Asian markets drop as traders await Fed boss testimony

Source: AFP

Unlock the best of Legit.ng on Pinterest! Subscribe now and get your daily inspiration!

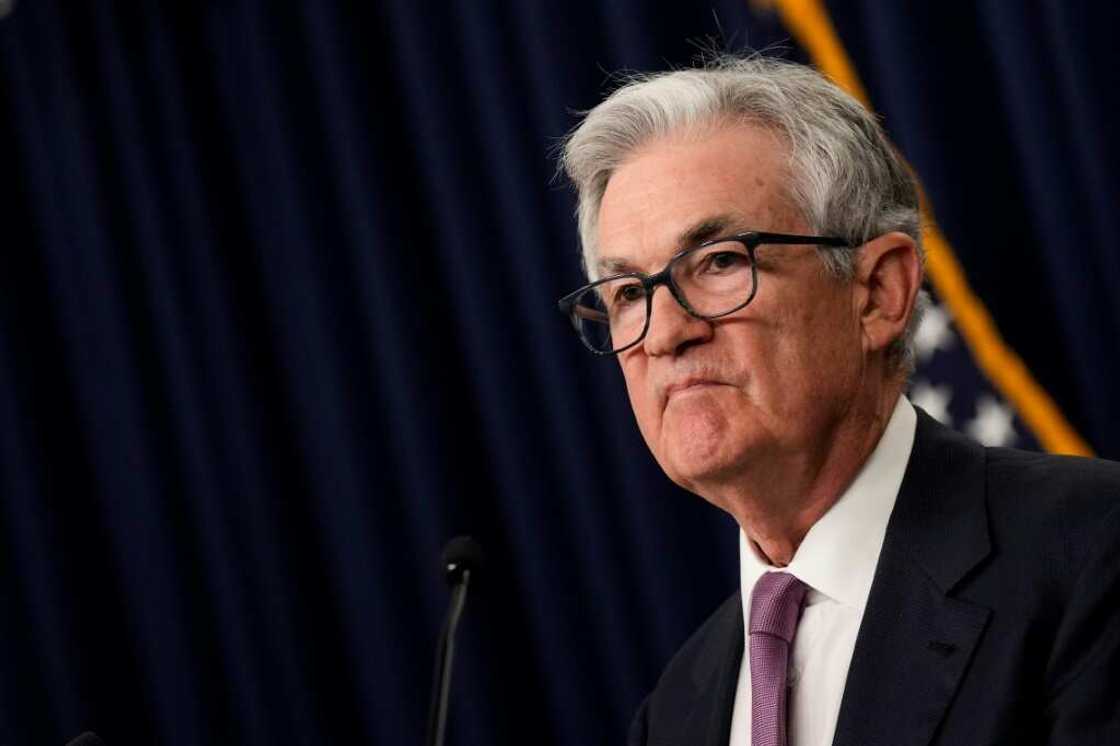

Asian markets mostly dipped Wednesday, following a downbeat lead from Wall Street as investors braced for Fed boss Jerome Powell's testimony to the US Congress.

The retreat extended a subdued start to the week, with investors unimpressed by China's efforts to boost its economy, including a fresh interest rate cut that was smaller than expected.

All three major US indices as well as the top European markets closed in the red on Tuesday, and Asian investors picked up the baton in a similar mood.

Hong Kong, Shanghai, Sydney, Wellington and Seoul all dropped in morning trade. Tokyo also fell at the open but clawed back into positive territory.

All eyes are on Washington, where Fed Chair Powell will make a semiannual appearance before Congress.

His comments will be closely scrutinised for clues about the direction of the Fed's campaign to fight soaring inflation with interest rate hikes.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

"He will come on and try to remain hawkish," ANZ Bank's Mahjabeen Zaman told Bloomberg Television, saying there was still a risk of further hikes.

The US central bank last week held rates steady after 10 straight increases, but signalled more hikes to bring prices under control.

The anxiety over Powell's testimony built on top of disappointment on market floors this week with Beijing's moves to try and revive the Chinese economy.

The People's Bank of China reduced its benchmark five-year rate by 10 basis points on Tuesday, less than the 15 points expected, though it did meet forecasts for a 15-point reduction in the one-year rate.

"Developments in China, where the central bank cut its reference interest rate by ten basis points, continue to point to a slower-than-predicted post-pandemic recovery in the world's second-largest economy," said ActivTrades analyst Ricardo Evangelista.

"With China's economy struggling to regain momentum, the headwinds for the global economy get stronger."

CMC Markets analyst Michael Hewson said the consensus was that the PBoC's "measure won't make much difference" and that it is just "tinkering around the edges".

Key figures around 0245 GMT

Tokyo - Nikkei 225: UP 0.4 percent at 33,523.53

Hong Kong - Hang Seng Index: DOWN 1.6 percent at 19,296.96

Shanghai - Composite: DOWN 0.1 percent at 3,236.00

Euro/dollar: DOWN at $1.0917 from $1.0918 at 2020 GMT on Tuesday

Pound/dollar: DOWN at $1.2763 from $1.2766

Dollar/yen: UP at 141.61 from 141.40 yen

Euro/pound: UP at 85.53 pence from 85.50 pence

West Texas Intermediate: UP 0.4 percent at $71.46 per barrel

Brent North Sea crude: UP 0.3 percent at $76.14 per barrel

New York - Dow: DOWN 0.7 percent at 34,053.87 (close)

London - FTSE 100: DOWN 0.3 percent at 7,569.31 (close)

-- Bloomberg News contributed to this story. --

Source: AFP