Moniepoint customer service: how to contact them and access other services

Are you struggling with Moniepoint banking issues and have been looking for solutions in vain? The bank has a seamless personal banking experience until you encounter issues you cannot solve alone. In such cases, the most reliable option for assistance is Moniepoint customer service, which is available 24/7.

Source: UGC

TABLE OF CONTENTS

- Moniepoint customer service contacts

- Ways of accessing Moniepoint banking services

- Common Moniepoint issues

- Is Moniepoint a bank?

- What do I do if my Moniepoint account is restricted?

- Does Moniepoint require BVN?

- What is Moniepoint customer service phone number?

- Is Moniepoint customer service available 24/7?

- How do I report unauthorised transactions or fraud?

- How secure is Moniepoint?

- What should I do if my Moniepoint app isn’t working?

Moniepoint is one of the leading fintech companies in Nigeria. It offers a range of banking services through its online banking app. Like many other fintech companies, Moniepoint leverages its customer service to cater to the needs of its clients. Moniepoint customer service offers its customers round-the-clock assistance on different platforms.

Moniepoint customer service contacts

While the Moniepoint app offers reliable banking services, occasionally, you may encounter problems you cannot solve. These issues can be frustrating, especially if you want to transact urgently. For assistance on any Moniepoint banking issue, you can contact its customer service through the following channels.

Source: UGC

- Phone number: +234 201 888 9990

- Email address: support@moniepoint.com

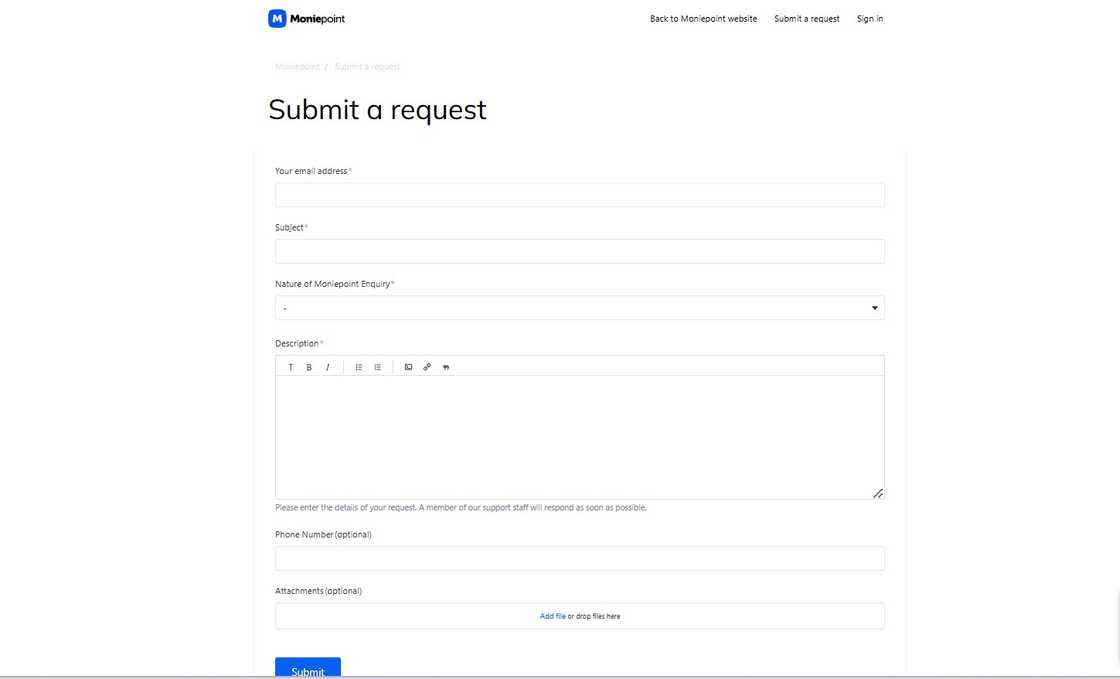

- Online contact form: Visit Moniepoint's official website and click Contact at the top right section of the page. Under Get help, click Submit an issue, and a Submit a request page will appear.

- Website chat: Visit Moniepoint's official website and click the Chat icon at the bottom right corner of the page. A chat box will appear where you can raise your issue.

- Physical address: You can visit Moniepoint’s physical office at Plot 7A, Block 4, Admiralty Road, Lekki Phase 1, Lagos State.

- Social media platforms: On social media, you can seek help on X (Twitter), Facebook, and Instagram.

Ways of accessing Moniepoint banking services

Moniepoint does not have physical branches like many brick-and-mortar banks in Nigeria. Customers can only interact with its financial services through its USSD codes and mobile app.

Moniepoint USSD code

Moniepoint USSD code enables you to perform various transactions on your phone without internet connectivity. Therefore, you can conveniently use the USSD code anywhere, even if you do not have a smartphone. You can use the codes to transfer funds, purchase airtime, buy data, reset your PIN, block/unblock your account, and check your balance.

Below is a compilation of common Moniepoint USSD codes and their functions.

| USSD code | Function |

| Check balance and account details | *5573*5# |

| Transfer funds to another Moniepoint account | *5573*1*Amount*Account Number# |

| Transfer funds to other banks | *5573*2*Amount*Account Number# |

| Buy airtime (self) | *5573*Amount# |

| Buy airtime (others) | *5573*Amount*Phone Number# |

| Buy data | *5573*4# |

| Reset user PIN | *5573*6# |

| Get OTP | *5573*73Code# |

| Block account | *5573*911# |

| Forgot username | *5573*73*1# |

| Get OTP (signup) | *5573*74Code# |

Moniepoint mobile app

Apart from the USSD code, Moniepoint customers can access services using its mobile app. The mobile app option is available to customers with smartphones and internet access.

The app allows users to instantly access services such as paying bills, sending money, purchasing airtime, and checking balances. It is available for download on Android and iOS devices.

- Moniepoint app on Android.

- Moniepoint app on iOS.

Common Moniepoint issues

Users of Moniepoint financial services may occasionally experience problems with the app, USSD code, or POS. Understanding common issues may give customers peace of mind and help them seek appropriate measures to resolve them, while others may require customer service assistance. Below are common problems you may encounter.

- Account restriction – An account can be restricted for multiple reasons, including fraudulent transactions, exceeding the transaction limit, multiple failed login attempts, and incomplete KYC information.

- Network downtimes – This problem occurs when Moniepoint’s network is disrupted, affecting transactions made on the network. It is not specific to Moniepoint; it also occurs to other financial institutions offering online financial services. When there is a network outage, it is recommended not to perform a transaction multiple times.

- POS network problems – If you want to transact through a Moniepoint point-of-sale device, you may sometimes experience connection issues. Although network connectivity can be with the bank’s servers, the problem may also occur on the user’s end. The issue may arise due to poor network connection, lack of data, and SIM card errors.

- Transaction errors – You may experience transaction errors for reasons other than network connection issues. The errors may occur due to your errors, such as entering an incorrect bank account, wrong bank selection, and inputting an incorrect PIN. To avoid this error, accurately enter the correct information and use the right USSD codes.

- App or website errors – Sometimes, the Moniepoint app or website may be unresponsive or too slow. In other cases, you may be unable to access certain app features. If this problem persists, you can consider updating the app or freeing some space on your device.

Is Moniepoint a bank?

Source: Getty Images

Moniepoint is not a traditional bank but a fintech company that offers traditional banks' financial services. It does not have physical branches and only provides its services through a mobile app and USSD code.

What do I do if my Moniepoint account is restricted?

Account restriction occurs for multiple reasons, including fraudulent transactions, exceeding transaction limit, incomplete KYC, or failed numerous logins. You should immediately contact Moniepoint customer service for problem diagnosis and finding a possible solution.

Does Moniepoint require BVN?

A Bank Verification Number (BVN) is a must-have detail for opening a Moniepoint account, upgrading KYC, and performing transactions.

What is Moniepoint customer service phone number?

You can contact Moniepoint customer service by calling +234 201 888 9990. Alternatively, you can reach them via email at support@moniepoint.com, social media, or the official website live chat.

Is Moniepoint customer service available 24/7?

You can call the customer service number at any time. Depending on pending inquiries, the response may take a considerable time for email inquiries. However, responses typically take between 24 hours and 48 hours.

How do I report unauthorised transactions or fraud?

Take swift action by contacting and reporting the transaction to Moniepoint customer service through their official contact, such as a hotline or email address. You can also block the account by dialling the USSD code *5573*911# to prevent further fraudulent transactions.

How secure is Moniepoint?

Moniepoint offers secure financial transaction services. Users of its mobile app and USS codes have secret Personal Identification Numbers, enabling them to authorise transactions and secure their accounts.

What should I do if my Moniepoint app isn’t working?

The Moniepoint usually works well and may rarely have problems. However, if you experience issues such as slowness or unresponsiveness, consider checking your network connection, restarting your phone, or contacting customer service for assistance.

Moniepoint customer service operates 24/7, receiving and solving customers’ issues and inquiries. It is an integral department of the fintech company that ensures customers understand its services and their problems are satisfactorily handled. You can access various Moniepoint services and products using its USSD codes and mobile app.

DISCLAIMER: This article is not sponsored by any third party. It is intended for general informational purposes only and does not address individual circumstances. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind. Any action you take upon the information presented in this article is strictly at your own risk and responsibility!

Legit.ng recently published a list of OPay bank USSD codes and how they work. With many banks trying to reach more clients, USSD codes have allowed those without the internet and smartphones to access financial services. OPay is one such bank that uses USSD codes for various transactions.

USSD codes allow you to access banking services anytime, anywhere. Knowing the USSD codes lets you comfortably perform transactions such as paying bills, purchasing airtime, or transferring funds. Discover the codes applicable for various OPay bank transactions.

Source: Legit.ng