Federal Government Reveals Borrowing Calendar for the First three Months to Raise Fund for 2022 Budget

- Federal government has announced plans on how it intend to borrow from citizens to finance the 2022 budget

- The 2022 budget has an expenditure plan of N17.127 trillion but FG is expecting only N10.74 trillion

- To help cover the deficit, Patience Oniha, DMO director-general has announced how the first tranche of domestic borrowing will take place

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

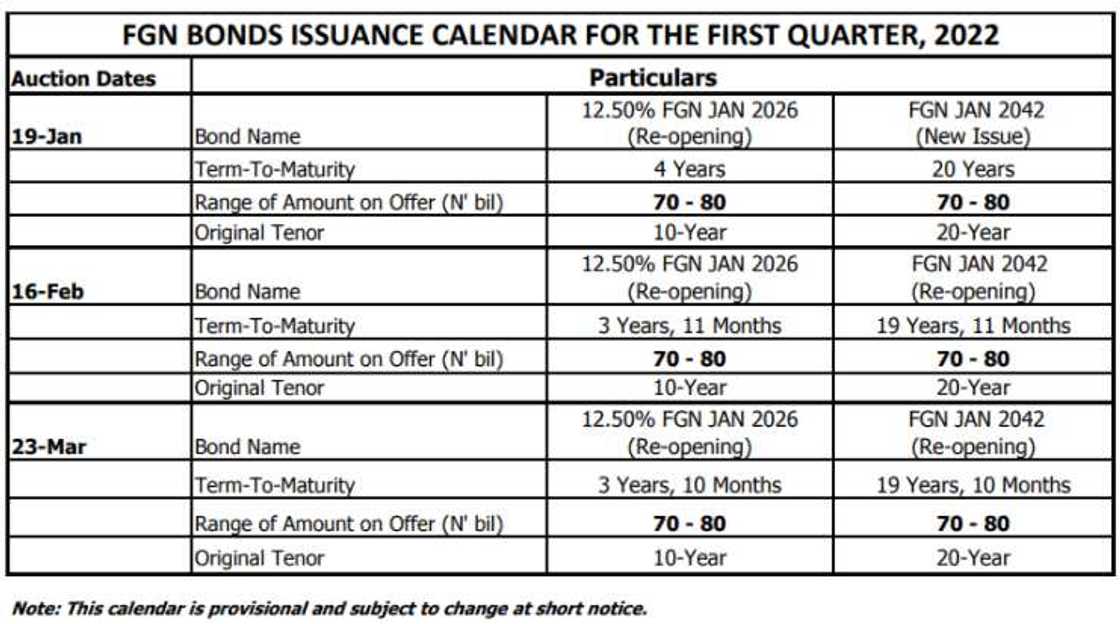

The Debt Management Office (DMO) of Nigeria has released its FGN bond issuance calendar for the first quarter of 2022. This is contained in a document released by the DMO on its website.

According to the press release, the issuance for the quarter under review will be held on 19th January, 16th February, and 23rd March 2022 respectively.

The breakdown of the calendar shows that the agency will be issuing a new FGN bond (FGN Jan 2042) with a maturity tenor of 20 years, Nairametrics reports.

Read also

Federal government announces plan to lift 35m people out of poverty, create 21m new jobs in 3 years

Source: Facebook

What do FGN bonds mean

FGN Bonds are debt securities (liabilities) of the Federal Government of Nigeria (FGN) issued by the Debt Management Office (DMO) for and on behalf of the Federal Government. The FGN has an obligation to pay the bondholder the principal and agreed interest as and when due.

Do you have a groundbreaking story you would like us to publish? Please reach us through info@corp.legit.ng!

When you buy FGN Bonds, you are lending to the FGN for a specified period of time. The FGN Bonds are considered as the safest of all investments in domestic debt market because it is backed by the ‘full faith and credit’ of the Federal Government, and as such it is classified as a risk-free debt instrument.

According to the DMO, the bonds have no default risk, meaning that it is absolutely certain your interest and principal will be paid as and when due. The interest income earned from the securities are tax exempt.

Railway, satellite lead list of 15 projects Nigeria agreed N2.50trn loan with China

In a related story, rhe Debt Management Office (DMO) has announced Nigeria's overall public debt has risen to N38 trillion as of September 30, 2021.

The loan from China is one area many Nigerians are interested in amid stories of assets being seized from nations unable to repay their debt.

DMO has now released a thorough analysis of loans received from China in the last 13 years, including how much has been returned and for what projects the funds were obtained.

Source: Legit.ng