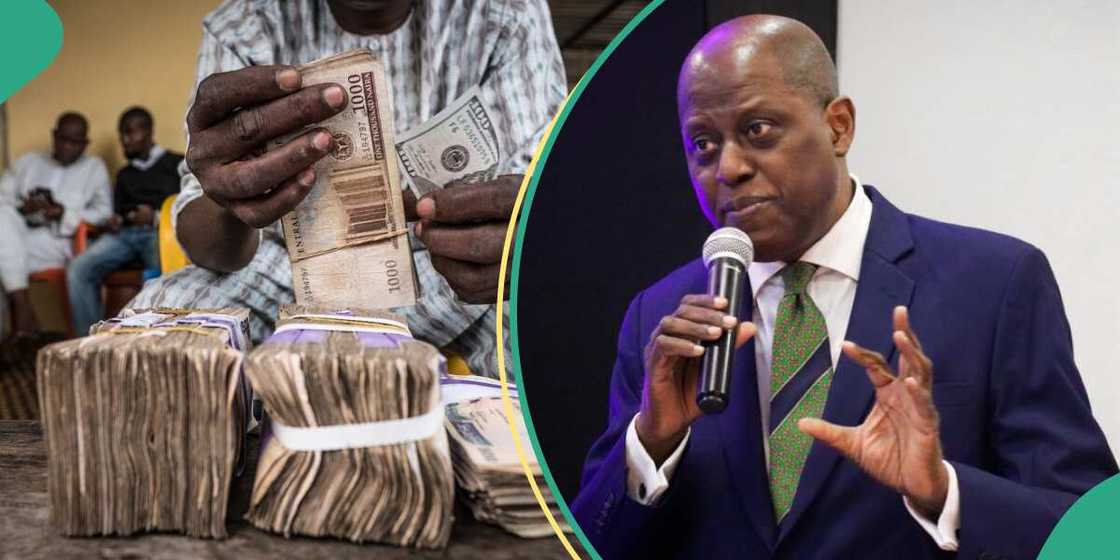

"I can confirm": Finally, Naira To Bounce Back, Dollar To Fall Below N1k As CBN Begins FX Solution

- As promised, the administration of President Bola Tinubu is determined to help naira recover against the dollar

- To achieve this, the first step is to clear the backlogs of foreign companies' funds trapped in Nigeria

- The decision will help ease the pressure on Nigerian currency at the official and unofficial market

PAY ATTENTION: Click “See First” under the “Following” tab to see Legit.ng News on your Facebook News Feed!

Dave Ibemere has over a decade of experience covering business and the economy.

The Central Bank of Nigeria (CBN) has started payment of debts owed to international banks, companies and airlines.

Legi.ng had reported that Olayemi Cardoso, Governor of the CBN, on the assumption to office, declared that he would immediately address the backlog of unpaid foreign exchange commitments.

Source: UGC

The Debts

CBN's 2022 audited financial statement reveals Nigeria owes foreign banks such as JPMorgan and Goldman Sachs about $13.8 billion.

There is another N3.15 trillion in foreign currency forward, which are FX obligations it requires to make to foreign investors.

The International Air Transport Association (IATA) also claimed that its members trapped funds in Nigeria are at $783 million.

CBN begins repayment

BusinessDay reports that the CBN has repaid over 75% to 80% of outstanding matured FX forwards in banks.

Sources quoted in the report revealed that the payments were made to only international banks.

The banks that have been settled include Citi Bank, Standard Chartered and Stanbic IBTC.

A note from Citigroup reads:

“We have being directed to inform you that CBN has cleared all outstanding matured forwards forex."

Another source said:

“I can confirm the backlog in 14 banks have been cleared."

Also, Emirates and Etihad Airlines have been reported to have received a percentage of their trapped funds.

Impact of CBN's decision

The huge backlogs have been identified as one of the reasons for the depreciation of the naira in both the official and black foreign exchange markets.

It is expected that when the payments are fully cleared, liquidity in the official market will improve, and patronage in the black market will reduce, helping the naira to dollar exchange rate fall below N1,000.

The federal government has already predicted an exchange rate of N650 to N750 a dollar by December.

"No more N1k": BDC operators agree on new dollar to naira exchange rate

Legit.ng also reported that Bureau de Change dealers want to crash the dollar across the country.

ABCON initiated the move in support of the CBN efforts to stabilise the naira at the foreign exchange market

The wide disparity between the black market and the official exchange rate has been a genuine concern for the CBN.

Source: Legit.ng