Oil extends rally on supply woes as dollar holds gains on US rate talk

Source: AFP

PAY ATTENTION: #StartupSouth Awards 2023 Nominated Legit.ng in the category Best Startup Coverage! Your support matters - click to VOTE for Legit.ng for free!

Oil extended gains Thursday to a fresh one-year high and towards the $100-a-barrel mark on concerns about growing demand and waning supplies, while bets on another US interest rate hike kept the dollar elevated against its peers and equities mixed.

News that troubled Chinese developer Evergrande had suspended trading in its Hong Kong-listed shares added to the uncertainty, following a tepid lead from Wall Street where speculation about more Federal Reserve policy tightening has winded investors.

The risk-off mood on trading floors sums up generally gloomy sentiment seen through most of September, which saw central banks around the world either hike rates again or warn of more to come owing to stubborn inflation.

One of the main drivers of that is a surge in crude prices, which has been fuelled by thinning supplies after Saudi Arabia and Russia said they would cut output until the end of the year and a pick-up in demand in key consumer nations including the United States and China.

News that stockpiles at the key US storage facility in Cushing, Oklahoma, had hit their lowest since July last year -- and operational minimums -- sparked a strong rally Wednesday, with WTI soaring more than three percent to its highest since August 2022.

Brent pushed further above $97 to a new 10-month peak.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

"My fear in this market is we have de-stocked so much inventory," said Amrita Sen, of consultant Energy Aspects. "Right now, what's going on in the US -- Cushing is dry," she told Bloomberg TV.

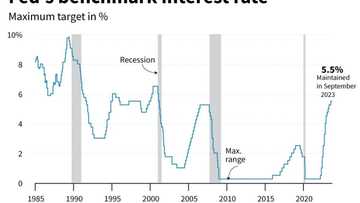

The spike in crude is causing headaches for central bank decision-makers, with Fed officials hinting that with inflation still well above target and the labour market still resilient they would likely have to push borrowing costs even higher than their already 22-year highs.

Evergrande woes build

On Wednesday, Minneapolis Fed boss Neel Kashkari said a possible US government shutdown -- caused by a standoff in Washington -- and an autoworker strike could weigh on the economy and ease pressure on the bank to tighten further.

However, he also warned that if the economy remained in rude health and inflation was not coming down then more hikes would be likely.

"If our interest-rate increases are not slowing the economy the way that we expect, then there is that risk that we might have to go higher," he told CNN.

The prospect of an extended period of higher rates has pushed the dollar ever higher against its major peers, particularly the yen, which faces extra pressure owing to the Bank of Japan's refusal to move away from its long-running, ultra-loose monetary policy.

The dollar is edging back towards the 150 yen mark last seen in October last year, leading authorities to say they are keeping an eye on movements and are ready to intervene in markets to support the unit.

However, National Australia Bank's Tapas Strickland said: "Finance Minister Suzuki's comments that he is watching FX markets with a 'sense of urgency' has become a daily ritual, but he has so far stopped short of intervention. Not that urgent, evidently."

Equity markets in Asia were mixed following a weak lead from Wall Street, with Tokyo, Hong Kong and Wellington all down, while Shanghai, Sydney, Singapore, Taipei and Manila edged up

Traders in Hong Kong were again on edge after Evergrande announced the suspension of trade in its shares as well as those of its electric vehicle and property services units without giving an explanation.

The move came a day after a report said its billionaire boss Xu Jiayin was being held by police under "residential surveillance".

The firm had only just resumed trading a month ago, having been suspended for 17 months for not publishing its financial results.

On Sunday, officials said it was unable to issue new debt as its subsidiary, Hengda Real Estate Group, was being investigated.

And on Friday it said meetings planned this week on a key debt restructuring would not take place.

Key figures around 0230 GMT

Tokyo - Nikkei 225: DOWN 1.7 percent at 31,813.01 (break)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 17,428.67

Shanghai - Composite: UP 0.1 percent at 3,111.80

West Texas Intermediate: UP 1.1 percent at $94.67 per barrel

Brent North Sea crude: UP 0.9 percent at $97.41 per barrel

Dollar/yen: DOWN at 149.50 yen from 149.64 yen on Wednesday

Euro/dollar: UP at $1.0511 from $1.0502

Pound/dollar: UP at $1.2139 from $1.2134

Euro/pound: UP at 86.59 pence from 86.54 pence

New York - Dow: DOWN 0.2 percent at 33,550.27 (close)

London - FTSE 100: DOWN 0.4 percent at 7,593.22 (close)

Source: AFP