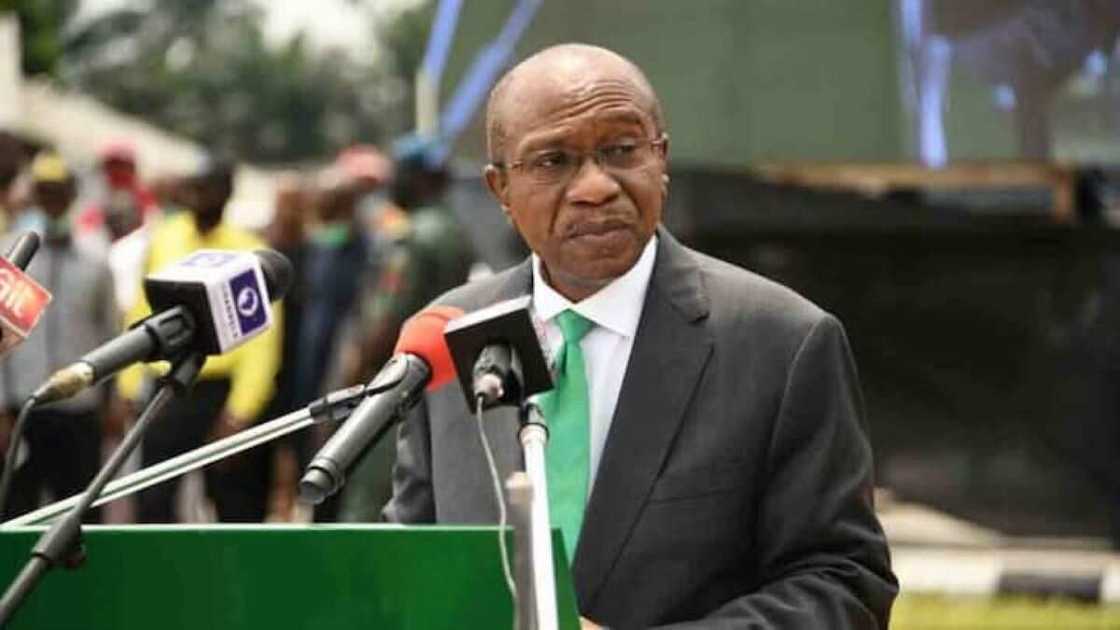

Emefiele States Why Naira is Falling, Says National Card to Commence January

- The Central Bank of Nigeria (CBN) governor, Godwin Emefiele, has said the number of Nigerians seeking foreign education is to blame for the fall of the naira

- He said there has been be a tremendous increase in visa issuances to Nigerians by the UK in 2022 alone

- Emefiele stated that the move has immensely put pressure on Nigeria’s foreign reserves and the naira

PAY ATTENTION: How media literate are you? Click to take a quiz – bust fake news with Legit.ng!

The governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, has blamed the number of Nigerian students seeking foreign education for the depletion of the foreign reserves.

Nairametrics reports say the official foreign exchange received from crude oil sales into Nigeria’s reserves has depleted steadily from over $3 billion monthly in 2014 to zero dollars in 2022, according to Emefiele.

Source: Facebook

Nigerian students seeking visas overseas increase

He stated this at the 57th annual bankers’ dinner organised by the Chattered Institute of Bankers of Nigeria (CIBN) in Lagos on Saturday, November 26, 2022.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

The CBN boss noted that the Nigerian foreign exchange market is in the middle of a severe crisis, putting pressure on the reserves and suppressing the value of the naira.

BusinessDay report said that market demands for goods and services have continued to soar under different uses amid falling foreign exchange supply.

The apex bank helmsman noted that the number of student visas given to Nigerians by the United Kingdom has spiked from a yearly average of about 8,000 visas in 2020 to almost 66,000 in 2022, implying an eight-fold increase amounting to $2.5 billion yearly in study-related forex outflow to the UK alone.

RT200, a boost to foreign exchange inflow

Due to this and the need to increase forex earnings, the CBN and the Bankers’ Committee started the RT200 scheme in February 2022, Emefiele said.

He said that the scheme was primarily designed to handle the problem of repatriation of non-oil export proceeds creatively.

Emefiele noted that inflows via the programme in 2022 increased to about $1.6 billion and could surpass $2.5 billion by the end of this year.

He said:

“Under the rebate scheme of the programme, the Bank has reimbursed a total of N78.4 billion naira, which I consider a fair price to incur to stabilise our foreign exchange market,” Emefiele said.

Before the introduction of the RT200, the CBN embarked on several initiatives to encourage forex inflow into Nigeria.

The Naira-4-Dollar initiative, reflecting the CBN’s efforts to increase migrants’ remittances into the country, was one such initiative.

Emefiele said:

“I am happy to note that, so far, the Naira-for-Dollar scheme has been successful in increasing remittance inflows through our registered International Money Transfer Organizations (IMTOs).”

National Domestic Card Scheme to start January 2023

The National Domestic Card Scheme, Emefiele said, is expected to lower operating costs for banks incurring huge charges for foreign card schemes. Also, it would reduce huge forex commitments associated with using foreign card initiatives.

The scheme will commence on January 16, 2023. Emefiele added that Nigeria would join a growing list of emerging markets and developing economies, such as India, Turkey, China and Brazil, which launched the domestic card scheme.

CBN, NIBSS move to unify payments through National Domestic Card scheme

Legit.ng reported that Nigeria’s apex bank, the Central Bank of Nigeria (CBN) and the Nigeria Inter-Bank Settlement System (NIBSS), including the Bankers Committee, will float a national card scheme to enhance the payment system in Nigeria.

Vanguard reports that the Managing Director of NIBSS, Premier Owoh, stated this during the Committee’s meeting on Thursday, October 20, 2022.

Owoh said the project has been approved and is the brainchild of CBN.

Source: Legit.ng