US Fed likely to hike rates again as banking fears resurface

Source: AFP

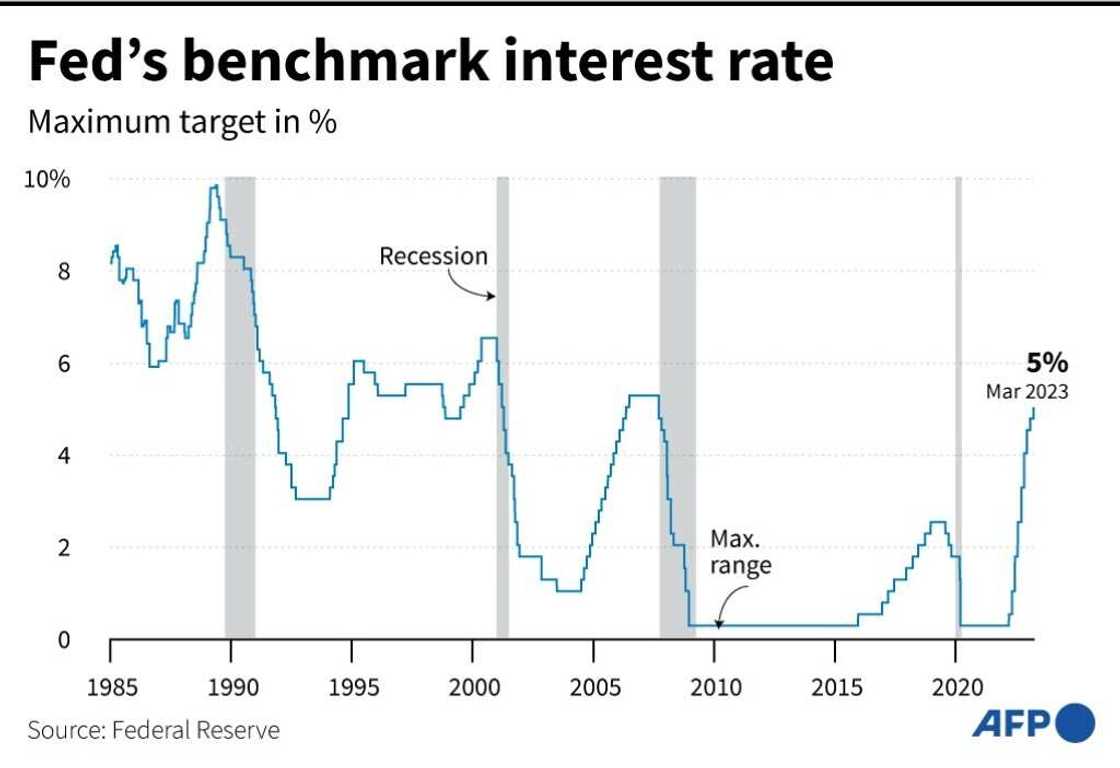

The US Federal Reserve is widely expected to raise its benchmark lending rate for a 10th -- and possibly final -- time on Wednesday, as it looks to bring down inflation while aiming to prevent fresh banking concerns from spreading.

The Fed has been on an aggressive campaign of interest-rate hikes since March last year, rapidly raising rates nine times in a row to help target high inflation, which remains stubbornly above its long-term target of two percent.

"Getting inflation back down to two percent has a long way to go and is likely to be bumpy," Fed Chair Jerome Powell said during a press conference after the March rate decision.

With the Federal Open Market Committee (FOMC) widely expected to raise its base rate by a quarter-point on Wednesday, analysts and traders are instead keeping a keen eye out for any change to the Fed's forward guidance on interest-rates.

Analysts, including Goldman Sachs chief US economist David Mericle, predicted that the US central bank would signal a pause in hikes from June onward, while Deutsche Bank economists saw the Fed maintaining a "tightening bias" due to "stubbornly elevated" inflation.

Banking woes resurface

This week saw the reemergence of turbulence in the banking sector after a relatively calm period.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

First Republic Bank collapsed over the weekend in what is the second-largest commercial bank failure in US history.

Other regional banking stocks came under renewed pressure on Tuesday, with some seeing their share price decline by as much as 25 percent on renewed concerns about the impact of interest-rate hikes on their financial health.

Despite Tuesday's turbulence, futures traders still see a greater-than 85 percent chance that the Fed will stick to its guns and hike rates by a quarter-point on Wednesday, bringing its benchmark lending rate to between 5 and 5.25 percent.

Heading for recession?

The data on the US economy remains mixed but is showing some signs of softening, with growth slowing to an annualized rate of 1.1 percent in the first quarter of the year.

This, according to some analysts, will provide the Fed with the justification it needs to come out with more mild forward guidance on Wednesday's decision.

Source: AFP

"We expect Chair Powell today to emphasize that the Fed is now data-dependent, and that nothing is guaranteed," Pantheon Macroeconomics economists wrote in a note to clients after markets closed Tuesday.

The data on inflation paints a picture of slowing price increases in some areas and ongoing stubbornness in others, while figures on employment point to a weakening job market as the economy slows.

"By the time of the June meeting, we believe softness in the data and ongoing worries about the impact of constrained bank credit will probably be enough to deter further hikes," Goldman Sachs economists wrote in a recent note to clients.

Minutes published from the March FOMC meeting showed that the Fed predicted the US will enter a mild recession later this year when it decided to hike interest rates.

The extent of the recession could depend on how much further the Fed decides to raise interest rates, KPMG senior economist Kenneth Kim wrote in a recent note.

"Any further rate hikes beyond May risk a deeper recession than the mild downturn we currently foresee," he said.

Tighter credit conditions

Fed officials have in recent weeks suggested that the tighter lending conditions that materialized in the wake of the dramatic collapse of Silicon Valley Bank in March could act like an additional rate hike, possibly reducing the number of hikes necessary to bring inflation back down to two percent.

"A significant tightening of credit conditions could obviate the need for some additional monetary policy tightening," Fed governor Christopher Waller said last month.

Source: AFP

But he cautioned against "making such a judgment" before good data on the effect of the financial turmoil and bank lending was published.

That data could come as early as next Monday when the Fed's quarterly review of banking lending practices is published.

This lending data has already been made available to FOMC members during their interest-rate deliberations, adding to the interest among analysts and traders in the Fed's future interest-rate guidance on Wednesday.

"If the Fed intends to pause in June, it will likely use the post-meeting statement to guide market expectations," Oxford Economics' chief US economist Ryan Sweet wrote in a recent note to clients.

"The Fed has options with its forward guidance and could leverage what it has used in past statements that corresponds with this being the final rate hike in the tightening cycle," he said.

Source: AFP