Japan to unveil huge package to address inflation

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

Japan is expected Friday to announce a huge stimulus package to cushion the economy from the impact of a weak yen and inflation, though the central bank refused to budge from the ultra-loose policy that has hammered the currency.

Ahead of cabinet approval for the relief measures, Prime Minister Fumio Kishida said the government would "seek swift approval" of an extra budget worth 29.1 trillion yen (around $200 billion).

Prices are rising in Japan at their fastest rate in eight years, although the three-percent inflation rate remains well below the sky-high levels seen in the United States and elsewhere.

The yen has also lost more than a fifth of its value against the dollar this year, prompting authorities to intervene to prop up the currency.

The spending package is expected to include measures to encourage wage growth and support households with energy bills, which have spiked since Russia's invasion of Ukraine.

Local media including the Nikkei business daily said total fiscal spending on the measures could be as high as 39 trillion yen, a figure that could rise to 71.6 trillion yen when private-sector investments that ministers hope will also be made are taken into account.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

Japan -- which has one of the world's highest debt-to-GDP ratios -- has already injected hundreds of billions of dollars into its economy over the past two years to support recovery from the Covid-19 pandemic.

But this year the yen has been driven sharply lower by the widening gap between the monetary policies of the US and Japanese central banks, with the BoJ keeping rates ultra low to encourage sustainable growth, while the Federal Reserve is ramping them up.

Source: AFP

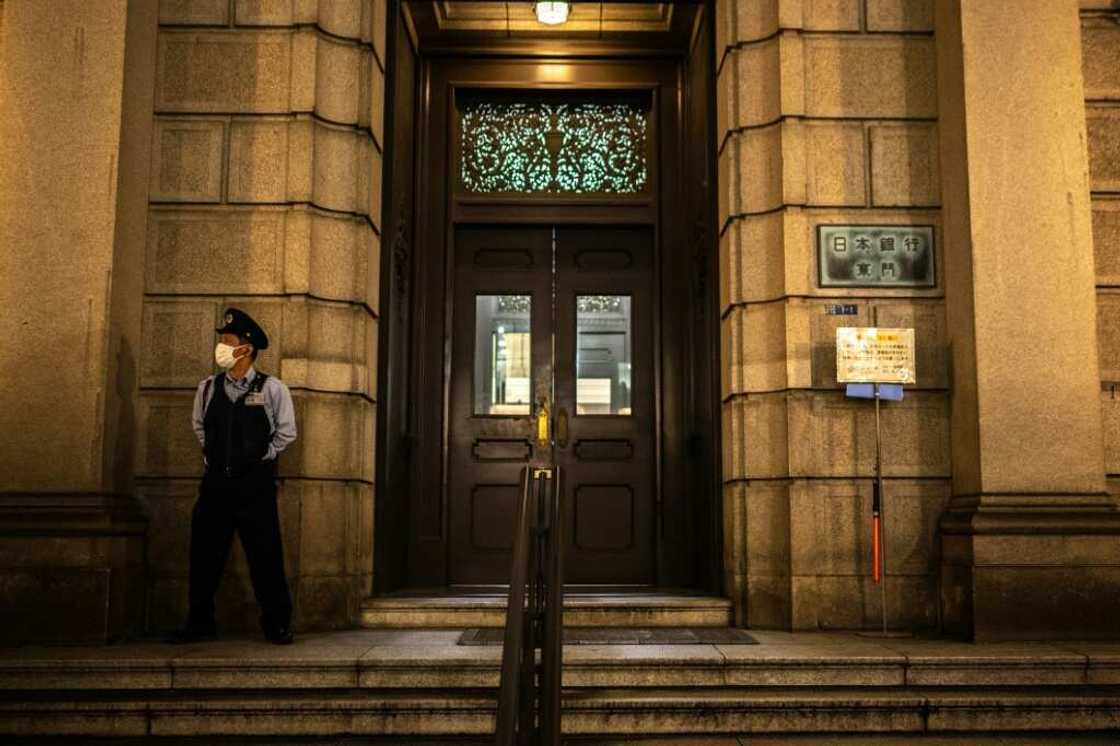

On Friday, following a two-day policy meeting, the Bank of Japan said it would continue to keep its easy policy, defying growing pressure to tweak its strategy as the yen declines.

Ahead of the BoJ meeting, UBS economists Masamichi Adachi and Go Kurihara said that a mix of continued easing by the bank and the government's stimulus measures would be "optimal".

That is because Japan's inflation is not demand-driven, but largely down to soaring energy costs, they explained in a commentary.

"An alternative mix, especially with tightening monetary policy to counter (the yen's) depreciation and higher (consumer price) inflation under the current circumstances, would have a worse outcome for the economy, especially with market turmoil not only in Japan, but also in other markets," the pair said.

This view was echoed by Yoshiki Shinke, chief economist at Dai-ichi Life Research Institute.

"It's understandable that the government is announcing new stimulus now, because Japan's economy faces weak demand due to price rises," he told AFP.

This is "in contrast to the United States, where demand is strong, with the Fed trying to cool down inflation", he said.

"It's impossible that Japan would hike rates to curb inflation, for this reason," Shinke explained.

Source: AFP