Debt Servicing Eats up N45 of Every N100 Taxes Collected From Nigerians, Companies in 2 Months

- Nigeria's debt problem has again been laid bare as a new report from CBN shows 45% of taxes generated are used to service debt

- The taxes were collected from Nigerians, and companies in the form of VAT, excise duty, income tax

- It is expected that the debt costs will increase in the coming months as more loans collected over the years mature

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

The Central Bank of Nigeria has revealed that more than 45 per cent of tax collections in April and May of 2022 were used to repay loans.

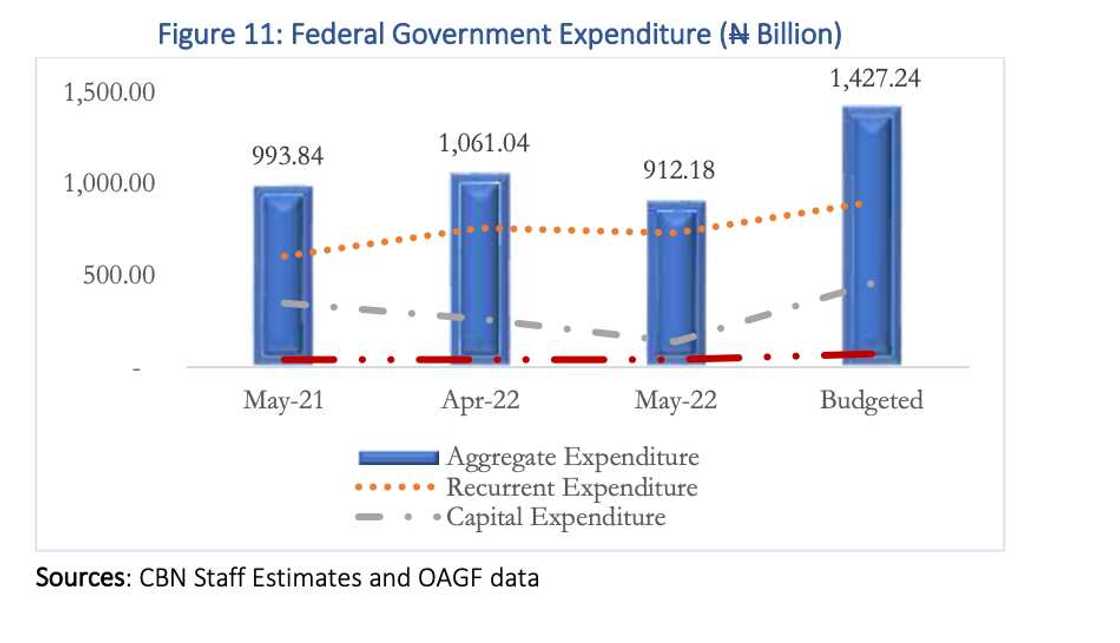

CBN's in its economic report for May 2022 revealed that debt servicing costs in April and May amounted to N412.91 billion.

While FG recorded N977.88 billion in tax receipts from Value Added Tax, Company Income Tax, and Customs & Excise Duties.

Source: Facebook

The above shows that for every N100 tax receipt recorded by the federal government, an average of N45 went into repaying debts procured from local and foreign creditors.

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

Breakdown of May revenue

According to the CBN report, Nigeria recorded non-oil receipts of N549.10 billion in May 2022, down from N857.68 billion in April.

It stated:

"The performance reflected the 66.2 per cent, 24.1 per cent, and 18.5 per cent decline in Company Income Tax (CIT), Customs & Excise Duties, and Value-Added Tax (VAT), respectively.

"In addition, receipts from CIT were particularly low, due to seasonal effects, as firms prepared towards the end-June cut-off date for filing tax returns."

Expert speaks

Speaking on Nigeria's debt service, Ibrahim Shelleng, MD, Credent Investment Managers Ltd, said development signals cause for concern for the economy.

He said:

"Debt service certainly presents a concerning situation because it will effectively limit the government's ability to spend on much-needed capital expenditure and infrastructure.

It exposes the country's fiscal stability to global headwinds, making it even more expensive to fund the budget as interest rates rise globally due to inflationary pressures.

"However, this also presents a challenge to the government to find new revenue sources as borrowing may become more difficult."

Top five states with highest external debt

Meanwhile, with Naira going through a rough patch against the US dollar, servicing the external debts of 36 states in Nigeria has become more expensive.

Data from the Debt Management Office (DMO) showed that as of December 2021, the total external debt stock of 36 subnational governments and the Federal Capital Territory Abuja stood at $4.77 billion.

As of December 2021, the states with the highest external debts were Lagos, Kaduna, Cross River, Edo, and Rivers.

Source: Legit.ng