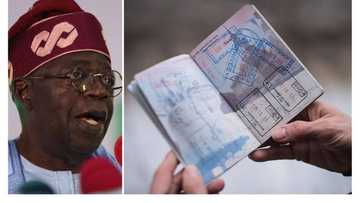

“It Remains Naira Card”: Nigerians React as CBN Lifts Dollar Deposit Restriction on Bank Accounts

- The CBN has removed the dollar cash deposit restrictions on domiciliary accounts that were put in place under the leadership of Godwin Emefiele

- The latest development will allow Nigerians to have unrestricted access to funds in their accounts

- It is expected that the new policy changes would enhance liquidity and stability in Nigeria's foreign exchange market

The Central Bank of Nigeria (CBN) has continued its operational changes on the foreign exchange market.

The latest is the removal of restrictions on domiciliary accounts, allowing account holders to withdraw up to $10,000 daily

Source: Getty Images

Punch reports that the CBN made this disclosure following an extraordinary Bankers' Committee meeting on Sunday, June 18, 2023, in a press statement signed by Haruna Mustafa, the Director of the CBN's banking supervision department.

Bankers' Committee in Nigeria is composed of representatives from the Central Bank of Nigeria (CBN) and commercial banks operating in the country.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

CBN lifts dollar deposit restrictions

In the statement, CBN stated that these policy changes are intended to enhance transparency, liquidity, and price discovery in the foreign exchange (FX) market.

It was also noted that the objective is to improve FX supply, discourage speculation, instill customer confidence, and maintain stability in the FX market.

The bank further declared that ordinary domiciliary account holders will have unrestricted access to funds in their accounts.

Part of the statement reads:

"Under the new directive, domiciliary account holders are permitted to utilize cash deposits not exceeding $10,000 per day or its equivalent through telegraphic transfer.

"Deposit Money Banks (DMBs) are required to submit returns to the CBN, including the purpose of such transactions.

“Cash deposits into domiciliary accounts will also not be restricted, subject to DMBs conducting proper KYC…"

Nigerians react to the Forex policy changes

@iSlimfit reacting to the news on Twitter said:

"This is a great start. The most important should be increasing the limit on Naira cards for international transactions."

@Puregirli wrote:

"Great news... Can they now remove the ban on our Naira account for international transactions,,?

@instaG0travels reacted:

"Great news for international students! This has streamlined the payment process for your fees, eliminating the complications of form ABCD processing. This makes it easier than ever for you to manage your finances and pay your fees while studying abroad. Get ready to embark on an exciting journey of international study journey with us. Navigate to the link in our bio to begin your hassle-free application process now."

Aliko Dangote loses over N1.4trn in hours after CBN naira decision

Meanwhile, in another report, Nigerian billionaire Aliko Dangote's wealth has experienced a significant decline of N1.4 trillion following the devaluation of the naira

The devaluation was triggered by CBN's move to unify the country's multiple exchange rate system

Most of Dangote's investments, which are linked to his wealth, are based in Nigeria, and the performance of the naira directly affects his wealth

Source: Legit.ng