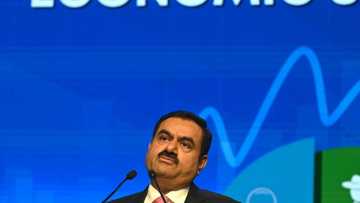

Adani Enterprises shares suspended as price slumps again

Source: AFP

Shares in the flagship firm of beleaguered Indian tycoon Gautam Adani were repeatedly suspended on Friday as a rout triggered by allegations of accounting fraud deepened.

Adani Enterprises fell 10 percent at the open, while Adani Power, Adani Green Energy, Adani Total Gas -- in which French giant TotalEnergies has a 37.4 percent stake -- and Adani Transmission were also suspended when they hit their trading stops.

Trading in Adani Enterprises later resumed, only for them to immediately fall another five percent, triggering another halt.

The conglomerate's combined market capitalisation has plummeted by more than $100 billion since US short-seller Hindenburg Research -- which makes money by betting on shares falling -- released an explosive report last week.

Adani himself has seen his fortune plummet by tens of billions of dollars, dumping him out of the real-times Forbes rich list top 10 and depriving him of his title as Asia's richest person.

Adani late Wednesday cancelled a $2.5-billion stock sale meant to help reduce debt levels -- long a concern -- restore confidence and broaden its shareholder base.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

Big banks including Credit Suisse and Citigroup have stopped accepting Adani bonds as collateral for loans to private clients, according to Bloomberg News.

That fuelled worries about how Adani will raise fresh funds, with Adani dollar bonds trading at distressed levels and signs of contagion in Indian markets increasing, Bloomberg reported.

According to Hindenburg Research, Adani has artificially boosted the share prices of its units by funnelling money into the stocks through offshore tax havens.

This "brazen stock manipulation and accounting fraud scheme" is "the largest con in corporate history", Hindenburg said.

Adani said it was the victim of a "maliciously mischievous" reputational attack and issued a 413-page statement on Sunday that it asserted showed Hindenburg's claims were "nothing but a lie".

Hindenburg said in response that Adani failed to answer most of the questions raised in its report.

Critics say Adani's closeness to Prime Minister Narendra Modi, also from Gujarat state, has helped him win business and avoid proper oversight.

Source: AFP