Meet CBN Governors From Independence to Date in Nigeria

- The Central Bank of Nigeria was established by the CBN Act of 1958 and started operations on July 1959

- The bank is Nigeria's apex bank and serves as a financial adviser to the federal government of Nigeria

- The bank is also in charge of monetary policies in Nigeria, including currency and regulation of the financial services sectors in Nigeria

PAY ATTENTION: How media literate are you? Click to take a quiz – bust fake news with Legit.ng!

The Central Bank of Nigeria is Nigeria's apex bank and monetary authority established by the CBN Act of 1958 and began operations on July 1 1959.

The main job of the CBN is mostly regulation of the financial services sector in Nigeria, maintenance of the nation's external reserves, promoting monetary stability and a sound financial environment and acting as a banker of the last resort and financial adviser to the Nigerian government.

Read also

New twist as Ohanaeze, Yoruba Youth Council back CBN’s withdrawal limit policy, reveals fresh position

Source: UGC

After colonial rule in Nigeria ended, the country desired to be proactive in developing the economy, especially after the civil war.

The CBN became involved in lending directly to consumers and contravened its original purpose of working through commercial banks in activities which involved consumer lending.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

Policy implementation and criticism

The early functions of the CBN were mainly to act as the government's agency for the control and supervision of the banking sector, supervising the balance of payments per the federal government's demands and streamlining monetary policy along with the demands of the federal government budget.

Changes under Chukwuma Soludo

The CBN helped in the growth and financial trust of Nigerian commercial banks by ensuring that all the banks in Nigeria had enough capital bases.

It ensured that the banks' customers did not bear losses alone in the event of a collapse. The policy led to the collapse of some commercial banks due to their inability to meet the required capital base of N25 billion.

The policy solidified the commercial banks in Nigeria and ensured that individuals and organisations without financial stability do not operate banks in the country.

Nigeria has one of the most advanced financial services sectors in Africa, with most commercial banks operating in other African countries.

Changes under Sanusi Lamido Sanusi

In 2oo9, under the leadership of Sanusi, the CBN sacked the CEOs and executive directors of five commercial banks in Nigeria for mismanagement of loans and over-dependence on the CBN.

Ex-president Goodluck Jonathan suspended Sanusi in 2014 on the allegations of financial recklessness.

The CBN also fired the entire First Bank of Nigeria board, which was in serious financial trouble.

Changes under Emefiele

Last year, the Emefiele-led CBN announced the suspension of foreign exchange sales to the bureau de change operators.

Due to the decision, all forex sales were to be done directly by the commercial banks.

In July 2021, Emefiele announced the launch of Nigeria's and Africa's first Central Bank Digital Currency (CBDC), known as the e-naira, on October 25.

Emefiele became the 11th CBN governor and its indigenous governor. He succeeded Sanusi Lamido Sanusi.

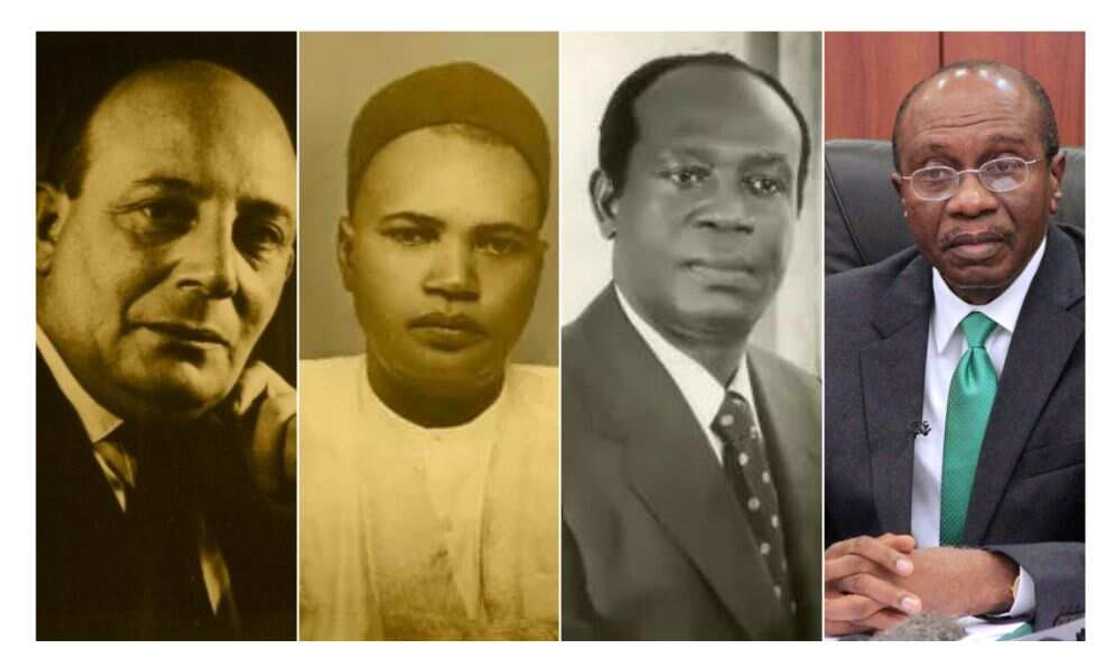

Central Bank governors to date

- Roy Pentlow Fenton - 1958 - 1963

- Aliyu Mai-Bornu - 1963 - 1967

- Clement Nyong Isong -1967-1975

- Adamu Ciroma - 1975-1977

- Ola Vincent - 1977-1982

- Abdulkadir Ahmed 1982 -1993

- Paul Agbai Oguma 1993-1999

- Joseph Sanusi 1999-2004

- Charles Chukwuma Soludo 2004 -2009

- Sanusi Lamido Sanusi -2009 - 2014

- Godwin Emefiele -1014 - date

Access, Zenith are the leading commercial banks in Nigeria by total assets in 2022

Legit.ng reported that Nigerian banks have emerged stronger in the face of economic uncertainty, increasing their asset base by over N4.76 trillion in the first six months of 2022.'

Data obtained from the Nigerian Exchange showed that 13 banks increased the value of their assets at the end of June 2022 by 8.1% to N63.59 trillion, up from N58.83 trillion at the start of the year.

Access Bank, Zenith, and FBN Holdings retained their positions as the top three commercial banks based on asset base.

Source: Legit.ng