Access Bank payday loan: terms and conditions to know (2022)

Access Bank payday loan is a thing people remember in the first turn when it’s necessary to raise some money for urgent needs. It’s a quick loan, which is supposed to be repaid quickly and it’s a true first aid in certain situations. Do you want to know how to obtain such a loan? Keep on reading!

Source: UGC

Access Bank payday loan: requirements

We are all used to thinking that loans are something rarely given to rare people because of numerous requirements. Say, a person needs to meet some superhuman criteria to be found eligible and receive a loan. Sometimes, loans are really quite hard to get. Banks don’t want to lose their money and only give loans to people who are utterly reliable and have funds to pay the loans back.

Payday loans are somewhat different from the rest. They are usually quite small and they are meant to fund some small but urgent people’s needs. For instance, somebody falls ill, there’s not enough money to pay for medications, and the payday is quite far. Sometimes, it’s necessary to make other urgent payments, which are decisive in some ways but a person can’t afford it because of no funds at hand.

This is why requirements for payday loans are not that tough. They are easily met if you have a job and a regularly paid salary. The requirements Access Bank has for its customers who want to get a loan are simpler than ever. They just need to be employed and it even doesn’t matter whether the account where they receive their salary is domiciled with another bank.

There’s one simple condition you should meet if you want to receive such a loan: either you have a salary account in the Access Bank or you are a customer of Remita (simply because Access Bank payday loans are a mutual product they have launched together). A Remita customer is anyone who is receiving their salary via Remita payment tools.

There are no other specific conditions or requirements. You don’t need to bring one or two guarantors and neither do you need any collateral. Everything is as simple as that. What’s more – you will be even more astonished – you can now borrow money from the Access Bank via a special USSD code.

What is Access Bank payday loan USSD?

The USSD code, which allows getting a payday loan faster is a new thing. It has been introduced only recently for those who meet the few Access Bank requirements. Now, you can simply dial the code *901*11*1# and receive an instant loan in several simple steps. You don’t need to wait for a long time. You can receive what you need in a matter of minutes.

The Access Bank offers a range of payday loans, which vary between N1,000 and N500,000, which are given at 3% of interest rates flat. In most cases, the bank decides how much every given person can receive from them. As a rule, such a loan must be paid back by the end of the month or at the moment you receive your salary, whichever happens earlier. As soon as the moment comes and the loan matures, the necessary amount will be retrieved from your account as due.

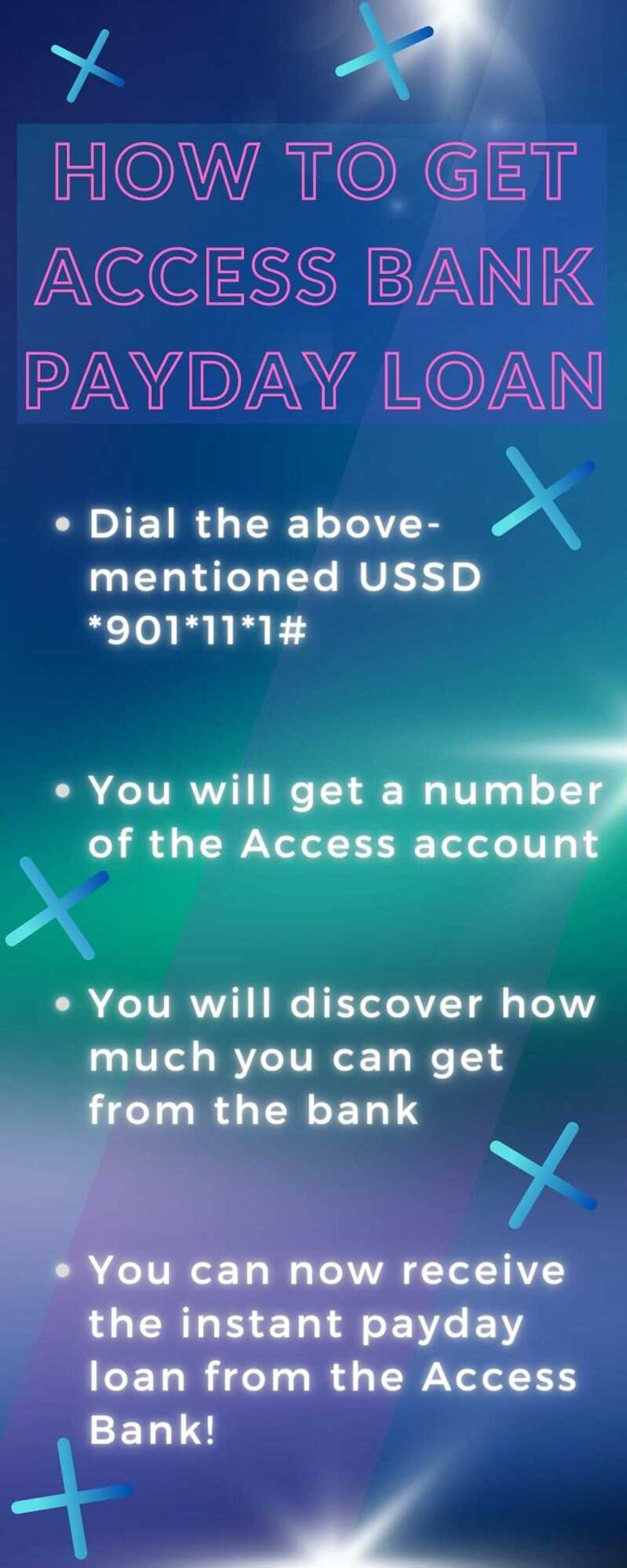

How to get Access Bank payday loan?

You need just a few minutes and the loan is in your hands!

- First of all, dial the above-mentioned USSD *901*11*1#

- In a short while, you will get a number of the Access account

- Then, you will discover how much you can get from the bank

- That’s it! You can now receive the instant payday loan from the Access Bank!

If you have questions on the procedure or other details, you are free to turn to the Access Bank directly and find out everything you need. They are accessible on the phone (discover the valid numbers at their official website) or via email (again, see the email address on the official website to avoid swindlers and loss of money).

DISCLAIMER: This article is intended for general informational purposes only and does not address individual circumstances. If a reader clicks on our advertising partner links within our platform, we may receive a referral fee. Our team will never mention an item as the best overall product unless they believe it is the best option. Compensation does not direct our research or editorial content and in most cases does not impact how our listing articles are written. It is not a substitute for professional advice or help and should not be relied on to make decisions of any kind.

Source: Legit.ng