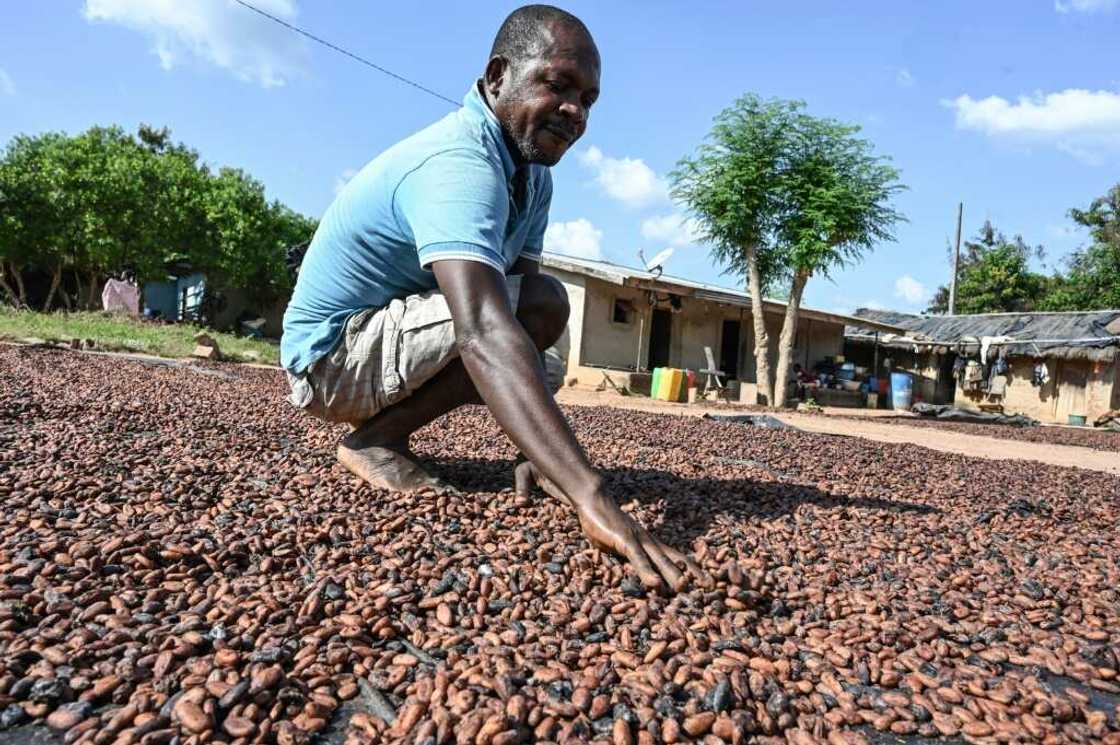

Ivory Coast, Ghana throw down gauntlet on cocoa price

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

The world's chocolate industry could be in for a turbulent ride as the two biggest cocoa producers set down demands for manufacturers to pay higher prices for their growers.

The quarrel focuses on the Living Income Differential (LID) -- a policy that Ivory Coast and Ghana introduced in 2019 to fight poverty among cocoa farmers in the global $130-billion chocolate market.

Under it, Ivory Coast and Ghana vowed to charge a premium of $400 per tonne on all cocoa sales, starting with the 2020/21 harvest.

But trade boards in the countries -- the Ivorian Coffee-Cocoa Council (CCC) and the Ghana Cocoa Board (Cocobod) -- say the scheme is being undermined as cocoa traders depress the price of another premium that operates in parallel.

"We've introduced the Living Income Differential as a means of improving the farmer income," said Fiifi Boafo, Cocobod's spokesperson.

"You have these companies circumventing these processes to ensure that the Living Income Differential effect is not felt in (their) lives."

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

The two countries together account for 60 percent of the world's cocoa but their farmers earn less than six percent of the industry's global revenue.

They boycotted a bridge-building meeting in Brussels late last month and set November 20 as a deadline for bringing buyers into line.

Source: AFP

They are threatening to punish corporations by barring them from visiting plantations to estimate harvests -- a key factor in cocoa price forecasting.

They are also threatening to suspend sustainability programmes that chocolate giants use to enhance their image with fast-growing ethnic consumers.

"This boycott and also ultimatum is to draw attention to the fact that inasmuch as it is important for us to talk about deforestation, it is important to talk about child labour, it is equally important to talk about the farmer income," said Boafo.

Premium pressure

The LID premium is being completed by a price stabilisation fund to help buffer the international price of cocoa in the event of big market fluctuations.

Some experts say the chocolate giants have factored the LID into their costs but claw back some of this by exerting pressure on another premium based on the quality of cocoa beans.

This premium, known as the origin differential, has plunged below zero in recent years, effectively cancelling out part of the LID.

Covid is being used as "a pretext not to pay," CCC President Yves Brahima Kone told AFP. "The thing is, the multinationals have increased their profits -- they are able to pay."

Source: AFP

The World Cocoa Foundation, an umbrella group of public entities and corporations aimed at supporting sustainability in the sector, declined to comment on the faceoff.

Among corporations, Nestle said it strongly backed efforts for growers to maintain a decent standard of living and had been paying the LID since its inception.

Some experts say that time may weigh against Ivory Coast and Ghana if the row escalates.

Virtually all of Ivory Coast's crop is purchased by roughly half a dozen majors. Of this, around 80 percent heads to Europe, the wealthy market where sustainability factors -- environmental and labour criteria -- count most for consumers.

"Ivory Coast's economy is heavily dependent on cocoa income," said one specialist. "It needs to sell its beans."

"Stopping sustainability programmes is difficult to explain to the general public, and Ivory Coast's image could (also) suffer."

Source: AFP