OECD raises global growth forecast but recovery 'fragile'

Source: AFP

The OECD raised its global economic growth forecast on Friday as inflation eases and China emerges from Covid restrictions, but warned of vulnerabilities as seen in the US bank sector turmoil.

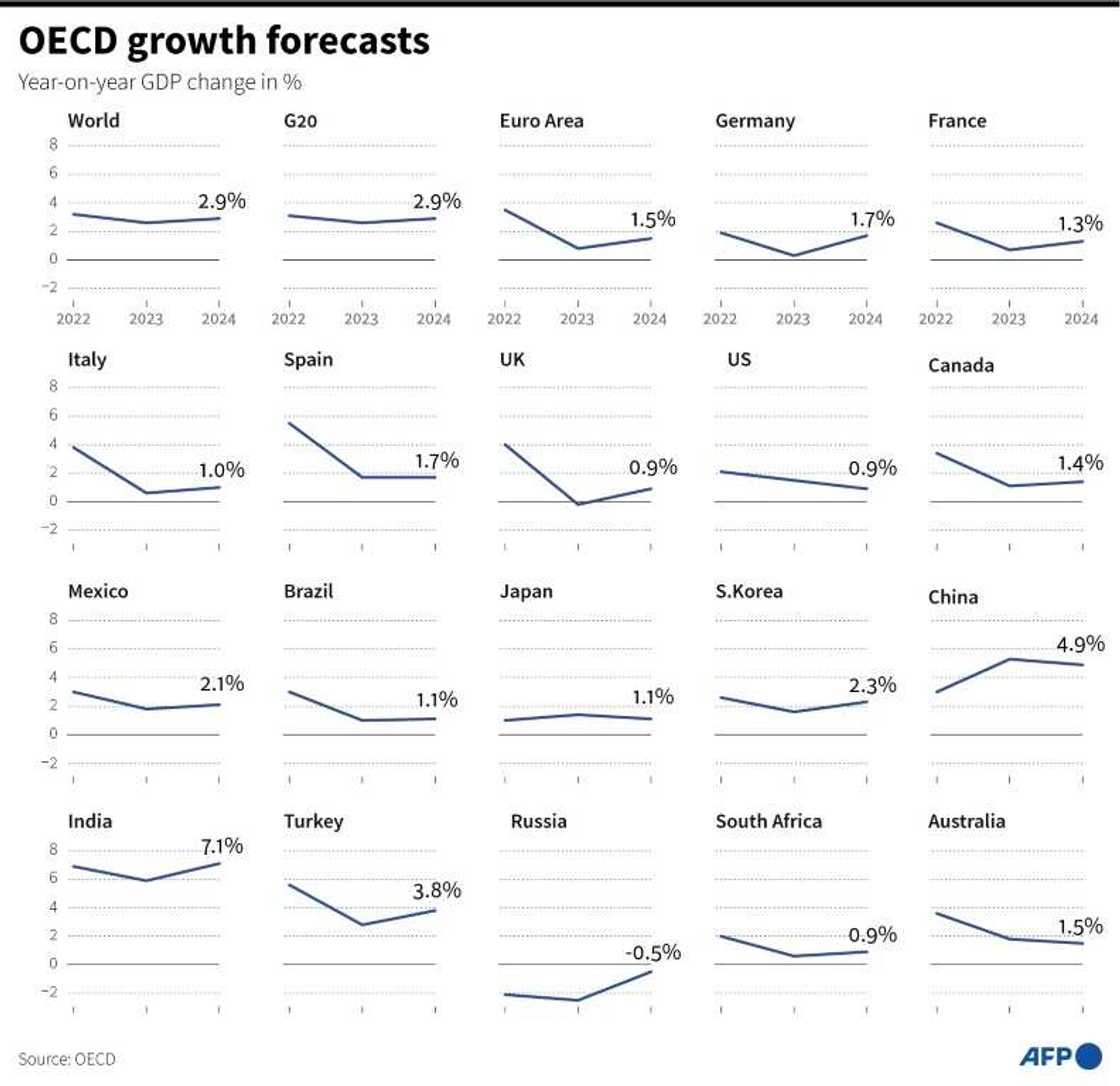

The Organisation for Economic Co-operation and Development said it now expects the global economy to grow by 2.6 percent this year compared to 2.2 percent in its previous forecast in November.

But it remains under the 3.2-percent expansion seen in 2022, the Paris-based OECD said in its updated economic outlook titled "A Fragile Recovery".

"More positive signs have now started to appear, with business and consumer sentiment starting to improve, food and energy prices falling back, and the full reopening of China," the OECD said in its Interim Economic Outlook report.

But it warned that "the improvement in the outlook is still fragile. Risks have become somewhat better balanced, but remain tilted to the downside".

It cited uncertainty over the course of the war in Ukraine, the risk of renewed pressure on energy markets and the impact of rising interest rates.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

US bank trouble

Central banks worldwide have hiked rates in efforts to tame decades-high inflation, but markets fear that the rising borrowing costs could tip economies into recession.

"Signs of the impact of tighter monetary policy have started to appear in parts of the banking sector, including regional banks in the United States," the OECD said.

"Higher interest rates could also have stronger effects on economic growth than expected, particularly if they expose underlying financial vulnerabilities."

The monetary tightening has been linked to the collapse of Silicon Valley Bank last week after it booked a $1.8 billion loss on bonds whose prices were brought down by the higher rates.

A second US lender, Signature Bank, also imploded over the weekend while a third, First Republic Bank, was rescued Thursday by a coalition of its peers through $30 billion in deposits.

Source: AFP

Fears of contagion spread to Europe, with Credit Suisse securing a $54 billion lifeline from the Swiss central bank after its shares tanked.

The OECD said the sharp changes in market rates and value of bond portfolios could "further expose duration risks in the business models of financial institutions, as highlighted by the failure of the US Silicon Valley Bank in March".

But it said that "prompt actions" by US authorities to protect client deposits and regulation that was imposed after the 2008 financial crisis "reduce the risk of broad financial contagion from such events".

China upgraded

The OECD also upgraded its economic outlook for 2024, with growth of 2.9 percent compared to 2.7 percent in the previous forecast.

Inflation is expected to "moderate gradually" this year and in 2024 after central banks raised their rates to tame consumer prices that have soared in the wake of Russia's invasion of Ukraine.

The OECD trimmed its outlook for headline inflation by 0.1 percentage points to 5.9 percent in 2023, although it hiked its forecast for core inflation, which excludes volatile food and energy prices, to 4.0 percent.

The OECD said monetary policy needs to remain restrictive until clear inflationary pressures have been brought down durably as pressures in energy markets could reappear.

The European Central Bank raised its rates by a hefty 50 basis points on Thursday while the US Federal Reserve meets next week.

China's abrupt decision to drop its Covid restrictions in December has also led to an improvement in the outlook.

The world's second biggest economy is expected to rebound this year with 5.3 percent growth, the OECD said, raising its previous forecast of 4.6 percent. It expanded by three percent last year.

It raised its US growth forecast to 1.5 percent while the eurozone's was revised to 0.8 percent, both up from 0.5 percent in the previous outlook.

The OECD trimmed its 2023 growth forecasts for Japan and Korea, to 1.4 and 1.6 percent respectively.

Source: AFP