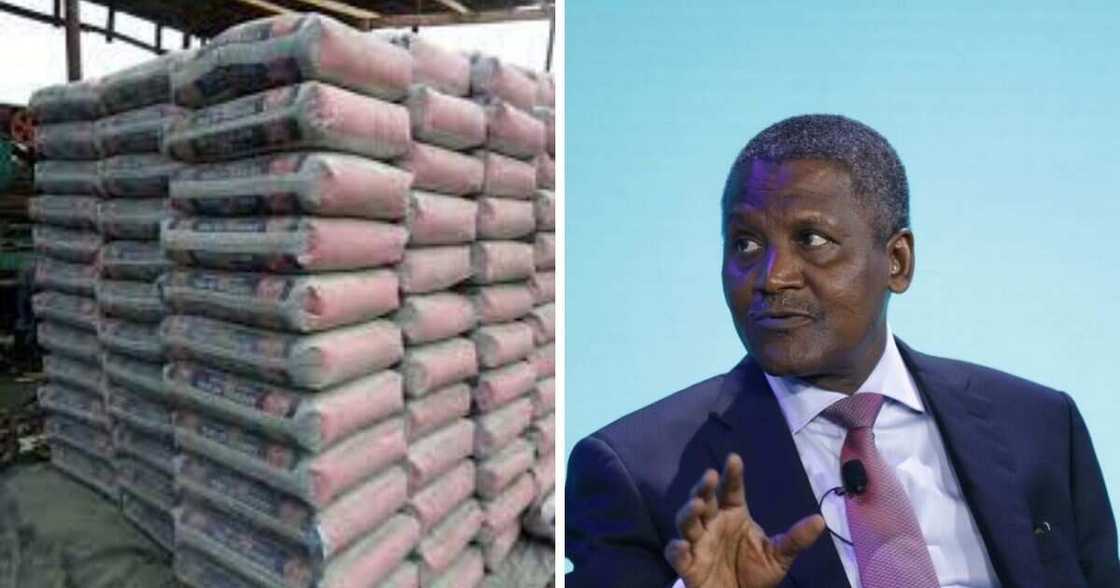

Dangote Cement Shares Surge, Investors Given Buyback Opportunities

- Dangote Cement shares appreciated by 6.18 per cent and closed at N275 per share on Wednesday, January 12, 2022

- The share increase saw the firm's market capitalization surge from N4.41 trillion to N4.69 trillion

- Also, the company offered its shareholders the buyback alternative which will begin on January 19, 2022

Share owners of Dangote Cement were all smiles on Wednesday, January 11 as the company announced that the shares of the leading cement maker has hit N275 per share.

Also, the company offered its shareholders the buyback choice, which will take on January 19, 2022, and will last for two days.

Source: Getty Images

Boosted market cap

Nairametrics reports that the shares appreciated by 6.18 per cent and closed at N275, shoring up the market cap up from N4.41 trillion to N4.69 trillion.

PAY ATTENTION: Install our latest app for Android, read best news on Nigeria’s #1 news app

Read also

Twitter: Nigeria loses N546bn in 222 days, the 2nd worst among countries to have shutdown internet to citizens

It registered a gain in share prices which could be due to investors’ confidence being boosted by the buyback option in the shares of the company.

Dangote Cement’s stock price grew from N259,000 per share at the start of the trading day to N275 per share which was the highest at the start of the trading day, which represents a gain of 6.18 per cent in terms of money at N16.00.

How the stock price performed

The boost in the share price of the cement company affected the firm’s market cap in a positive note, going from N4.41 trillion to N4.69 trillion at the end of the trading activity, taking the gain to N727.65 billion.

Stakeholders cash out big

Legit.ng reported that stakeholders of the leading cement manufacturing firm, Dangote Cement and MTN, Africa’s leading telecom company, are smiling to the bank as the companies emerged as the best dividend-paying companies in 2021.

Available statistics say that Nigerian firms paid a total of N989 billion as dividends from January to September this year. This represents a 27 per cent spike from the same period last year.

Among them are 30 of some of the most capitalised companies on the Nigerian Stock Exchange which paid shares this year and in 2020.

Source: Legit.ng