Analysis: How Unsustainable Terms are Making Chinese loans repayment difficult for poor African countries

There is a "sincerity question" on the Chinese government giving out loans to poor countries in the world after it was revealed that the "constrictive terms" of some of these contracts are making African countries and some other borrower nations stand at the risk of imminent defaults.

PAY ATTENTION: Join Legit.ng Telegram channel! Never miss important updates!

China is effortlessly giving the United States a tough fight in the echelon of "big brother" nations offering aid to poor countries by doling out loans through its much-touted Belt Road Initiative (BRI) under the pretence of helping the global struggling economies.

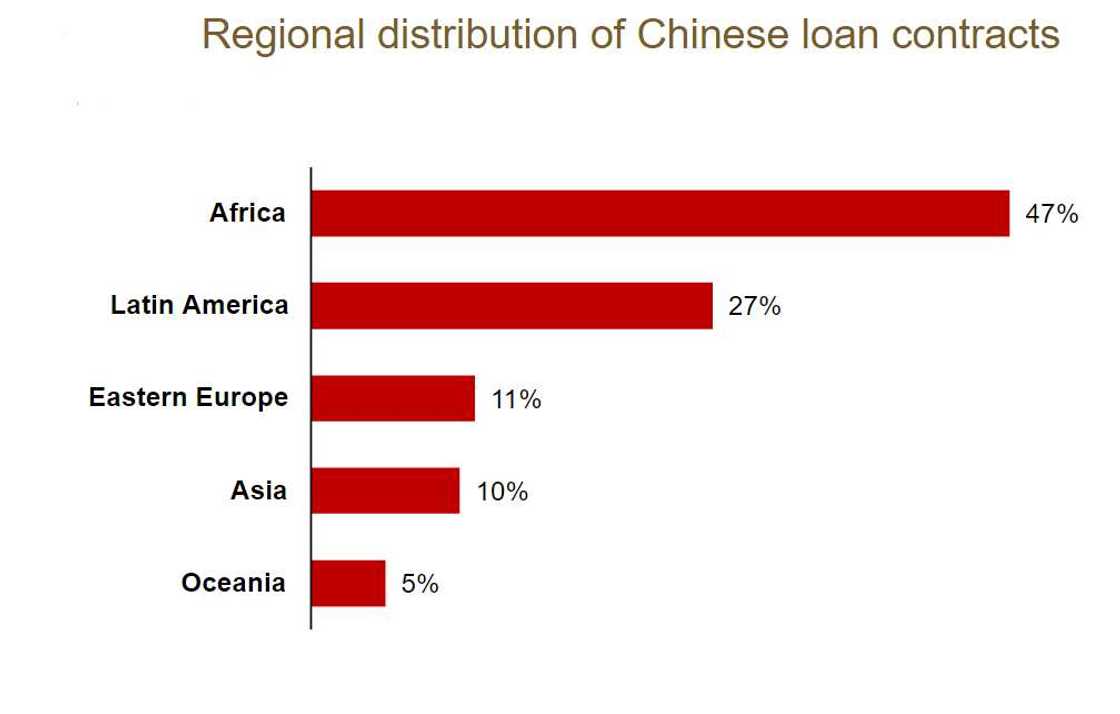

According to Aid Data, a research lab, the regional distribution of these loan contracts shows that Africa, which is constituted majorly by poor countries including Nigeria (with over 200 million population), is standing on the Chinese loan contract log with 47%, followed by Latin America (27%), Eastern Europe (11%), Asia (10%) and Oceania (5%).

Source: Getty Images

However, the stringent terms of these loan contract under the questionable conditions in the BRI make the borrowers to be at the risk of losing their sovereign assets.

“A commercial cross-default clause helps protect creditors from falling behind in the payment queue; a cross-suspension clause lets a policy lender pause disbursements when the debtor's policy or project effort—or its relationship with the lending institution—deteriorates.

"Some Chinese contracts combine elements of both, further constraining the sovereign borrower,” Aid Data claimed.

The confidentiality clauses that come with the loans also do not allow the borrowers to openly reveal the terms of loans.

This means that it makes it difficult for any third party like the Paris Club to come to the rescue to restructure loans in case of the borrower's financial distress.

An example of this is Sri Lanka, a South Asian nation with a 21 million population, losing its sovereignty due to loan structure that is putting China far above the borrower in the agreement process.

As it stands, Beijing is empowered in the arrangement to terminate the contracts or speed up debt repayment if borrowers’ actions are not in line with the Chinese interests and expectations.

Zambia as case study

The confidentiality and unusual clauses in the loan agreements have badly damaged the ability of the poor and developing countries to renegotiate debts in the current COVID-19 pandemic, which has affected them the most.

Zambia has become the first African country to default on its sovereignty since the coronavirus crisis began. The country of 17.8 million population currently has 92,409 COVID-19 cases according to Worldometers, a research site.

Chinese loans account for one-third of Zambia's national debt as China has invested in the mining and industrial sectors as well as agriculture in the country.

PAY ATTENTION: Install our latest app for Android, read the best news on Nigeria’s #1 news app

We don't plan to take over Nigeria's sovereignty -China

Meanwhile, amid outrage generated by the $500 million loans recently collected by the federal government from China, the government of the Asian country said there is no plan to take over Nigeria’s sovereign right should there be defaults in the payment.

China said it is only committed to maintaining the mutual relationship with African countries, saying "we follow a “five-no” approach in our relations with Africa."

Back story

It would be recalled that transport minister Rotimi Amaechi while speaking with journalists, had explained why there is nothing wrong with the federal government ceding Nigeria's sovereignty to China in the signing of a loan deal.

According to him, out of the $500m loans the federal government took to build the Abuja-Kaduna rail line $96m has been paid, adding that the loan will be paid for twenty years.

Source: Legit.ng