Paramount says ending Simon&Schuster/Penguin deal after US antitrust ruling

Source: AFP

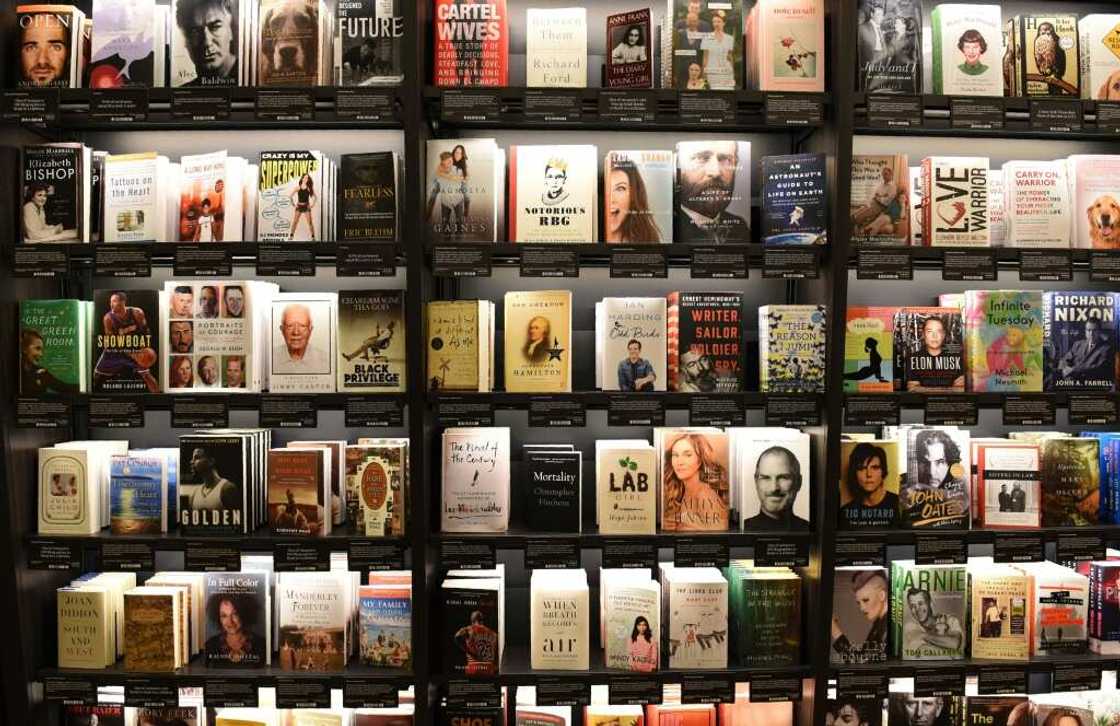

Paramount Global on Monday officially dropped a plan to sell its Simon & Schuster division to rival publisher Penguin Random House after a US judge blocked the $2.2 billion deal on antitrust grounds.

Paramount, formally known as ViacomCBS, said the transaction was "terminated" following the October 31 US judicial ruling against the deal.

Penguin Random House, a subsidiary of the German Bertelsmann Group, must pay a $200 million termination fee, Paramount said.

The firm signaled it still intends to divest the unit, calling it "a non-core asset."

"Simon & Schuster is a highly valuable business with a recent record of strong performance; however, it is not video-based and therefore does not fit strategically within Paramount’s broader portfolio," the statement said.

In challenging the deal, the US Justice Department had argued that allowing Penguin Random House, the largest book publisher in the world, to buy a major competitor would enable it to "exert outsized influence over which books are published in the United States and how much authors are paid for their work."

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

Bertlesmann had argued that the argument was based on an "inaccurate" reading of the market and that the merger would have been good for competition.

US District Court Judge Florence Pan concluded the government had shown the merger would substantially lessen competition "in the market for the US publishing rights to anticipated top-selling books."

German company confirmed in a statement Monday that it had reversed a previous plan to appeal the US district court ruling.

But the firm said it remained confident in growing its book publishing business.

"Penguin Random House is part of the Global Content Strategy, one of our five strategic priorities," said Bertelsmann Chief Executive Thomas Rabe. "Bertelsmann plans to achieve annual growth of five to ten percent in this area -– organically, but also through acquisitions."

Source: AFP