Grain prices ease back but fertiliser costs a growing risk

Source: AFP

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

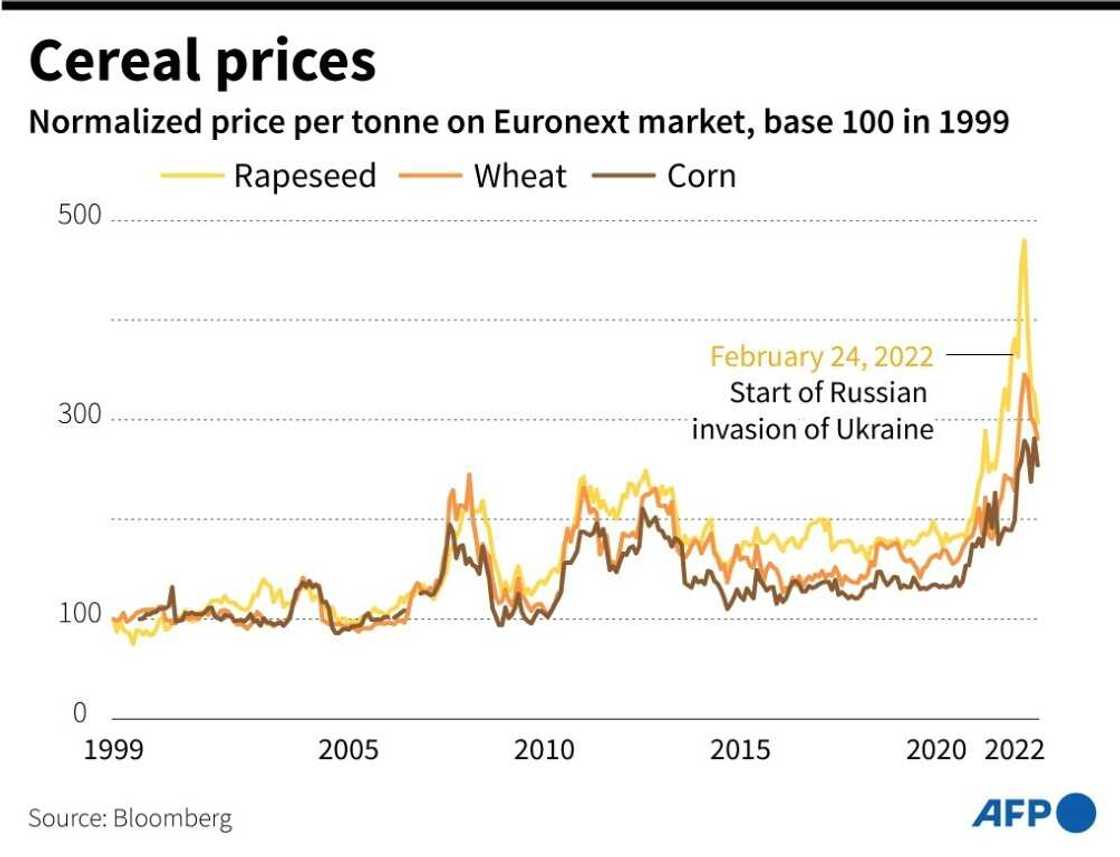

Grain prices have dropped sharply from the record highs they reached following Russia's invasion of Ukraine, but another menace to global food security remains: a shortage of fertiliser.

The conflict sparked fears of famine in poorer countries reliant on agricultural goods from Ukraine and Russia, two nations that were responsible for nearly a third of global wheat exports last year.

Wheat prices reached a peak of nearly 440 euros ($440) a tonne on the European market in mid-May, double the level of one year ago, as crucial Ukrainian shipments were stuck at port due to a Russian naval blockade in the Black Sea.

But prices have fallen to around 300 euros in August.

"The situation began to calm down at the end of May, beginning of June with the first reassuring harvest forecasts for Europe and the resumption of Ukrainian exports, first by road and rail, then by sea," said Gautier Le Molgat, analyst at consultancy Agritel.

Kyiv and Moscow reached an agreement in July, brokered by the United Nations and Turkey, that allowed Ukraine to resume grain shipments in the Black Sea.

PAY ATTENTION: Subscribe to Digital Talk newsletter to receive must-know business stories and succeed BIG!

The agreement opened a shipping corridor for 20 million tonnes of maize, wheat and sunflower seed oil stocked in Ukraine. According to the Joint Coordination Centre which manages the sea corridor, more than 720,000 tonnes have already left Ukraine.

"Thanks to intensive international cooperation, Ukraine is on track to export as much as four million metric tonnes of agricultural products in August," a senior US State Department official told AFP on Tuesday.

Strong ruble

In addition to more supplies reaching markets and helping lower prices, the deal has led to a drop in insurance premiums, reducing transport costs.

Source: AFP

But the reduction in tensions is, for the moment, benefitting Ukraine more than Russia, which is expecting a bumper harvest of 88 million tonnes of wheat.

Russian wheat exports in July and August are running 27 percent lower than last year, according to estimates by the Russian market research firm SovEcon.

That is due to fierce competition on the international grain market, as well as the strong value of the ruble and a high Russian export tax.

"As a result, farmers remain reluctant sellers," said Andrei Sizov, SovEcon's managing director.

The low volume of Russian exports is one of the main reasons why wheat prices have remained so high, said Sizov.

Fertiliser costs a growing problem

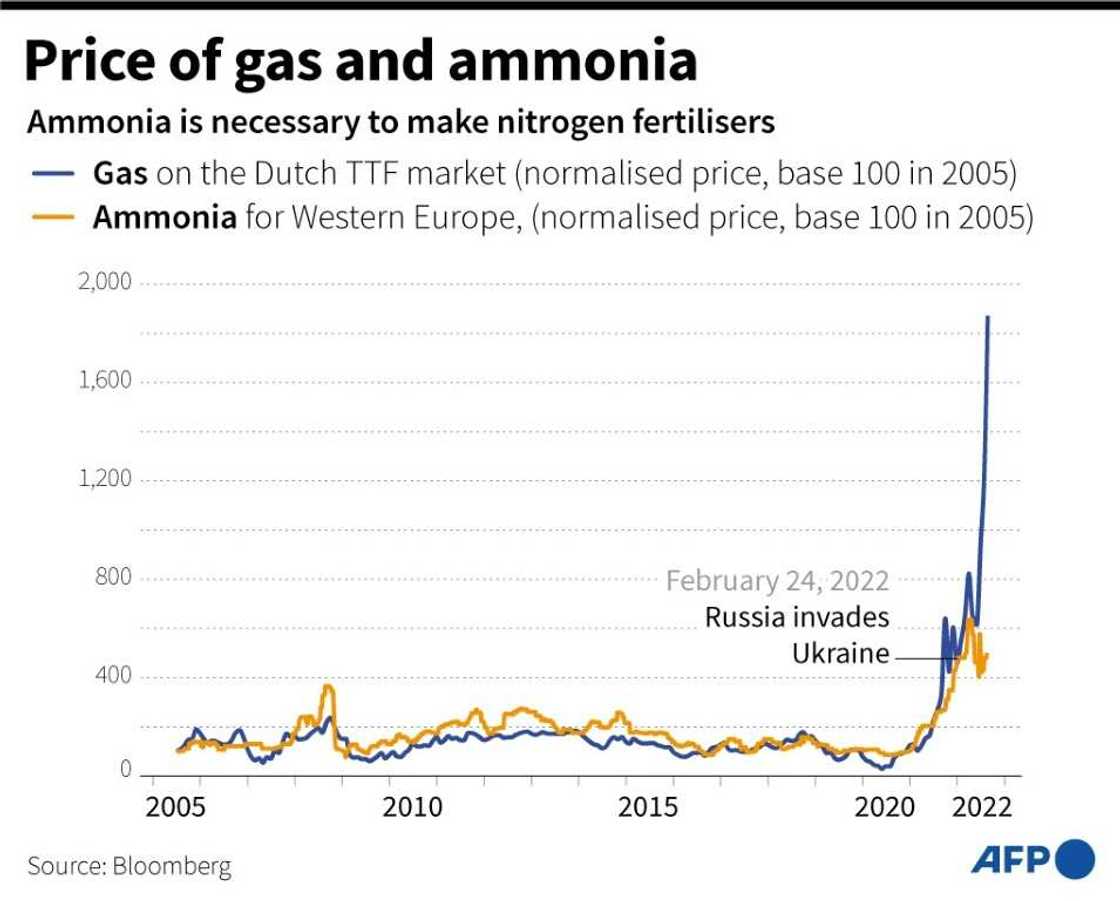

One of the reasons prices have not come down further is the surge in energy prices, due to the post-pandemic recovery and the war.

Higher oil prices impact transportation costs, while natural gas is a feedstock for manufacturing the chemical fertilisers that most farmers now use.

"Fertiliser prices have tripled in the last 18 months and the hard part of my job is forecasting what they will do in the next 18 months," Joel Jackson, a fertiliser analyst at BMO Capital Markets, said at an analyst conference in July in the United States.

With European gas prices soaring above 300 euros per megawatt hour, compared to an average of 20 euros over the past decades, "we've got a big problem as it's untenable for ammonia manufacturers," said Nicolas Broutin, head of the French subsidiary of Yara, the Norwegian firm which is Europe's largest fertiliser producer.

Source: AFP

Yara announced Thursday it was reducing once again its production in Europe of ammonia, which is made using hydrogen obtained from natural gas and which provides the nitrogen in synthetic fertilisers.

The firm will only be using 35 percent of its production capacity in Europe. A number of other European manufacturers have either reduced or halted output.

Although fertilisers do not fall under international sanctions, farmers are also at risk of shortages of another major element of fertiliser -- potassium or potash -- as both Russia and Belarus are major producers.

BMO Capital Markets' Joel Jackson said fertiliser manufacturers worry that the high prices will prompt farmers to reduce or eliminate their use.

"We're already seeing that throughout Europe," said Yara's Nicolas Broutin.

CyclOpe, a French-based commodities research firm, said "it's in 2023-2024 that the rise in fertiliser prices and eventually their reduced use will be felt."

Source: AFP

Farmers will try to pass on higher fertiliser costs to consumers, driving up food costs.

Meanwhile, reduced fertiliser use will result in lower crop yields and harvests, which will also drive up food prices.

CyclOpe expects in particular "considerably reduced" output in Africa, where farmers and consumers are both more sensitive to prices.

Source: AFP