Nigerians Knock Emefiele, CBN Over Indemnity on Bank Transfers

- Nigerians are not happy with the new policy recently introduced by the CBN that bank customers produce indemnity on bank transfers

- The policy mandates bank customers to pay indemnity on transfers above N1 million for individuals and N5 million organisations

- Nigerians who read the story on Legit.ng's website frowned at the policy, saying it is anti-people and favours the banks

Nigerians have knocked the Central Bank of Nigeria (CBN) and its helmsman, Godwin Emefiele over the introduction of indemnity on bank transfers above N1 million for individuals and N5 million for corporate organisations.

Those who commented on Legit.ng’s story reporting the new CBN policy lambasted the apex bank and its governor, Godwin Emefiele for wanting to further impoverish Nigerians with what they have called obnoxious policies.

Source: UGC

CBN wants to punish Nigerians, readers lament

According to them, since Emefiele became the bank’s governor, not many of his policies have benefited depositors, stating that the ex-Zenith bank chief has been favourable to the banks.

PAY ATTENTION: Follow us on Instagram - get the most important news directly in your favourite app!

Haliru Abubakar who commented on Legit.ng’s story said Emefiele has been protective of his colleagues.

Abubakar said:

“What do you expect from a banker supervising banks? His interest is always to protect his colleagues, Remember when Sanusi removed ATM withdrawal charges upon assumption he returned it and reversed so many customer-friendly policies in favour of the banks. Thank God he has tenure and will one day leave.

"It's a punishment for not allowing him to contest."

Lydia Austin-Afa said the policy is designed to rob Nigerians and is not favourable.

Austin-Afa said:

Read also

No one is allowed to visit my house or office without PVC: Peter Okoye instructs his securities and management

“Always looking for means to rob hard-working people who refuse to give up.”

Tracy Nddy said:

“We have seen it all in this administration. Which other can be worse? Non. Don't worry, your clocks are ticking. Affliction shall not rise a 3rd time."

Tunde Oladunjoye said that the policy is designed to burden depositors rather than relieve them.

“Just passing all burdens to the masses what a country... This type of democracy is not good for Nigeria.. Too much impunity.”

Legit.ng packs reactions over policy

The story which was published on June 3, 2022, has packed over 7,000 comments and had close to 1,000 shares and 14,000 reactions on social media.

Many of the comments condemned the CBN policy and asked that the bank reverses itself immediately.

CBN: New eNaira updates will support utility bills payment, air travel and USSD transactions

Recall Legit.ng reported that Nigeria’s apex bank, the Central Bank of Nigeria has issued a new directive mandating bank customers to pay indemnity on bank transfers above N1 million for individuals and N10 million for corporate organizations.

Read also

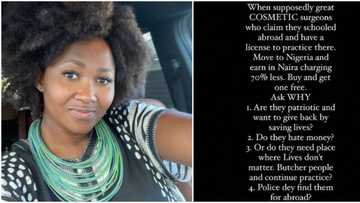

Nigeria is a safe haven for bad IJGB cos-surgeons: Actress Mary Njoku asks hard questions as she drops opinion

The CBN pegged an upper limit on the amount transferable at N25 million and N250 million for individuals and corporate customers respectively.

Vanguard reports that the new directive is to absolve the banks and put liabilities for any breach or risks arising from such transfers on the bank customers.

Source: Legit.ng