drive a cashless economy and control inflation, among other things

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

The Central Bank of Nigeria (CBN) has shrunk the currency in circulation from N3.29 trillion as of October 2022 to N1.38 trillion by January 2023 as it embarks on the demonetisation policy with the naira redesign policy.

According to data obtained from the apex bank, this represents a drop of N1.91 trillion in three months.

Source: Getty Images

Naira redesign causes a drop in circulating currency

The move is due to the naira redesign plans of the CBN announced by Godwin Emefiele in October last year.

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

The CBN boss also announced January 31, 2023, as the deadline for circulating old currency notes, extending it to February 10, 2023.

CBN said:

“Accordingly, all Deposit Money Banks currently holding the existing denominations of the currency may begin returning these notes to the CBN effective immediately. The newly designed currency will be released to the banks on a first-come-first-serve basis.

“Customers of banks are enjoined to begin paying into their bank accounts the existing currency to enable them to withdraw the new banknotes once circulation begins.”

Emefiele narrates challenges of currency management

The Punch reports that Emefiele decried challenges of currency management, including hoarding banknotes by the public, with data indicating that over 80% of the currency in circulation was outside the banking system.

Emefiele also stated that the shortage of clean and fit naira notes with the attendant negative image of the CBN and increased risk of financial stability, currency counterfeiting, and ransom payment, among others, as reasons for the aggressive push for currency redesign by the bank.

The CBN added that the currency in circulation rose by N58.36 billion to N2.84 trillion in September last year from N2.79 trillion in August 2022.

Also, the cash in circulation increased to N2.81 trillion in July last year from N2.74 trillion at the end of June 2022. It dropped to N2.79 trillion in May 2022 from about N2.80 trillion at the end of April 2o22.

Circulating currency is money outside the vaults of the CBN, meaning all legal tender is in the hands of citizens and Deposit Money Banks.

Naira Crisis: CBN's cashless policy gathers N1.6 trillion cash in circulation in one month

Recall that Legit.ng reported that cash in circulation in Nigeria dropped to a record low of N1.39 trillion in January 2023, representing the lowest level in the last seven years.

Data from the Central Bank of Nigeria (CBN) disclosed that the total amount received in January alone is about N1.6 trillion.

Read also

Naira against dollar hits N767, falls heavily against euro, pound ahead of 2023 general election

The drop followed the apex bank’s aggressive monetary policy to end the circulation of old naira notes and introduce limited circulation of new notes into the economy.

Source: Legit.ng