History of taxation in Nigeria

Nigeria can`t run and develop without taxes. Therefore, from the early stages of Nigerian tribes’ existence, there were taxes. Take a look at the history of taxation in Nigeria. Find out how Nigeria earned its money and place in history!

What is tax?

A tax comes from the Latin taxo! It`s a form of mandatory financial charge regulated by a state. It`s created to fund various state institutions. Taxes can be direct and indirect. It is possible to pay taxes by money or labor. Most countries have a system of taxes that helps them to sustain and develop. There are even countries who pay taxes to their citizens. For instance, Macau (Chinese Las-Vegas) pays about $1127 to its residents annually.

History of Taxation in Nigeria till date

Taxation Beginning

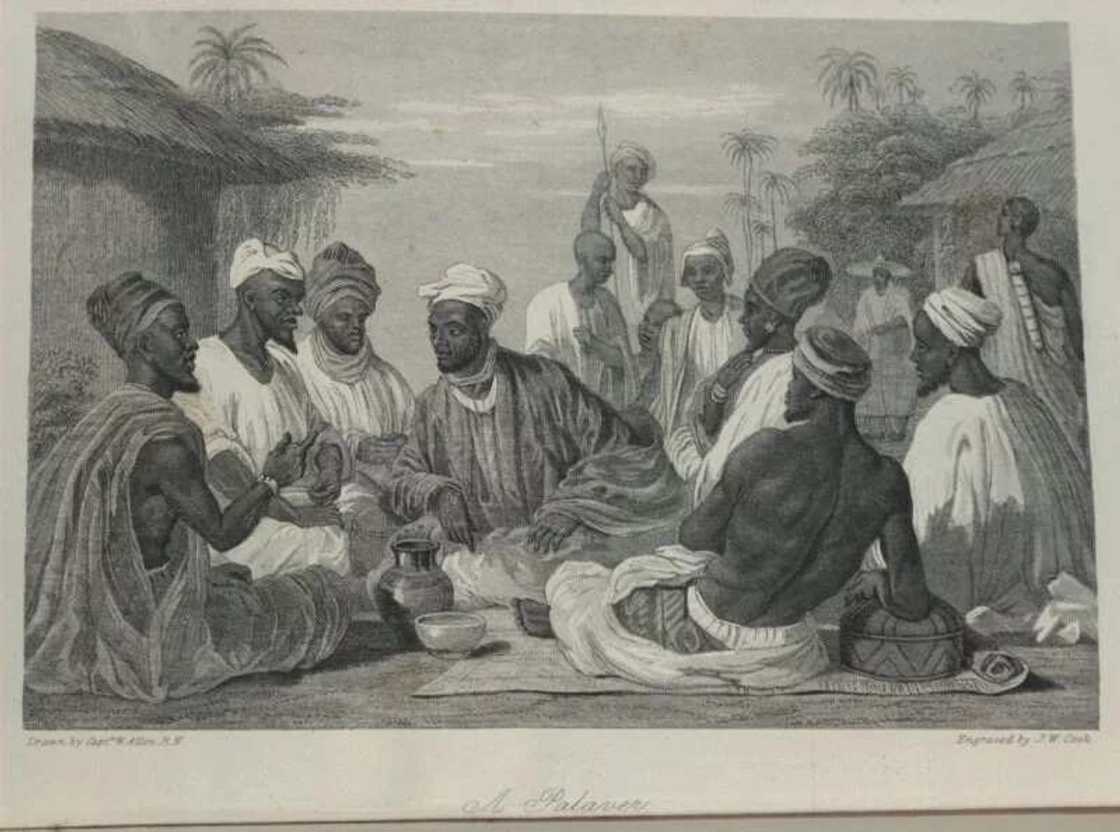

There was no formal tax policy in Nigeria until the 1930s. Only traditional rulers had the authority to collect taxes and use them however they wanted. These rulers managed to create their own system of taxes. However, none of them managed to survive long enough to be printed in books of history.

Northern Nigeria – History and Development of Taxation

Before the colonization period in Nigeria, the tax system was traced to the Northern parts of the country. The Emirs created a system of taxes throughout the north. The basis for the taxation was the Islamic Religion. The Southern part of the country was not as organized as the North. Therefore, the South did not have the centralized system of taxation.

According to the historical data, the parts of Nigeria that were under the Islam taxation had several forms of taxes:

- Zakat – it`s an obligatory tax presented by all representatives of the Islamic religion. It was gathered for educational, religious and spiritual purposes.

- Kudin-Kasa – it was a tax for land utilization;

- Shuka-Shuka – it was a tax for cattle rearers;

- Isha-Kole – this tax was to be paid to community leaders or chiefs;

- Owo-Ori – this tax was paid to the country for services provided by individuals;

- Community tax – this tax was obligatory for all adult members of the community.

Colonization Period

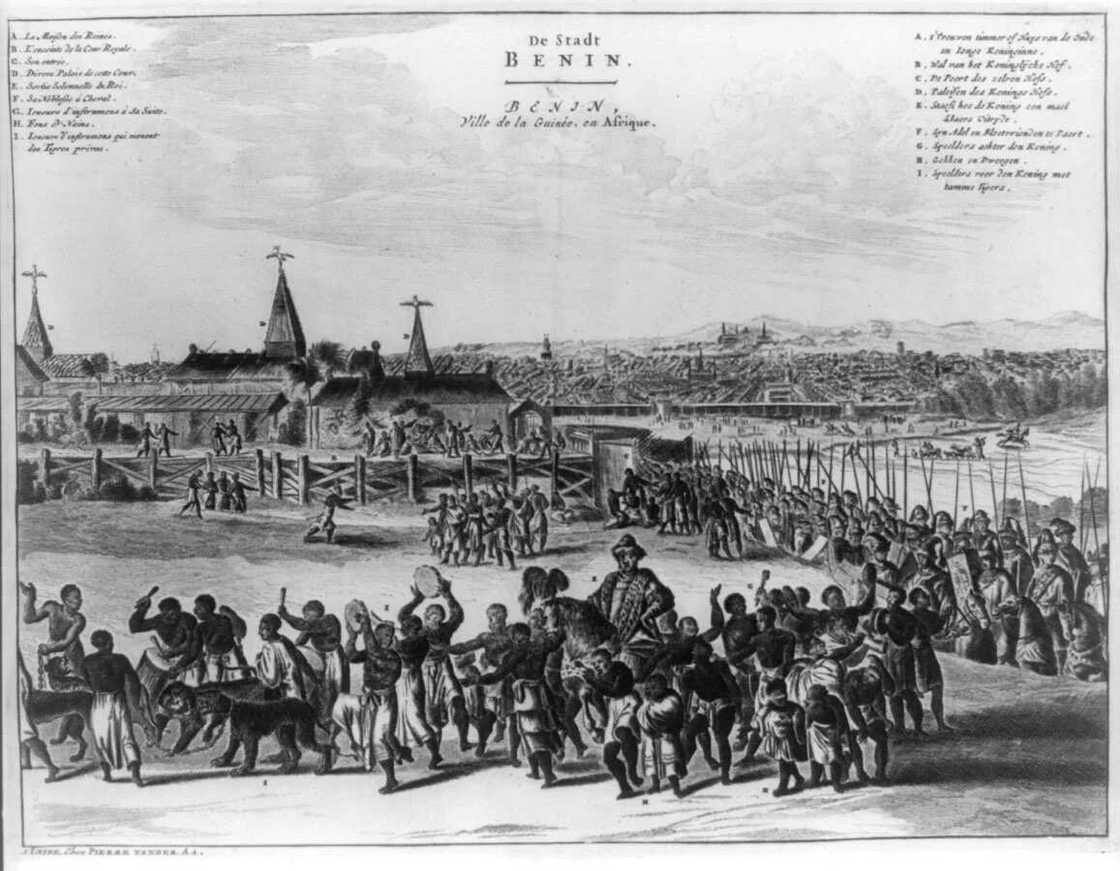

Looking at the history of taxation in Nigeria, the beginning of the colonization period was connected with various trading posts and companies in the West Africa. The British Empire tried to fight for economic dominance in the region. As a result, the GB exploited the resources and people of Africa.

In the mid-19th century, the GB was mainly interested in opening the markets in Nigeria. These markets also included the slave trade. Several colony powers tried to implement their taxation rates on traders.

The British Empire eventually secured Nigeria and started to implement its own taxes. The formal British administration in Nigeria began in 1861. In that time, Lagos was named the crown colony of the region. Even with the formal administration, taxation was not centralized.

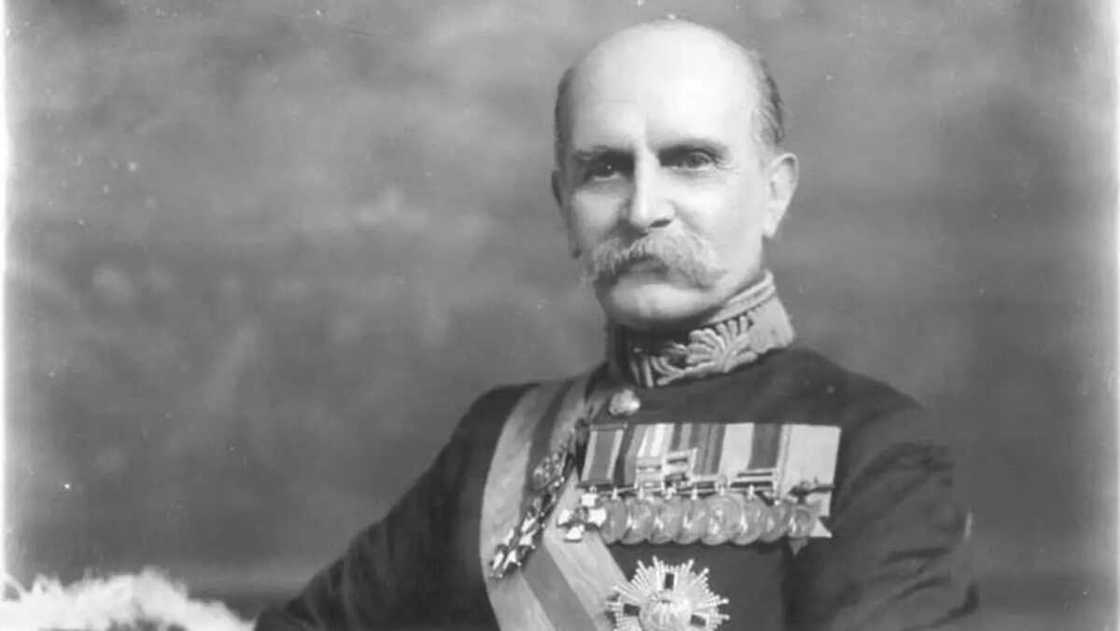

Lord Lugard taxation in Nigeria

READ ALSO: How many tribes in Nigeria?

Lord Lugard was a British colonial administrator in Nigeria. He tried to harmonize and centralize the tax system in Nigeria. As a result, he implemented the Stamp Duties Proclamation in 1903. This proclamation was followed by the Native Revenue Proclamation in 1906.

The Native Revenue Proclamation was created to harmonize the taxes. It created the four core principles of payment. Therefore, when a person wanted to pay taxes, he/she could just follow these questions:

- What to pay?

- Whom to pay?

- Where to pay?

- When to pay?

This procedure simplified and clarified the taxation policy in Nigeria. These two proclamations became the first in the sequence of the taxation policies in Nigeria.

Tax laws in Nigeria

The present form of Nigeria taxation can be traced back to 1914. During that year, the Northern and Southern Directorate implemented the basics of taxation in Nigeria. In addition, it helped to start the sequence of tax ordinances in Nigeria.

- Proclamation Law 1914;

- Native ordinance 1917;

- The Non-natives Protectorates Tax Ordinance 1931;

- Raisman Commission 1958.

Raisman Commission introduced the standardized tax principles. The recommendations from the Commission were later accepted and adopted by the National Government. These recommendations became the part of the Nigeria`s Constitution. The constitution gave birth to the Income Management Act and Companies Income Tax Act in 1961.

The following complexities in tax reforms created the sequence of tax laws. The latest representations of these tax laws are the Personal Income Tax Act 2004 and the Companies Income Tax Act 2004.

Current Tax Situation in Nigeria

According to the Nigerian Laws, there are three legal bodies that can levy the taxes on Nigerians.

- Federal Internal Revenue Service. They are responsible for Capital Gain Tax, Educational Tax, Value Added tax, Withholding tax, Companies Income Tax, Personal Income tax.

- State Boards of Internal Revenue. This legal body is responsible for Road Taxes, individual capital gains, individual withdrawing.

- Local Government Revenue Service. This legal body is responsible for collecting taxes on the local governments level.

Taxation History Conclusion

The taxation in Nigeria has come a long way to the point where we now have the present form of tax policies. However this form is still under development. New forms of taxation will be developed, and they will be able to change the face of Nigeria. Still, they will stand on the shoulders of the previous taxation policies.

READ ALSO: Smallest country in Africa by population

Source: Legit.ng