Forex Trading: How Professionals Make Money and Avoid Loses

- There are the right ways to go about when you want to make money from forex trading.

- Many forex traders have failed for simply lacking or ignoring some basic knowledge of the trade.

- Traders can increase their chances of success if they do their research and treat forex trading as a business.

PAY ATTENTION: See you at Legit.ng Media Literacy Webinar! Register for free now!

Currency trading has become a popular option to swiftly accumulate cash. Forex trading is difficult in reality, yet it's so captivating that both beginners and seasoned pros become obsessed.

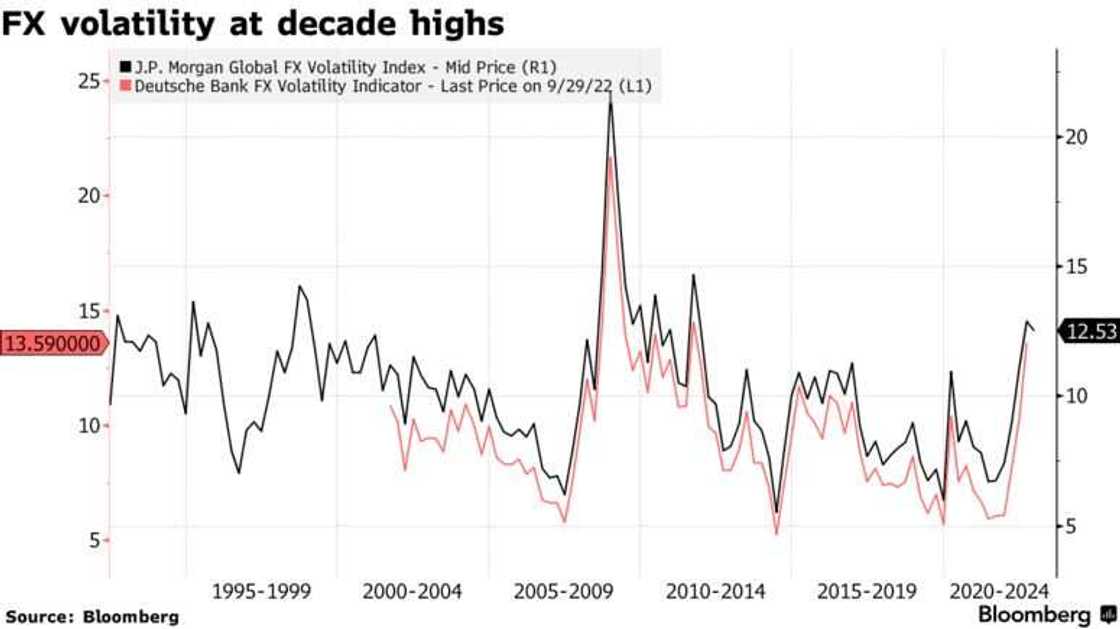

Speculative hedge funds and other players have been attracted by the activity, and real-money investors have been attracted by the volatility of portfolio valuations. The swings were accelerated by the conflict in Ukraine and the Fed's rash rate increases, which attracted capital to the dollar as a safe haven and affected markets ranging from stocks to Bitcoin.

Source: UGC

Even investors who are not generally focused on foreign exchange have begun to do so for two main reasons: first, the dollar has remained the only effective market hedge still in existence, and second, speculative investors have found the dollar's rise to be very marketable.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

Source: UGC

What distinguishes profitable Forex traders from the competition?

In the world of forex, it's common knowledge that 90% of retail traders fail. According to some reports, failure rates can reach 95%.

Regardless of the precise amount, I can assure you that such estimates aren't too far off having interacted with thousands of traders over the years. What distinguishes the 5–10% then?

Forex traders always take precautions to avoid losing money. Furthermore, traders can increase their chances of success if they do their research, do not take on too much debt, employ smart money management techniques, and treat forex trading as a business.

Combining sound research with effective execution will dramatically improve your performance rate as a trader, and like with many other skill sets, successful trading results from a combination of imagination and diligence.

Before trading forex, conduct your research to see if you have the necessary information. You should also look for a fully registered broker to safeguard yourself against fraud. The magnitude of the position will be directly impacted by current and upcoming losses.

Realize Your Limits

Each successful forex day trader controls their risk; it is one of the most important factors in ongoing success, if not the most. You must get knowledgeable about the Forex market and exercise good judgment in order to properly win deals. Spending more is the key to having more money. The more capital you invest, the more likely you are to make money.

To start, you must keep your risk very low for each trade, often 1% or less. Losses accumulate, and even successful day trading techniques can have losing streaks. To manage risk, stop-loss orders are used. The profitability rate is great if you succeed in your trades. Because they made more money than they anticipated, many people who started trading forex as a side gig eventually quit their employment to focus exclusively on it.

Read also

All testimonies there are from hacked accounts - Nigerian man exposes fake online Kia Rio Splash promo

Once you know what to anticipate from your system, have the patience to wait for the price to reach the levels it predicts for either the entry or departure stage. Forex markets can make adjustments very quickly—even quicker than stocks—so you can monitor your investment. Keep your eyes on your finances and be prepared to act if things start to go awry.

Find the right entrances and exits

Trading professionals frequently become confused by the conflicting information they observe when examining charts at different timeframes. What appears to be a buying opportunity on the weekly chart may actually be a sell signal on the intraday chart.

Make sure that the weekly and daily charts you use to time your input are in sync with one another. Only confirmation from the daily and weekly charts can validate a purchase signal. As a result, it's critical to keep your timing in harmony.

No amount of study will be useful if our trades lack a suitable trigger point. A currency pair may be predicted to appreciate, but until we know when and how,

No amount of study will be useful if our trades lack a suitable trigger point. Even if we may predict a currency pair to appreciate in value, we cannot make any long-term decisions based on this information unless we are certain of the precise timing and location of the increase.

Each transaction resembles a random drawing or a turn of the roulette wheel. If you have superior entrances and exits, your forex trading strategy will have an easier time achieving your objectives.

Pay attention to market correlations

There are a variety of market correlations between FX prices and other, related markets that are influenced by a wide range of circumstances because currencies are the basis of trade, economic linkages, and financial services.

Understanding the connections between your chosen currency and other associated markets can help you make wiser trading decisions. Think about the potential effects that changes in other markets might have on your forex trading.

Employ strategies for resistance and support

Forex traders can undervalue the significance of something as straightforward as being aware of the crucial support and resistance levels in the market they have chosen.

A currency's support level is essentially the price at which demand or trading volume picks up again, reversing the downward price trend of the currency. The resistance level of a currency signifies the point at which the market starts to believe that the currency is overvalued and may be a reliable sign of a forthcoming sell-off.

Knowing the locations of support and resistance levels can be useful when deciding when to enter and exit the Forex market.

Be flexible with your market analysis

Each trader approaches the market using a different set of methodologies, techniques, strategies, and tactics. Each trader should have their own distinctive method for conducting technical analysis, such as a combination of indicators that signal trades with a high possibility of success.

Possessing a unique set of trading techniques that you have developed over time is a wonderful thing.

In order to become proficient traders, successful traders study in-depth all pertinent information regarding the securities they trade and, more importantly, accurately analyze the likely impact of that information on a certain market.

- Olumide Adesina is a Financial Market analyst at Quantum Economics

Source: Legit.ng