Asian markets rise ahead of Powell testimony, US jobs data

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

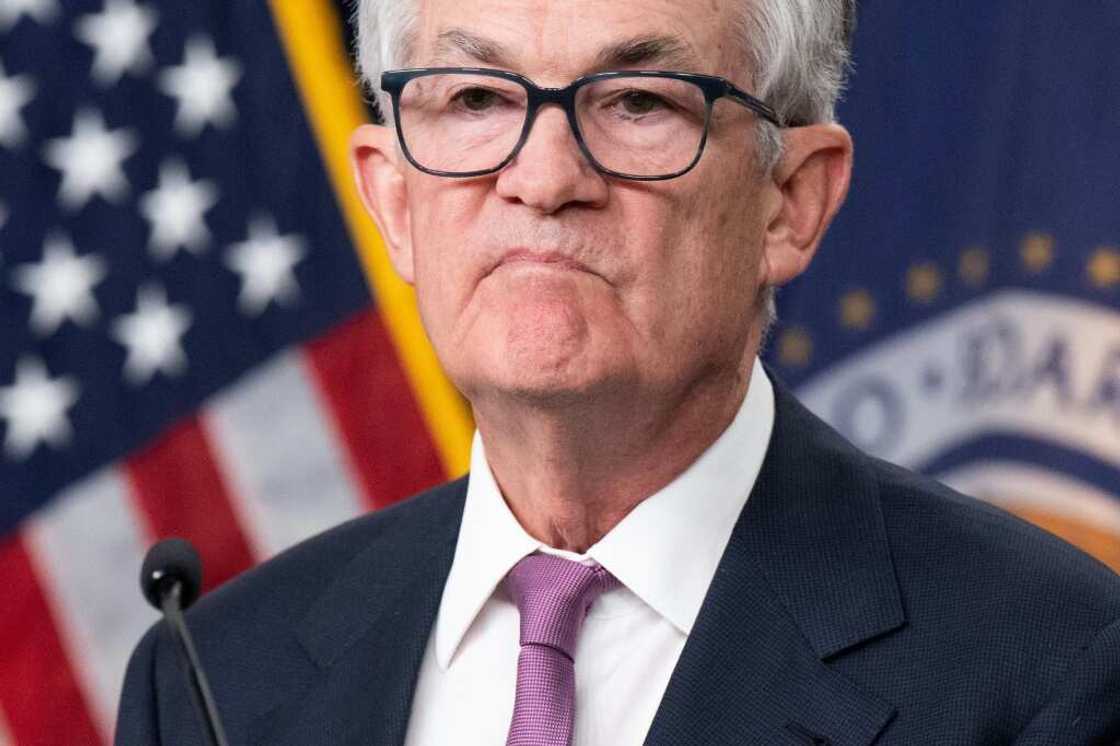

Asian markets mostly rose Tuesday as traders geared up for this week's release of key US jobs data and Federal Reserve chief Jerome Powell's testimony to lawmakers.

His remarks will be closely followed for an idea about the central bank's plans as it ramps up interest rates to quell inflation.

A recent run of figures has suggested the world's top economy continues to run hot and inflation is not coming down as quickly as hoped, putting pressure on the Fed to keep hiking borrowing costs.

Several officials have lined up to warn that rates would have to go higher and be held there for some time.

The prospect of more tightening has dealt a blow to investors who had grown optimistic the Fed would be able to cut rates by the end of the year.

OANDA's Edward Moya said traders were looking at two or three more quarter-point rises before the Fed holds fire.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

He added: "This week will likely deliver a make-or-break moment for risk appetite as we will hear Fed Chair Powell's testimony to Congress and find out if the hot January jobs report was an aberration.

"Stocks probably won't be able to have a meaningful rally until we hear from... Powell."

Powell is due to speak to lawmakers on Tuesday and Wednesday, while the closely watched non-farm payrolls report for February is set to be released Friday.

That comes after January's reading showed more than half a million new jobs were created, far more than expected, and another bumper figure could spark another sell-off in stocks.

In early Asian trade, Hong Kong, Shanghai, Tokyo, Sydney, Singapore, Seoul, Taipei and Manila rose, though Wellington and Jakarta dipped.

The gains came after a tepid lead from Wall Street and a soft performance Monday in Asia that came after China set a lower-than-expected target for economic growth this year.

The news dented hopes for fresh government stimulus, though observers said it could benefit the global economy as a powerful Chinese recovery would likely further fan inflation.

"China reopening trades have severely underperformed, with Asian equities being some of the worst-performing indices this year," said SPI Asset Management's Stephen Innes.

"It is unclear if this merely reflects a positioning unwind or a market downgrade of China's reopening prospects."

Key figures around 0230 GMT

Tokyo - Nikkei 225: UP 0.4 percent at 28,353.34 (break)

Hong Kong - Hang Seng Index: UP 1.7 percent at 20,958.58

Shanghai - Composite: UP 0.5 percent at 3,339.93

Euro/dollar: UP at $1.0691 from $1.0684 on Monday

Pound/dollar: UP at $1.2041 from $1.2023

Euro/pound: DOWN at 88.79 pence from 88.84 pence

Dollar/yen: UP at 135.98 yen from 135.95 yen

West Texas Intermediate: UP 0.6 percent at $80.91 per barrel

Brent North Sea crude: UP 0.7 percent at $86.75 per barrel

New York - Dow: UP 0.1 percent at 33,431.44 (close)

London - FTSE 100: DOWN 0.2 percent at 7,929.79 (close)

Source: AFP

Source: AFP