Energy majors look for mega profits to roll on

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

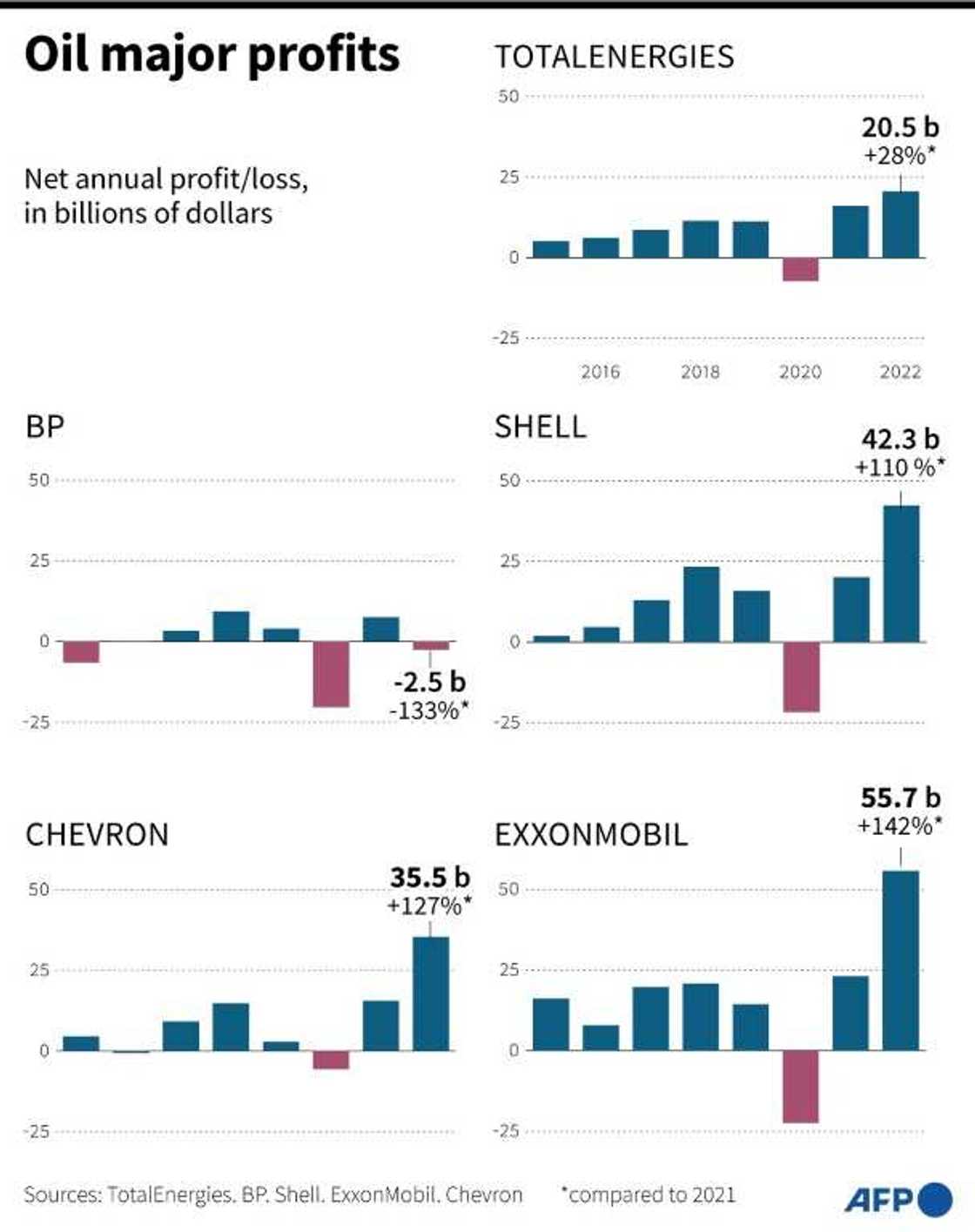

The world's top oil and gas companies amassed record profits last year after Russia's invasion of Ukraine drove prices higher -- and they can expect the good times to roll on despite calls to tax them more.

The net profits earned by the five majors -- Shell, Chevron, ExxonMobil, BP and TotalEnergies -- surpassed $150 billion in 2022, and would have been closer to $200 billion without costly withdrawals from Russia.

The massive sums -- in the midst of a cost-of-living crisis sparked by soaring energy costs and mounting damage from climate change -- have sparked more charges of profiteering from politicians and activists.

US President Joe Biden called the profits "outrageous" in his annual State of the Union speech on Tuesday and urged a tax hike on share buybacks to encourage energy firms to invest more.

Source: AFP

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

The surge in energy prices -- Brent crude flirted with $140 per barrel last March and European gas prices jumped by a factor of 15 during the summer to hit 350 euros per megawatt hour -- mechanically drove profits higher without energy firms having to invest in more production or cut costs.

Prices have declined since then, but "we can have further spikes as the war in Ukraine is far from over," warned Adi Imsirovic, a senior research fellow at the Oxford Institute for Energy Studies.

Despite the uncertainty in the economic outlook triggered by soaring energy prices, the OPEC oil cartel does not expect a drop in oil demand.

On the contrary, it foresees demand continuing to increase, rising by 2.2 million barrels per day in 2023 after climbing by 2.5 mbd in 2022.

China abandoning its zero-Covid policy should support that increase in demand, which will serve to keep prices high, as long as OPEC members continue to restrain production.

'Solidarity contribution'

With oil firms set to continue to rake in prodigious profits, pressure is likely to mount.

At the end January, Biden tweeted that oil companies were "using these record profits to pay out their wealthy shareholders instead of investing in production and lowering costs for Americans."

"It's unacceptable," he wrote, adding that it was time for oil giants to help lower prices for consumers.

Source: AFP

France's TotalEnergies was the latest to announce record earnings on Wednesday, reporting a $20.5 billion net profit for 2022.

The company said it was ready to consider another discount at the pump, having run a similar promotion last year.

Britain and the European Union have already put in place taxes on windfall profits.

Exxon has challenged the legality of the EU's "solidarity contribution", with chief executive Darren Woods saying last month that the tax was not legal and not what is needed.

"What's needed right now is more supply. And instead, what's been put in place is a penalty on the broad energy sector," Woods said.

The Exxon chief said the company benefitted from the favourable market but also from having made investments in expanding production during the pandemic.

"We leaned in when others leaned out," he said.

Slower green transition

Warwick Business School professor David Elmes said investments have paled in comparison to the cash oil firms are showering on shareholders.

"The recent results have been disappointing in that the level of investment supporting their move from fossil fuels has risen -– but not as much as the amount the companies are paying to shareholders as dividends or by buying back their own shares," he said.

Oxford's Imsirovi said governments continue to subsidise fossil fuels, which boosts demand and prices, while slowing the transition to green energy.

After its underlying profit more than doubled last year to $27.7 billion, BP reduced on Tuesday its target for cutting carbon emissions.

"We need to achieve net-zero (global emissions), but governments continue to subsidise fossil fuels. As a result, demand keeps growing instead of falling," Imsirovi said.

Imsirovi argued against governments stepping in to protect all consumers by subsidising prices.

"That only prolongs the crisis and high prices," he said. "Targeted cash transfers to the needy is better and cheaper."

Source: AFP