Debt Servicing Gulps 98% of Nigerian Govt Retained Revenue in 2021, as Salaries, Others are Funded with Loans

- Debts collected over the years by the present administration and the previous are causing serious fiscal headache

- From January to November 2021, 97.5 percent of Nigerian government's revenue was spent on servicing old debts

- With just a little over 5 percent revenue left, Nigerian government was forced to reply on the N4.3 trillion loan to cover other expenditures

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

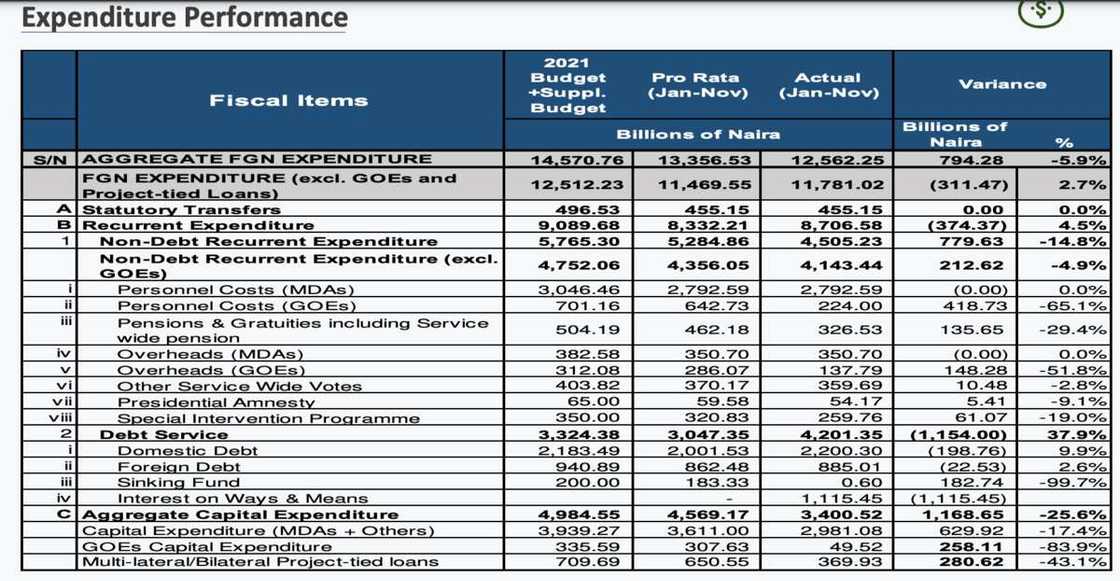

In the first nine months of 2021, Nigeria spent N4.2 trillion paying its debt. The Minister for Finance, Zainab Ahmed disclosed this during a public presentation of the 2022 FGN approved budget on Wednesday, 5 January 2021.

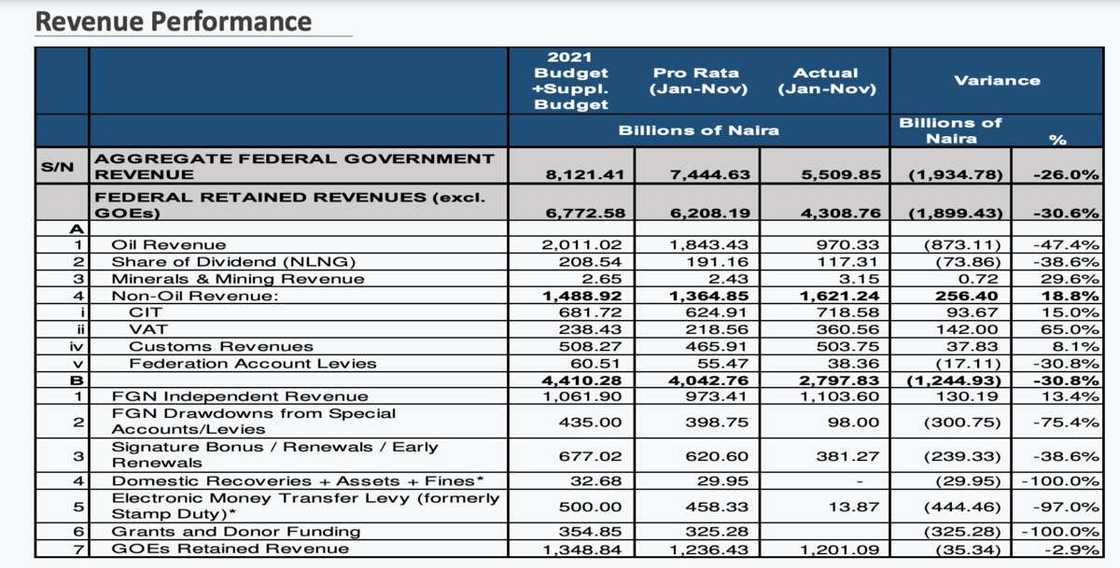

According to data from the presentation, the federal government retained revenue was N4.30 trillion, 30.6% short of the N6.20 trillion proposed target.

Breakdown of the retained earnings shows oil generated N970 billion, while non-oil tax revenues totalled N1.62 trillion.

Source: Facebook

For non-oil revenue, N718.58 billion was made from Companies Income Tax (CIT) and N360.56 billion from Value Added Tax (VAT) collections respectively.

Do you have a groundbreaking story you would like us to publish? Please reach us through info@corp.legit.ng!

Custom revenues amounted to N360.56 billion, while federation account levies made 38.36 billion.

Other revenues collected can be seen from the chart above.

Debt service

By implication, going by the 4.2 trillion debt serviced, which is 97.5 percent of the retained revenue (N4.30tn), for every N100 earned, the FG spends N98 in servicing debt.

Source: Facebook

More debts in 2022

During the presentation, the Minister of Finance offered little hope Nigeria is ending this fiscal storm anytime soon as government plans to borrow more in 2022.

A session of the presentation showed N6.68trillion was borrowed in the first nine months of 2021, N1.65 billion higher than the initial N5.03 trillion planned earlier in the year.

Read also

President Buhari lists 9 ‘worrisome changes’ lawmakers made to 2022 budget, reveals what he will do

While Nigeria is expected to have an overall budget deficit of N6.39tn for 2022. This will be financed by borrowings.

Ahmed revealed that the borrowing will come from domestic and foreign sources (N2.57tn) respectively, while Multi-lateral /bi-lateral loan drawdowns of N1.16tn and Privatisation Proceeds N90.7bn will also be use to cover the deficits.

Expert speaks

When contacted, an economist Kunle Lawal explained that the problem, however, with Nigeria’s borrowing is the piling interest rates which could make Nigeria’s debt even more expensive.

According to him, there is a long held agreed economic theory, which states that rising debt as a share of the economy would drive up the amount of money governments must pay in interest to borrowers.

Hence, in Nigeria’s quest to offset debts, she would have to borrow even more.

Lawal further listed the problems of government borrowing as higher debt interest payments, a need to raise taxes, and, sometimes, inflationary pressures (printing more money).

Read also

Elon Musk made N50trn, Jeff Bezos N2trn and what other rich people added to their wealth in 2021

Railway, satellite lead list of 15 projects nigeria agreed N2.50trn loan with china

Meanwhile, the Debt Management Office (DMO) has announced Nigeria's overall public debt has risen to N38 trillion as of September 30, 2021.

The loan from China is one area many Nigerians are interested in amid stories of assets being seized from nations unable to repay their debt.

DMO has now released a thorough analysis of loans received from China in the last 13 years, including how much has been returned and for what projects the funds were obtained.

Source: Legit.ng