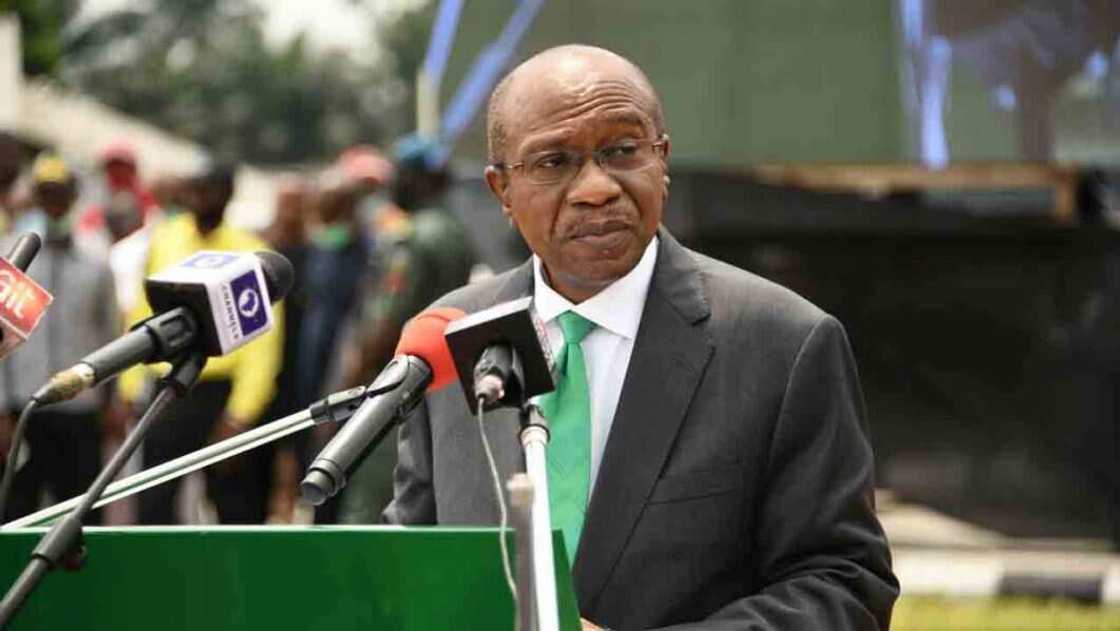

Explainer: How CBN Governor, Emefiele Breaks CBN Law to Meet President Buhari’s Loan Requests

- The Central Bank of Nigeria has so far borrowed the federal government over N20 trillion

- The debt level effectively indicates that the CBN has resorted to breaking its own fiscal responsibility law in order to meet the demands of President Buhari

- This massive debt is not included in the Debt Management Office's total public debt stock of over N41.6 trillion

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

The Federal Government of Nigeria's (FGN) debt to the Central Bank of Nigeria (CBN) has kept growing in recent years.

It is now at a point where the country's CBN can no longer keep to its own laws of fiscal responsibility.

According to Finance Minister Zianab Ahmed, the Federal Government borrowed N3.15 trillion from the CBN between January and July this year, BusinessDay reports.

Source: Facebook

This disclosure caught the interest of economists and financial analysts since the fresh loans in 7 months take FG debt to apex bank's to N20.61 trillion.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

Finance minister disclosure

The ministry of finance in its 2023-2025 Medium Term Expenditure Framework/Fiscal Strategy Paper disclosed the level of debt FG owed to CBN.

It reads:

"Nigeria's overall national debt amounted at N41.6 trillion as of March 2022. When compared to the N39.56 trillion reported in December 2021, this indicates a N2.048 trillion or 5% growth in three months.

"This does not include the FGN's outstanding CBN Ways and Means, which is believed to be over N20 trillion."

Ways and Means

The Central bank of Nigeria borrows FG through what it called Ways and Means Advances.

This is a loan facility to finance the government in periods of temporary budget shortfalls subject to limits imposed by law.

What the law says

One section of the CBN Act, 2007, states that in the case of a revenue shortage, the CBN must not lend to the Federal Government more than 5% of the previous year's revenue.

This part of the CBN Act intends to avoid the central government from becoming overly reliant on CBN finance, rather than opening up the economy to encourage local investments and attract foreign direct investments.

CBN violates its own law

Points to note

- The FGN's retained revenue in 2015 was N3.43 trillion, implying that the CBN's total financing to the FGN through its Ways and Means in 2016 should not have surpassed N171.55 billion.

- The FGN's total income in 2016 was N3.18 trillion, limiting the CBN's lending to the government in 2017 to N159.24 billion.

- Given the previous year's total retained income of N2.85 trillion, the CBN's financing to the FGN should have been N142.37 billion in 2018.

- The CBN should not have lent the government more than N209.28 billion in 2019.

- The CBN should have lent the FGN a maximum of N240.05 billion in 2020 and N201.24 billion in 2021.

From 2016 to 2021, the CBN's total lending to the FGN should have been N1.12 trillion. However, existing data indicates otherwise.

The CBN's loans to the FGN totaled N4.389 trillion in 2020. Another N932.6 billion was loaned to the FGN in 2021.

This implies in two fiscal years, the FGN obtained N5.32 trillion from the CBN.

Naira Continues Free-Fall At Official Markets

In another report, legit.ng reports that the rise in oil price, the successful Eurobond, and also the International Monetary fund(IMF) $3.5 billion SDR credit have helped boost Nigeria's reserves.

The report noted that Nigeria reserves could hit over 40 billion in the coming months when CBN gets all the money expected.

The rise in external reserves will come as a welcome boost for CBN in its fights to keep Naira stable amid pressure from investors and Nigerians for foreign currency

Source: Legit.ng