CBN warns Nigerians about text messages on new BVN policy

- The Central Bank of Nigeria (CBN) has warned the general public against BVN scammers

- The apex bank said these individuals send unsolicited messages to unsuspecting customers

- CBN warned that no bank or its agents would ever call bank customers or send emails/text messages requesting for passwords or details or the personal identification numbers (PIN)

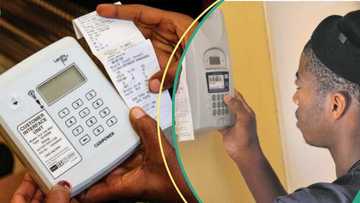

The Central Bank of Nigeria (CBN) has warned the general public of scammers who send unsolicited text messages to bank customers.

The apex bank in a new statement warned bank users to mindful of these text messages on Bank Verification Number (BVN).

The statement signed by the director, corporate communications for the CBN, Ibrahim Mu'azu, said the apex bank has noticed that some individuals send these text messages to unsuspecting customers.

READ ALSO: What truly happened between soldiers and Boko Haram terrorists in Yobe state - Defence headquarters speaks

Mu'azu said: "It has come to the notice of the Central Bank of Nigeria (CBN) that certain unscrupulous individuals have been sending unsolicited mails and text messages to unsuspecting bank customers, alerting them about deactivation or suspension of their bank accounts due to uncompleted Bank Verification Number (BVN) registration process.

"An example of such messages reads thus: 'Dear customer, due to the new BVN policy by the CBN your account has been deactivated and to activate call..."'

Mu'azu said the CBN wishes to warn Nigerians and the general public that such messages are intended to lure bank customers to reveal their personal account details which could be used to defraud them.

READ ALSO: Metuh’s trial: GEJ fights back, demands for N1bn travelling expenses to appear as witness

The public is hereby warned that the Central Bank of Nigeria (CBN) and deposit money banks nor their employees or agents would ever call bank customers or send emails/text messages requesting for passwords or details or the personal identification numbers (PIN).

He said: "Bank customers are therefore advised to personally visit their banks for any issue requiring disclosure of personal details."

PAY ATTENTION: Watch more videos on Legit.ng TV

Legit.ng earlier reported there were indications that commercial banks will soon start cracking down on customers' accounts.

The move which is aimed at curbing fraudulent transactions in the banking system is a new directive from the CBN.

It was gathered that 45.85 million total bank accounts unlinked, but when compared with the active accounts the number dropped to 15.72 million unlinked to BVN as of February 2017.

If any police officer misbehaves with you, call any of these numbers - on Legit.ng TV

Source: Legit.ng