Naira Swap, Banking Troubles: Nigerians Name Alternative Platforms for Saving, Seamless Transactions

- Collapsing bank structures and incomplete transactions are reasons Nigerians are looking for better alternatives

- The current cash scarcity has revealed how weak and unready banks are to go entirely cashless

- Frustrated Nigerians have lined up what they say are better options for saving their money in the banks

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

Following moves by the Central Bank of Nigeria (CBN) to swap old naira notes for new ones and its February 10, 2023, deadline, many banks in the country are at their wit's end due to the volume of hiccups in transactions.

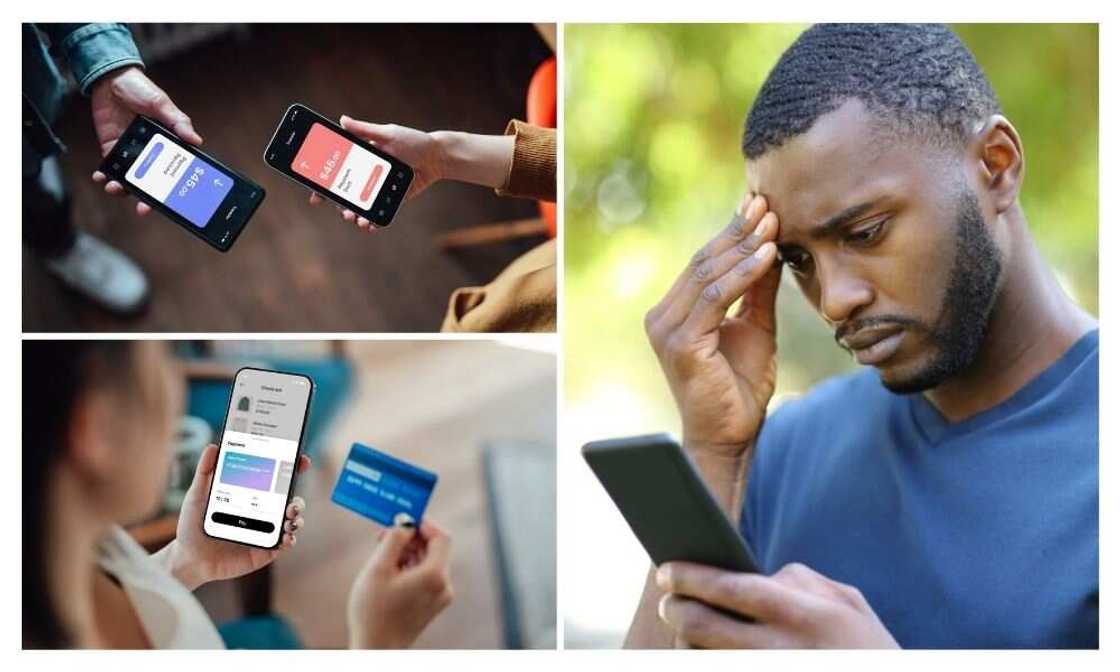

Reports of glitches from banking platforms have left many in Nigeria exasperated, frustrated, and yearning for better alternative savings platforms.

Source: Getty Images

Banks not ready for a cashless economy

Experts believe that the current bank woes, caused by scarcity of cash, have unearthed the underbelly of Nigeria's banking industry, showing how unready the entire banking sector is for the much-touted cashless policy of the Central Bank of Nigeria.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Recently, Nigerians reported incomplete transactions, collapsing bank apps and, in most cases, a complete shutdown of an entire bank's structure.

Agitated Nigerians are on the prowl for better saving alternatives that will neither rip them off nor collapse while performing financial transactions.

Analyst weighs in

Jerry Joseph, a financial analyst and a brand reporter with a Nigerian newspaper, told Legit.ng that CBN should have envisaged what is currently happening in the bank ecosystem.

Joseph said the apex bank believed that the banks that boast of robust infrastructure have what it takes to carry out the cashless policy but has now realised that everything has been a smokescreen all along.

"You would think that these banks with top-notch technology are ready for the cashless economy.

"The chicken has come home to roost. Instead of going cashless, the banks are busy hoarding scarce cash. Why? Because deep down, they don't have what it takes to drive the cashless policy," Joseph said.

Nigerians choose fintech over banks

Social media is replete with Nigerians throwing tantrums at their banks for failing them in their hour of need.

The frustration has led them to start naming what they consider better alternatives to exploitative banks.

Another factor leading the quest for alternatives is the belief that the banks have cut-throat charges, leaving Nigerians feeling short-changed and cheated.

Most of the alternatives suggested by Nigerians are primarily fintech platforms which many believe have brought disruption to the banking space.

These fintech companies have built digital wallets and mobile savings platforms that have kept Nigerians from experiencing excessive charges employed by banks.

Data from Statista states that Nigeria's digital wallet adoption will grow by 37.6% by 2025.

Statista predicted top mobile wallets in Nigeria that will gain massive adoption in the next two years.

Top mobile wallets and platforms

Paga

According to Statista, Paga is expected to reach more users by 2025. Paga is regarded as Nigeria's most prominent fintech firm, having processed over $2 billion in transactions in 2020.

MTN MoMo

The CBN's policy of granting telecommunication companies licenses to operate agency banking has led to the emergence of MTN Momo Payment Service Bank.

Momo is said to have the most significant number of agents across Nigeria, with over 100,000 spread across the 774 local government areas in Nigeria.

Quickteller

Nigeria's oldest payment platform, Quickteller, is regarded as a top player in the digital payment and savings ecosystem in Nigeria.

Quickteller's digital wallet is used widely in Nigeria with a focus on facilitating transactions across Africa.

Besides acting as a mobile transfer vehicle, Quickteller is also a savings platform.

Chipper Cash

The newest baby in the payment and savings ecosystem, Chipper Cash, blazed into the scene and won many hearts in Nigeria.

Aside from acting as a payment platform, Chipper Cash has a digital savings wallet that accrues interest for users.

The fintech firm also operates a virtual card that can be used for international transfers and transactions.

Chipper Cash has over three million users on its platform and processes over 80,000 transactions daily.

Opay

With over 18 million users in Nigeria, Opay, the digital payment platform, has emerged as a top powerhouse in the digital ecosystem of the country. Others are:

- KongaPay

- PalmPay

- PiggyVest

Top digital wallets to adopt in Nigeria to avoid excessive bank charges

Legit.ng earlier reported that excessive bank charges have driven Nigerians into the waiting arms of fintech firms that have developed products to lure them away from conventional banks.

These fintech companies have built digital wallets and mobile savings platforms that have kept Nigerians from the clutches of excessive charges employed by Nigerian banks.

Data from Statista states that Nigeria’s digital wallet adoption will grow by 37.6 per cent by 2025.

Source: Legit.ng