CBN Addresses Speculation of Converting Domiciliary Accounts to Naira

- Following the decision to ban sales of foreign exchange to Bureau de Change operators, fear rises over domiciliary account deposits

- The claim of the Central Bank of Nigeria converting domiciliary accounts into naira surfaces, affecting the value of the local currency

- The financial regulator refutes speculations as it races to deal with fall out from the decision to exclude Bureau de Change from forex sales

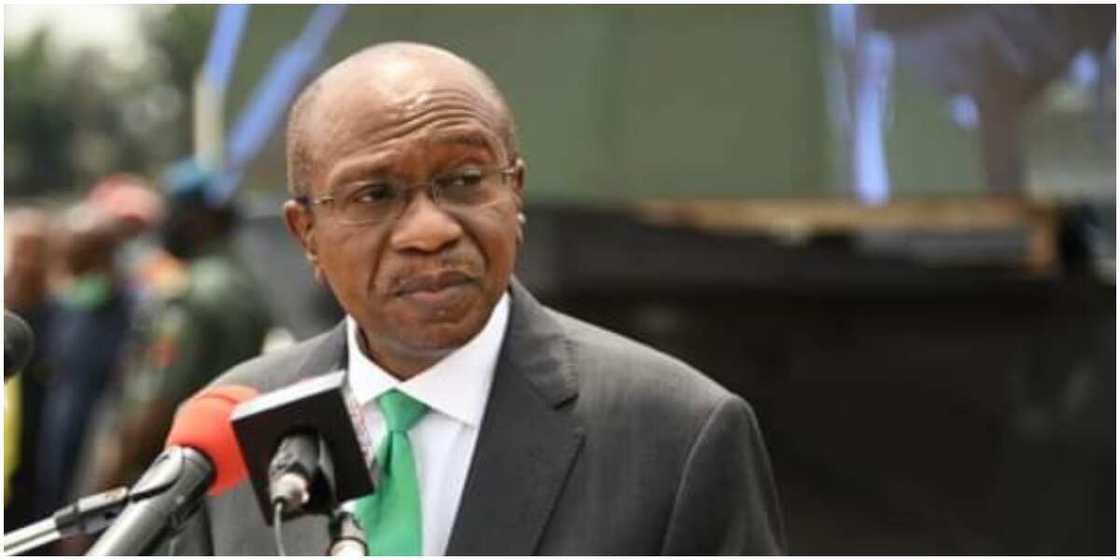

Central Bank of Nigeria (CBN) has denied reports that it intends to convert deposits in domiciliary accounts into naira amid a ban on sales of forex to Bureau De Change operators.

There are speculations that the apex bank is eyeing the dollars and other foreign currencies domiciled in commercial banks as it pushes for lenders to start selling forex directly to customers.

Read also

Bureau de change President, Aminu Gwadabe, says CBN forex ban won't stop them from selling dollars

However, Osita Nwanisobi, the acting director of corporate communications, CBN, said there's no truth in the report, and the financial regulator has put measures in place to monitor forex sales of banks.

Source: Facebook

He said those behind the report are criminal speculators, whose intention is to cause panic in the foreign exchange market.

And this was reflected on Monday's Bureau de Change activities, which saw one dollar sold for N520, against last week Friday's transaction of $1 to N515.

What caused the speculation?

The CBN had stopped sales of forex to the Bureau de Change operators last week after its Monetary Policy Committee meeting, stating that BDC's are now involved in corrupt practices.

According to CBN governor, Godwin Emefiele, BDC operators are aiding money laundering and encouraging the acquisition of forex through illegal channels.

It had instruct banks to set up a foreign exchange post in their branches to sell forex to Nigerians in need of it. This sudden decision caused panic in the foreign exchange market.

Ex-CBN head unhappy with move by Emefiele

Former CBN deputy governor, Obadiah Mailafia, has criticised the decision to discontinue sales of forex to Bureau de Change operators, stating that it will create fear.

Mailafia said the financial regulator had made such a directive without informing the public the rate banks must sell forex. According to him, the lenders will contribute to the scarcity of FX.

He said banks are known for round-tripping, and they could hoard forex for their personal use, while the queue at the financial institutions will worsen the situation.

Source: Legit.ng