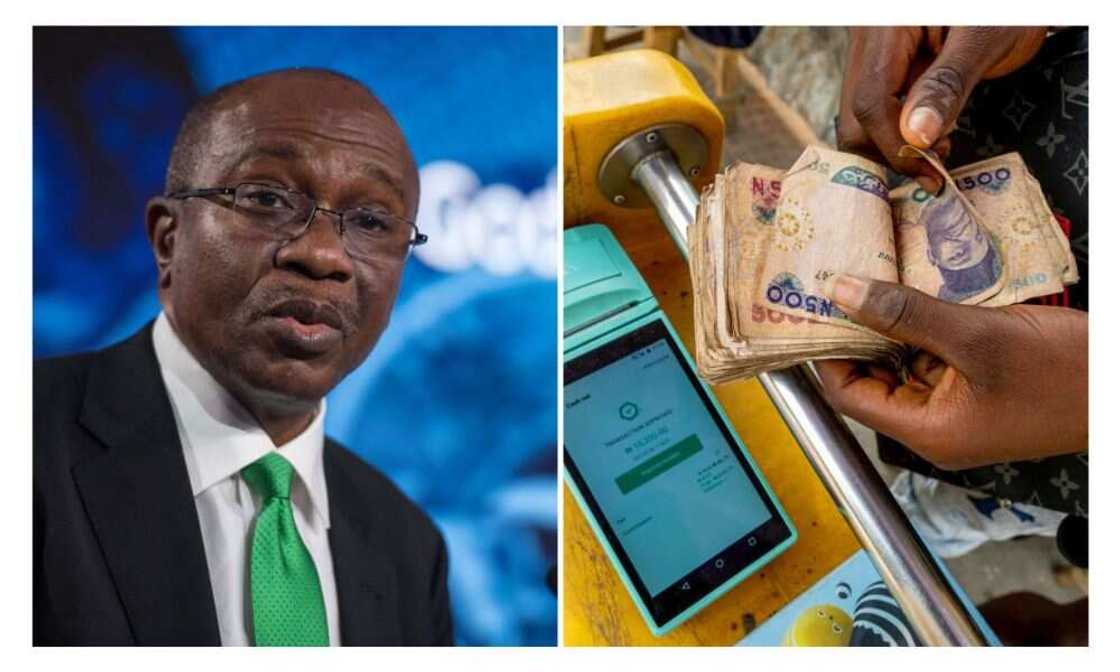

PoS Operators, Falana to go to Court Over CBN's Withdrawal Limit

- PoS operators have threatened to sue the Central Bank over the new withdrawal limit by the bank

- This is despite the CBN saying that the operators could apply for waivers to go above the withdrawal threshold

- Also, legal practitioner, Femi Falana has threatened the CBN with a lawsuit over the withdrawal limit

Point of Sale terminal operators otherwise known as PoS operators has begun moves to sue the Central Bank of Nigeria if it does not stop the withdrawal policy it recently imposed on Nigerians.

The policy limits over-the-counter withdrawals by individuals and corporate bodies to N100,000 and N500,000 respectively weekly.

Source: Getty Images

CBN's policy limits withdrawal limits from PoS terminals to N20,000 weekly

In a memo, the apex bank introduced the policy stating that third-party cheques above N50,000 would not be eligible for over-the-counter payment while existent limits of N10 million on clearing cheques still remain.

Read also

CBN to review cash withdrawal limit policy, as banks get ready to circulate new naira notes

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

The policy also asked banks to load only N200 and other lower denominations into their ATMs and limited withdrawals to N20,000 per day.

The Punch report said the policy will take effect on January 9, 2023, and had generated criticisms and controversy, leading the CBN to clarify on Wednesday, December 7, 2022, that PoS operators could apply for waivers.

Falana threatens lawsuit

However, Femi Falana, on Monday, December 12, 2022, described the policy as unconstitutional.

The lawyer said he would sue the Central Bank of Nigeria over the new policy, a Punch report said.

POS operators lament CBN's cash withdrawal limit, describe policy as deadly to businesses

Legit.ng reported that Point of Sale (PoS) operators have described the latest Central Bank of Nigeria (CBN) cash withdrawal limit as deadly and draconian to their businesses.

Read also

Trouble for CBN governor as lawmakers make stong decision over cash withdrawal limit policy

The daily limit of N20,000 from the PoS channel imposed by the apex bank, which takes effect on January 9, 2023, is seen as a threat and will destroy jobs and booming businesses.

The CBN wrote to banks and other financial institutions on Tuesday, December 6, 2022, that it had slashed cash withdrawal from ATMs, over-the-counter, PoS and cheques.

Source: Legit.ng