Investors Lose Over N280bn in Hours as Nigerian Stock Market Records 3rd Day of Negative Close

- Nigerian stock investors lost N289 billion in one day as the market recorded the third day of a negative close

- The losers' table was led by Caverton, Consolidated Hallmark, Eterna, FTN Cocoa and Linkage Assurance

- Stocks like Fidelity Bank, Access Holdings, UBA, Jaiz Bank and Zenith Bank were actively traded

CHECK OUT: Education is Your Right! Don’t Let Social Norms Hold You Back. Learn Online with LEGIT. Enroll Now!

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

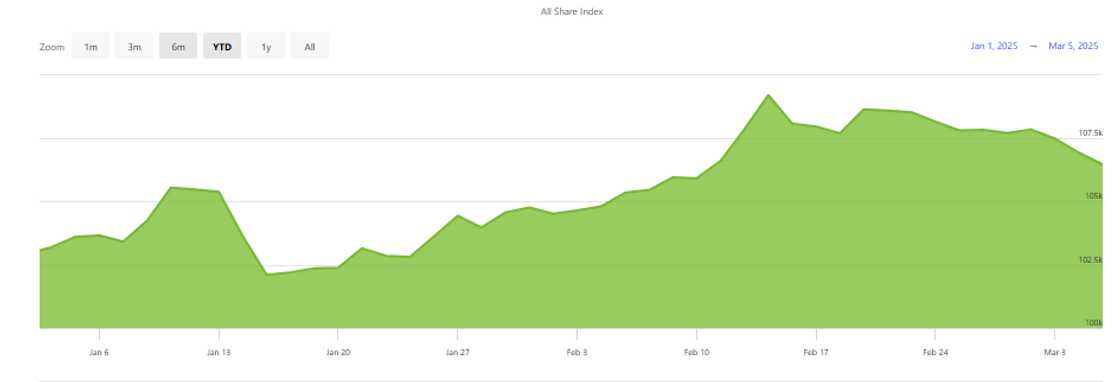

The Nigerian stock market extended its losing streak to three consecutive days on Wednesday, March 5.

Data from the Nigerian Exchange Limited (NGX) showed that the All-Share Index fell 0.44% to 106,436.48 points from 106,904.25 points.

Source: Getty Images

While market capitalisation dropped to N66.653 trillion from N66.942 trillion on the previous trading day.

This means N289 billion was lost by investors in the stock market at the end of trading on Wednesday.

Details on how the stock market performed

Stocks like Fidelity Bank, Access Holdings, UBA, Jaiz Bank and Zenith Bank were actively traded on Wednesday as investors in 11,423 deals exchanged 389,574,254 shares worth N11.309billion.

Source: Facebook

Here is a snapshot of the market activities.

Gainers list

- Tantalizers Plc gained N0.19, rising from N1.97 to N2.16 per share (9.64%).

- Union Homes Real Estate Investment Trust gained N4.30, moving from N48.65 to N52.95 per share (8.84%).

- Champion Breweries Plc gained N0.30, increasing from N3.90 to N4.20 per share (7.69%).

- Computer Warehouse Group Plc rose by N0.45, climbing from N7.90 to N8.35 per share (5.70%).

- Deap Capital Management & Trust Plc gained N0.05, moving from N0.90 to N0.95 per share (5.56%).

Losers list

- Caverton Offshore Support Group Plc declined by N0.28, falling from N2.80 to N2.52 per share (-10.00%).

- Consolidated Hallmark Holdings Plc dropped N0.39, moving from N3.95 to N3.56 per share (-9.87%).

- Eterna Plc fell by N3.65, decreasing from N37.80 to N34.15 per share (-9.66%).

- FTN Cocoa Processors Plc lost N0.16, declining from N1.68 to N1.52 per share (-9.52%).

- Linkage Assurance Plc dropped N0.12, moving from N1.32 to N1.20 per share (-9.09%).

Top active trades

- Fidelity Bank Plc led the market with 47,924,615 shares traded, valued at N803.47 million.

- Access Holdings Plc followed with 35,602,667 shares worth N853.88 million.

- United Bank for Africa Plc (UBA) recorded 29,052,308 shares, amounting to N1.02 billion.

- Jaiz Bank Plc traded 27,019,135 shares valued at N89.72 million.

- Zenith Bank Plc exchanged 21,648,652 shares worth N1.02 billion.

First Holdco becomes best-performing

Legit.ng previously reported that First Holdco Plc's outstanding financial performance and anticipated fundraising had kept investors clamouring for its shares.

The stock became the best-performing tier-one bank stock of the year and the second most traded on the Nigerian Exchange during the last three months.

Having outperformed several blue-chip stocks in year-to-date (YTD) returns, First Holdco solidified its position in the capital market with a 142% increase in profit before tax to N862 billion and gross earnings, topping N3.33 trillion in 2024.

Proofread by Kola Muhammed, journalist and copyeditor at Legit.ng

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Proofreading by Kola Muhammed, copy editor at Legit.ng.

Source: Legit.ng

Dave Ibemere (Senior Business Editor) Dave Ibemere is a senior business editor at Legit.ng. He is a financial journalist with over a decade of experience in print and online media. He also holds a Master's degree from the University of Lagos. He is a member of the African Academy for Open-Source Investigation (AAOSI), the Nigerian Institute of Public Relations and other media think tank groups. He previously worked with The Guardian, BusinessDay, and headed the business desk at Ripples Nigeria. Email: dave.ibemere@corp.legit.ng.

Kola Muhammed (Copyeditor) Kola Muhammed is an experienced editor and content strategist who has overseen content and public relations strategies for some of the biggest (media) brands in Sub-Saharan Africa. He has over 5 years of experience in copyediting.